United States Software Defined Networking Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware Component, Services, and Software), By Application (Open SDN, SDN via API, and SDN via Overlay), and United States Software Defined Networking Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Software Defined Networking Market Insights Forecasts to 2035

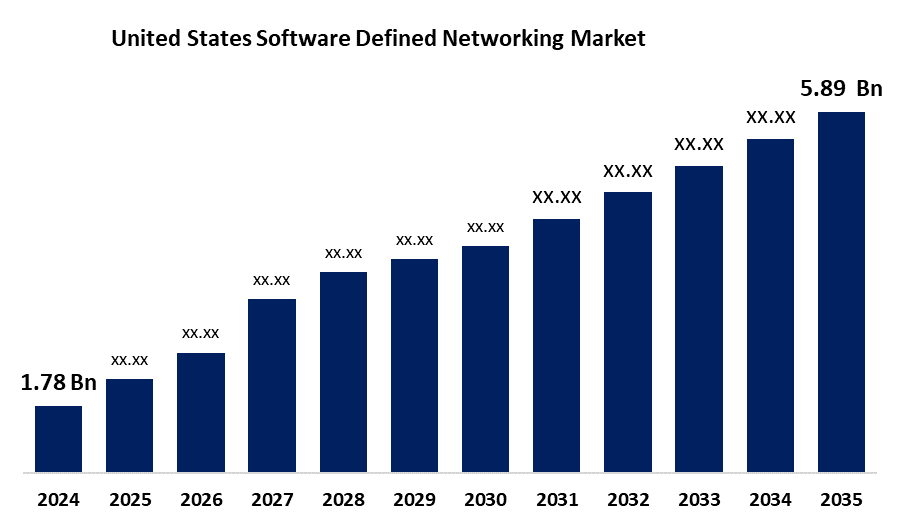

- The U.S. Software Defined Networking Market Size was estimated at USD 1.78 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.49% from 2025 to 2035

- The United States Software Defined Networking Market Size is Expected to Reach USD 5.89 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the USA software defined networking market is anticipated to reach USD 5.89 billion by 2035, growing at a CAGR of 11.49% from 2025 to 2035. The United States software defined networking (SDN) market grows due to increasing mobile data traffic, 5G adoption, and IoT expansion requiring flexible, scalable networks. Enhanced network security, cost efficiency, and simplified management attract enterprises. Integration with AI and machine learning for automation and predictive analytics further drives market demand, boosting SDN adoption across industries.

Market Overview

The United States software defined networking (SDN) market is defined by its technology that separates the network control plane from the data forwarding plane, allowing centralized and programmable network management through software controllers. This decoupling enables greater flexibility, agility, and simplified network operations. The market growth is primarily driven by increasing mobile data traffic, widespread adoption of 5G networks, and rapid expansion of Internet of Things (IoT) devices, all demanding scalable and efficient network solutions. SDN’s strengths lie in its ability to optimize network performance in real-time, reduce operational expenses, and support dynamic traffic loads. Additionally, the integration of SDN with Artificial Intelligence (AI) and Machine Learning (ML) presents opportunities for enhanced predictive analytics and automated network management. The rise of edge computing further expands SDN’s potential by addressing latency and security concerns. Government initiatives, including the Networking and Information Technology Research and Development (NITRD) program, actively support SDN research and innovation, ensuring the United States maintains technological leadership in networking.

Report Coverage

This research report categorizes the market for United States software defined networking market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA software defined networking market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. software defined networking market.

United States Software Defined Networking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.78 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.49% |

| 2035 Value Projection: | USD 5.89 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Component, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Cisco Systems, Juniper Networks, Arista Networks, VMware, Palo Alto Networks, Ciena Corporation, Broadcom Inc., Intel Corporation, Hewlett Packard Enterprise, Extreme Networks, Fortinet, Riverbed Technology, F5 Networks, Dell Technologies, IBM Corporation, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing demand for network agility and scalability to support digital transformation across industries. Enterprises seek to reduce operational costs and improve network management efficiency, making SDN an attractive solution. The increasing adoption of cloud computing, data centers, and virtualization fuels the need for flexible and programmable network infrastructure. Additionally, the rise in IoT devices and the expansion of 5G networks require dynamic network configurations, which SDN facilitates. Enhanced network security and simplified policy enforcement also propel market growth. Furthermore, government initiatives promoting advanced networking technologies and the surge in big data analytics contribute to the expanding SDN market in the U.S., creating opportunities for innovative service providers and technology vendors.

Restraining Factors

The complex integration with legacy systems, high implementation costs, and the need for continuous technology updates. Security risks arise from centralized network control, while a lack of standardization hinders interoperability. Additionally, regulatory compliance and data privacy concerns create barriers, slowing widespread adoption across industries.

Market Segmentation

The United States software defined networking market share is classified into component and application.

- The software segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA software defined networking market is segmented by component into hardware, services, and software. Among these, the software segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its critical role in enabling network programmability, automation, and centralized control. As organizations adopt cloud computing and virtualization, software solutions offer greater flexibility and faster network management than hardware alone. This drives higher demand for SDN software, making it the leading market segment.

- The SDN via overlay segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. software defined networking market is segmented by application into open SDN, SDN via API, and SDN via overlay. Among these, the SDN via overlay segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it enables seamless integration with existing networks without requiring major hardware changes. It offers greater flexibility and scalability by creating virtual networks over physical infrastructure, making it ideal for cloud and data center environments where rapid deployment and adaptability are crucial.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States software defined networking market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cisco Systems

- Juniper Networks

- Arista Networks

- VMware

- Palo Alto Networks

- Ciena Corporation

- Broadcom Inc.

- Intel Corporation

- Hewlett Packard Enterprise

- Extreme Networks

- Fortinet

- Riverbed Technology

- F5 Networks

- Dell Technologies

- IBM Corporation

- Others

Recent Developments:

- In June 2024, at Cisco Live 2024, Cisco launched Hypershield, an AI-native security product for fast, continuous protection across networks. They announced Firewall Threat Defense 7.6 to improve SD-WAN and zero-trust security. New Cisco 8000 Series routers were introduced, and a $1 billion Global AI Investment Fund was unveiled to boost AI innovation in networking and security.

Key Target Audience

Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. software defined networking market based on the below-mentioned segments:

United States Software Defined Networking Market, By Component

- Hardware Component

- Services

- Software

United States Software Defined Networking Market, By Application

- Open SDN

- SDN via API

- SDN via Overlay

Need help to buy this report?