United States Sorbitol Market Size, Share, and COVID-19 Impact Analysis, By Product (Liquid and Crystal), By Application (Oral Care, Vitamin C, Surfactant, Diabetic & Dietetic Food & Beverage, and Others), and United States Sorbitol Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsUnited States Sorbitol Market Size Insights Forecasts to 2035

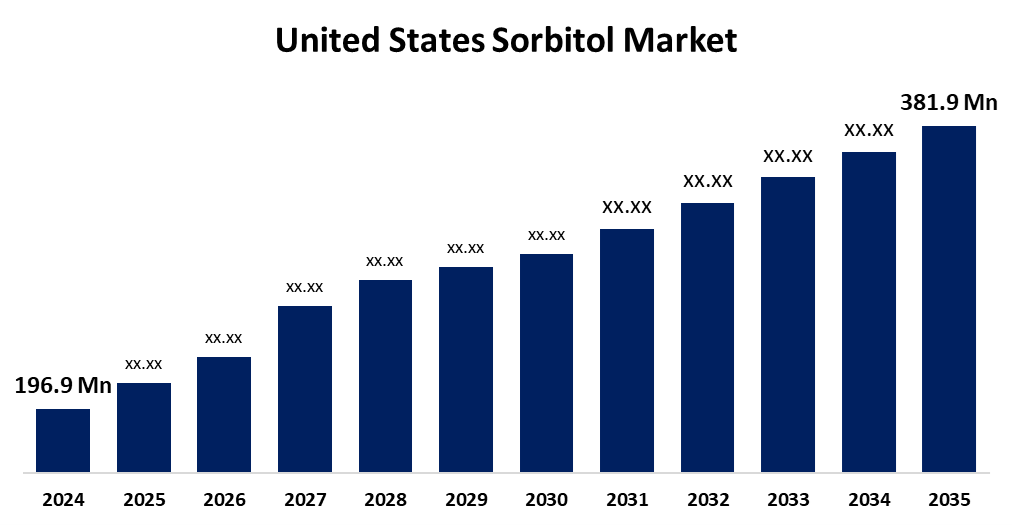

- The US Sorbitol Market Size Was Estimated at USD 196.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.21% from 2025 to 2035

- The US Sorbitol Market Size is Expected to Reach USD 381.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Sorbitol Market Size is anticipated to reach USD 381.9 Million by 2035, growing at a CAGR of 6.21% from 2025 to 2035. The expansion of the United States sorbitol market is propelled by the growing consumption of dietetic and diabetic foods and drinks.

Market Overview

Sorbitol, also known as D-sorbitol, D-glucitol, or E420, is a sugar alcohol (polyol). The major changes taking place in the US market for sorbitol are primarily determined by growing consumer awareness related to health and well-being. Such consumer awareness also determines both the stability and growth of sorbitol for the future via burgeoning demand for low-calorie sweeteners, of which sorbitol is being increasingly used in a variety of food and beverage applications. Sorbitol is frequently used in low-calorie and sugar-free products, and because of its ability to retain moisture, it is a particularly appealing sweetener for both businesses and customers. The increasing trend of using natural ingredients in food compositions has only helped sorbitol's growth because it is a substance that comes from natural sources like maize. Sorbitol's bio-based nature places it in a favorable market position, as many US food companies are attempting to reduce their carbon footprint on the environment. The government's encouragement of ecological practices and agriculture has created favourable market conditions for the production of sorbitol in the United States. All things considered, the outcomes of sustainability-focused trends and health-related consumer behaviours provide a positive market prognosis for sorbitol in the US market going forward. Sorbitol is classified as GRAS (Generally Recognised as Safe) by the Food and Drug Administration (FDA) for use in food and medicines. Therefore, it can be used in a larger number of products without requiring significant pre-market review.

Report Coverage

This research report categorizes the market for the United States sorbitol market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States sorbitol market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States sorbitol market.

United States Sorbitol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 196.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.21% |

| 2035 Value Projection: | USD 381.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Cargill, American International Group Inc, Ingredion Inc, DuPont de Nemours Inc, Archer-Daniels Midland Co, AD, Crescent Chemical, FMC Corporation, Sweetener Solutions, Merisant, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States sorbitol market is boosted as the incidence of diabetes and obesity rises, and the US sorbitol market is seeing an increase in demand for low-calorie sweeteners. The Centers for Disease Control and Prevention (CDC) estimates that approximately 34.2 million consumers in the US, or 10.5% of the US population, have diabetes. Generational change is part of what fuels the demand for sugar substitutes, including sorbitol. The major food and beverage manufacturers have been investing in updates of their product lines to include sorbitol as a safe sugar substitute to enhance enjoyment, if not actual consumption, of their products. Also, the inclusion of sorbitol in diets may facilitate the effective management of both weight and diabetes, which is likely to increase demand in the US sorbitol market, as a viable alternative for sugar substitutes.

Restraining Factors

The United States sorbitol market faces obstacles like the fluctuations in raw material prices provoked by changing prices for feedstocks, including corn, wheat, and potatoes, as well as the competitive situation. Alternative sweeteners include erythritol, xylitol, mannitol, and strong sweeteners, primarily stevia, often offering similar functional profiles at lower prices and/or altered taste profiles, have increased overall production costs and made planning for process possibilities in the medium to long term more challenging.

Market Segmentation

The United States sorbitol market share is classified into product and application.

- The liquid segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States sorbitol market is segmented by product into liquid and crystal. Among these, the liquid segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it is used in the food and beverage and pharmaceutical sectors to replace sugar in use. Expect any increase in use from these sectors, coupled with in low-calorie foods, will continue to drive demand for these products due to the continued increase in the number of obese and health-conscious patients.

- The diabetic & dietetic food & beverage segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States sorbitol market is segmented into oral Care, vitamin C, surfactant, diabetic & dietetic food & beverage, and others. Among these, the diabetic & dietetic food & beverage segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by economies of scale, with consumables moving into the functional food spaces, and near-zero manufacturing costs for the market leaders.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States sorbitol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill

- American International Group Inc

- Ingredion Inc

- DuPont de Nemours Inc

- Archer-Daniels Midland Co

- AD

- Crescent Chemical

- FMC Corporation

- Sweetener Solutions

- Merisant

- Others

Recent Development

- In December 2021, Cargill announced plans to acquire Croda’s bio-industrial business (announced in 2021), which bolsters its bio-based chemicals portfolio—though the agreement spans global operations, it feeds into U.S. strategies

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States sorbitol market based on the following segments:

United States Sorbitol Market, By Product

- Liquid

- Crystal

United States Sorbitol Market, By Application

- Oral Care

- Vitamin C

- Surfactant

- Diabetic & Dietetic Food & Beverage

- Others

Need help to buy this report?