United States Space Junk and Debris Removal Market Size, Share, and COVID-19 Impact Analysis, By Type (Artificial Debris and Natural Debris), By Technology (Active Debris Removal and Passive Debris Removal), and United States Space Junk and Debris Removal Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseUnited States Space Junk and Debris Removal Market Insights Forecasts to 2035

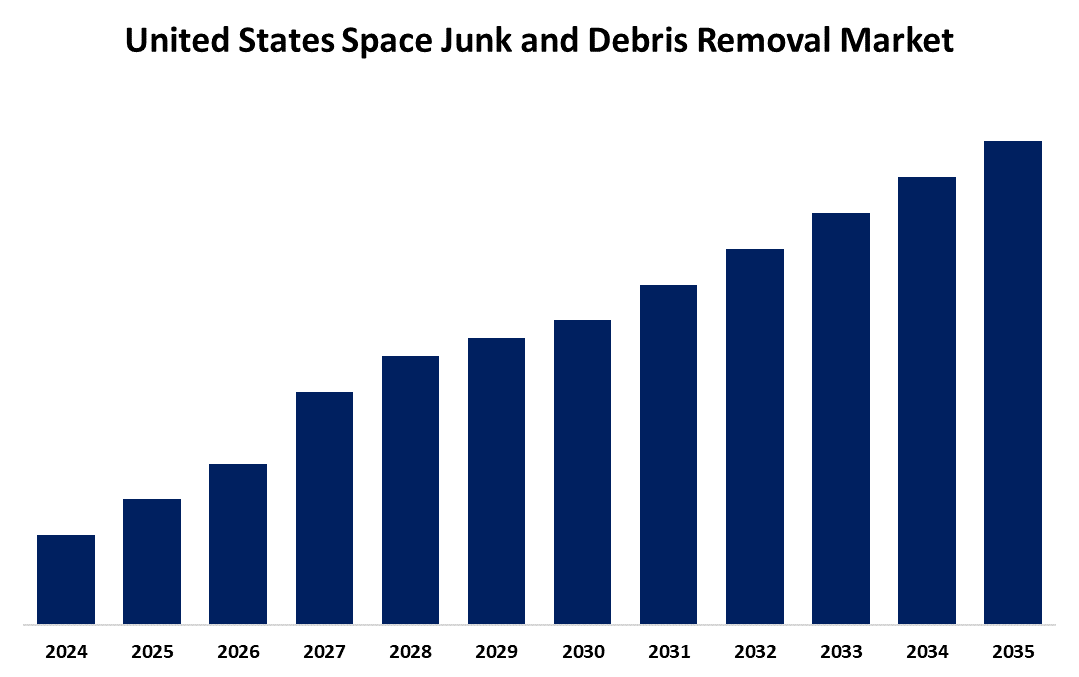

- The USA Space Junk and Debris Removal Market Size is Expected to Grow at a CAGR of around 6.2% from 2025 to 2035.

- The United States Space Junk and Debris Removal Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the U.S. Space Junk and Debris Removal Market Size is Expected to hold a significant share by 2035, Growing at a CAGR of 6.2% from 2025 to 2035. The United States space junk and debris removal market is growing due to increased satellite launches, rising collision risks in congested orbits, and heightened awareness of space sustainability. Government initiatives, private sector investments, and technological advancements in tracking and removal systems further drive demand.

Market Overview

The United States space junk and debris removal market defines the technologies and services aimed at tracking, managing, and removing defunct satellites, spent rocket stages, and other space debris that threaten active missions and long-term orbital safety. With a growing number of satellites launches and increased congestion in low Earth orbit, the risk of collisions has escalated, driving the demand for reliable debris mitigation solutions. Key market drivers include rising governmental and private sector investments, technological advancements in active debris removal, and the emergence of AI-powered tracking systems. The market’s strengths lie in strong aerospace infrastructure, innovation in robotic and capture technologies, and a robust ecosystem of space-focused companies. Opportunities abound in commercial satellite servicing, global collaborations, and sustainable space initiatives. Government-led efforts, such as NASA's Orbital Debris Program and the U.S. Space Force’s Orbital Prime initiative, are supporting R&D and encouraging public-private partnerships. Additionally, the growing emphasis on space sustainability and international norms for responsible space behaviour is accelerating the adoption of debris removal strategies.

Report Coverage

This research report categorizes the market for the United States space junk and debris removal market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States space junk and debris removal market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States space junk and debris removal market.

United States Space Junk and Debris Removal Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Technology, and COVID-19 Impact Analysis |

| Companies covered:: | Environmental Quality Management, Inc. (EQM), Tethers Unlimited, KBR, Inc., Voyager Space Holdings, D.H. Griffin Companies, LeoLabs, Privateer, Northrop Grumman, Lockheed Martin, Starfish Space, Kayhan Space, Firefly Aerospace, Orbit Guardians, Astroscale, ClearSpace, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The rapid increase in satellite launches and growing congestion in low Earth orbit raises the risk of collisions and threatens valuable space assets. Rising investments from both government agencies, such as NASA and the U.S. Space Force, and private space companies fuel demand for effective debris mitigation solutions. Technological advancements in robotics, AI-based tracking systems, and active debris removal methods have enhanced operational capabilities. Moreover, the emergence of on-orbit servicing and the growing importance of sustainable space operations further support market growth. Increased global collaboration and awareness about long-term space safety and orbital sustainability also drive the development and implementation of innovative debris removal technologies.

Restraining Factors

The high operational costs, complex regulatory approvals, and limited proven technologies for large-scale debris elimination. Technical challenges in tracking and capturing fast-moving debris, along with unclear international legal frameworks on ownership and responsibility, further hinder progress. These factors collectively slow commercial scalability and widespread adoption of debris removal solutions.

Market Segmentation

The United States space junk and debris removal market share is classified into type and technology.

- The artificial debris segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States space junk and debris removal market is segmented by type into artificial debris and natural debris. Among these, the artificial debris segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the growing volume of defunct satellites, spent rocket stages, and mission-related fragments in orbit. Human-made debris poses higher collision risks to active satellites and space missions, prompting increased focus and investment in tracking and removal technologies for artificial objects.

- The active debris removal segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States space junk and debris removal market is segmented by technology into active debris removal and passive debris removal. Among these, the active debris removal segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its effectiveness in directly eliminating high-risk objects from orbit. Technologies like robotic arms, harpoons, and capture nets enable precise targeting and deorbiting of hazardous debris, making active solutions more reliable and prioritized for collision prevention and orbital safety.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States space junk and debris removal market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Environmental Quality Management, Inc. (EQM)

- Tethers Unlimited, KBR, Inc.

- Voyager Space Holdings

- D.H. Griffin Companies

- LeoLabs, Privateer

- Northrop Grumman

- Lockheed Martin

- Starfish Space

- Kayhan Space

- Firefly Aerospace

- Orbit Guardians

- Astroscale

- ClearSpace

- Others

Recent Developments:

- In January 2025, Firefly Aerospace, the leader in end-to-end responsive space services, announced that Firefly’s Blue Ghost lunar lander had launched on a SpaceX Falcon 9 rocket, successfully acquired signal, and completed on-orbit commissioning. With a target landing date of March 2, 2025, Firefly’s 60-day mission was underway, including approximately 45 days on-orbit and 14 days of lunar surface operations with 10 instruments as part of NASA’s Commercial Lunar Payload Services (CLPS) initiative.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States space junk and debris removal market based on the below-mentioned segments:

USA Space Junk and Debris Removal Market, By Type

- Artificial Debris

- Natural Debris

USA Space Junk and Debris Removal Market, By Technology

- Active Debris Removal

- Passive Debris Removal

Need help to buy this report?