United States Software Market Size, Share, and COVID-19 Impact Analysis, By Type (Application Software, System Infrastructure Software, Development and Deployment Software, and Productivity Software), By Deployment (On-premises and Cloud), and United States Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Software Market Insights Forecasts to 2035

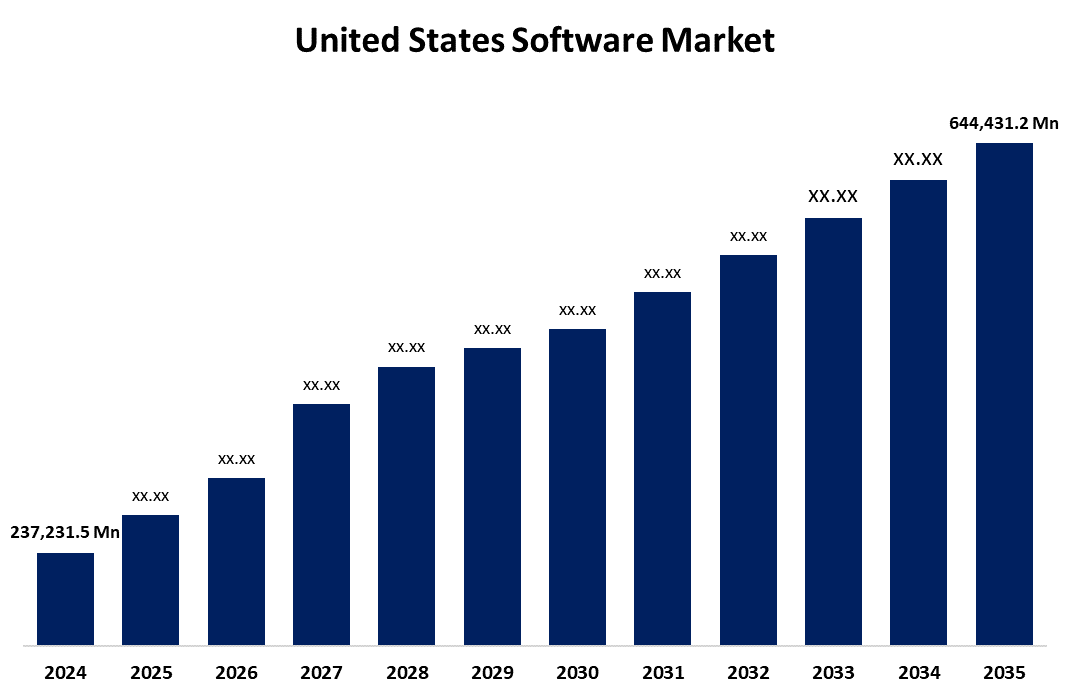

- The US Software Market Size Was Estimated at USD 237,231.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.51% from 2025 to 2035

- The US Software Market Size is Expected to Reach USD 644,431.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Software Market Size is anticipated to reach USD 644,431.2 Million by 2035, Growing at a CAGR of 9.51% from 2025 to 2035. The expansion of the United States software market is propelled by technological developments, governmental programs, and studies that improve the capabilities of software.

Market Overview

Software is a collection of data, programs, or instructions that are used to operate computers and carry out commands. Software is customized to meet the specialized needs of users in all fields and industries, allowing them to work more efficiently and productively. When a person or business uses finance software, they use financial transactions, budgeting, and investments. When they use video software, they create, edit, and play back content. Antivirus software finds, stops, and removes malicious software to protect the system from cybersecurity risks. So, software is classified into different categories, each of which serves a particular purpose and provides valuable tools that ease complex tasks. The U.S. software market has also grown tremendously due to digital transformation in nearly every industry. Cloud computing continues to be a leading trend with companies shifting to Software as a Service (SaaS) solutions due to scale and cost. Companies that focus on enhancing collaboration and productivity in the cloud are on the rise, particularly with more employees working remotely and with hybrid work models. The rise of AI, ML, and intelligent apps is changing the way software is developed, and is also changing what's possible through intelligent decision making and automated decisions, and processes. Another trend that is occurring is that organizations are focusing very much on cybersecurity, as organizations understand there is more sensitivity to protecting data and systems. As the number of cyber threats is growing, organizations are investing more in security software, and security services are increasing. Regulations and privacy requirements are forcing companies to implement secure software. The U.S. software market is changing fast, as technology is changing rapidly and customer solutions are driving growth.

Report Coverage

This research report categorizes the market for the United States software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States software market. Recent market developments and competitive strategies such as expansion, Deployment launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States software market.

United States Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 237,231.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.51% |

| 2035 Value Projection: | USD 644,431.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Deployment, and COVID-19 Impact Analysis |

| Companies covered:: | Infor, Workday, Inc., Microsoft, Avid Technology, Inc., Presonus Audio Electronics, Inc., Apple Inc., Adobe Inc., MOTU, Inc., Verint Systems Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States software market is fueled by the growth of the Internet of Things (IoT) provides compelling sources. Due to its broad effect across many sectors of the economy. The Internet of Things connects very large numbers of devices and systems from home appliances and industrial equipment to healthcare tools and municipal infrastructures. This connectivity in the IoT creates demand for significant amounts of software to help organizations manage, analyze, and secure the enormous amounts of data created through these connected devices. Companies are spending much more on software platforms that measure and collect data in real time, use big data to identify predictive analyses, and connect devices seamlessly.

Restraining Factors

The United States software market faces obstacles, like the ecological implications of computer software functioning. The growth of the software falling under its use model and development, and accompanying reliance on data centers and the cloud, creates energy usage and CO2 emission challenges. As the software service demand increases, the need for more data processing and storage leads to a requirement for larger-scale electricity consumption.

Market Segmentation

The United States software market share is classified into type and deployment.

- The application software segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States software market is segmented by type into application software, system infrastructure software, development and deployment software, and productivity software. Among these, the application software segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segmental growth is due to increased demand for several types of software to improve and enhance business activities and meet business processes using the latest IoT technologies and cloud-based solutions. The application software research includes enterprise resource planning (ERP), customer relationship management (CRM), supply chain management (SCM), enterprise collaboration software, enterprise content management (ECM) software, education software, and others.

- The on-premises segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the deployment, the United States software market is segmented into on-premises and cloud. Among these, the on-premises segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by allowing enterprises to keep control of data, due to data sovereignty regulations, and connect the modern data architecture to legacy systems with little change. Organizations looking to do on-premises data integration benefit from organizations that have data regulations, like finance and healthcare. Data integration vendors offer data replication solutions to ensure that all data is consistent and all local offices are running or offline. It also allows organizations to keep everything local while retaining security and control.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States software market, along with a comparative evaluation primarily based on their deployment offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Deployment development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Infor

- Workday, Inc.

- Microsoft

- Avid Technology, Inc.

- Presonus Audio Electronics, Inc.

- Apple Inc.

- Adobe Inc.

- MOTU, Inc.

- Verint Systems Inc.

- Others

Recent Development

- In February 2024, Copilot for Finance, a new AI-powered product in Microsoft 365, was unveiled by Microsoft with the goal of simplifying financial tasks, including analysis and reporting. For financial experts, this innovation promises higher accuracy and efficiency. Microsoft stands to gain from increased cloud service usefulness and attractiveness, which could lead to increased adoption.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States software market based on the following segments:

United States Software Market, By Type

- Application Software

- System Infrastructure Software

- Development and Deployment Software

- Productivity Software

United States Software Market, By Deployment

- On-premises

- Cloud

Need help to buy this report?