United States Smoothies Market Size, Share, and COVID-19 Impact Analysis, By Product (Fruit-based, Dairy-based, and Others), By Distribution Channel (Restaurants, Smoothie Bars, Supermarkets & Convenience Stores, and Others), and United States Smoothies Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Smoothies Market Insights Forecasts to 2035

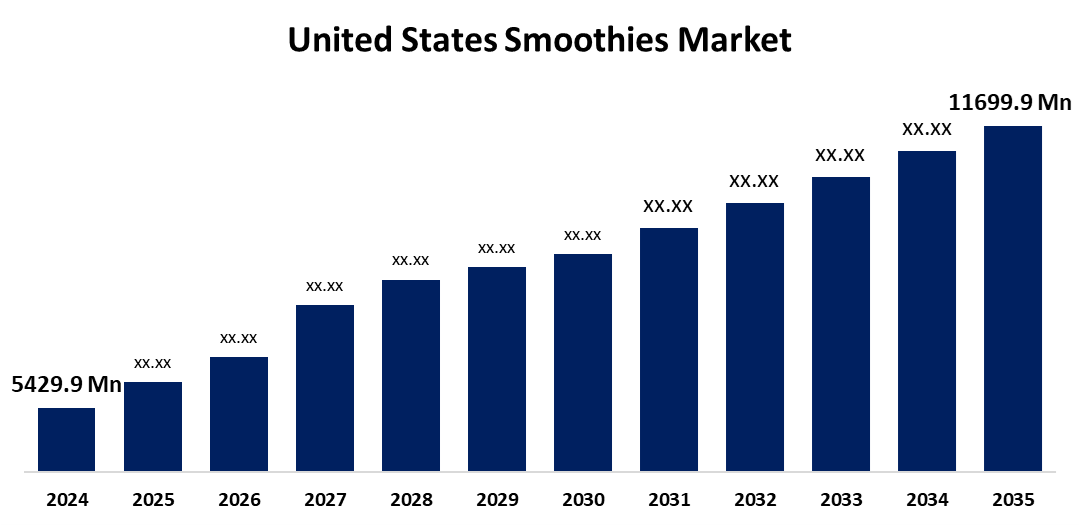

- The US Smoothies Market Size Was Estimated at USD 5,429.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.23% from 2025 to 2035

- The US Smoothies Market Size is Expected to Reach USD 11,699.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Smoothies Market Size is anticipated to reach USD 11,699.9 Million by 2035, Growing at a CAGR of 7.23% from 2025 to 2035. The expansion of the United States smoothie market is propelled by rising consumer knowledge about wellness and health.

Market Overview

A smoothie is a thick, chilly drink made by mixing whole fruits and vegetables with a liquid base, usually water, yoghurt, juice, dairy, or plant-based milk, and frequently ice or frozen products. In the U.S., the smoothie business has become a strong influencer of health and wellness, as prepared food and beverages have led to a change in consumer behavior due to the desire to consume more healthy food. Furthermore, nearly 90% of U.S. consumers consume the recommended number of servings of fruits and vegetables each day, according to the most recent data from the U.S. Department of Agriculture (USDA). This presents a fantastic opportunity for faster, smoother options to support better consumption. Functional smoothies, smoothies that are infused with added protein, vitamins, and minerals, have great appeal to consumers looking for specific benefits such as digestive health, immune health, or just general health. All of these factors will probably contribute to the smoothies steady expansion in the United States for the foreseeable future. A further important direction in the US smoothie market is the increasing emphasis on natural or organic products. Customers are leaning towards smoothies made with natural and organic ingredients because they are increasingly aware of the health risks associated with artificial additives and preservatives. The growing demand for organic products is apparent in the increasing number of certified organic operations under the USDA National Organic Program (NOP). The organic movement is receiving further encouragement from programs such as the USDAs Agricultural Marketing Service (AMS) Organic Market Development Grant (OMDG) program, which commits up to USD 85 million to develop critical markets. According to USDA information, organic is now a $63 billion industry, and most of this growth is driven by fruits and vegetables.

Report Coverage

This research report categorizes the market for the United States smoothies market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States smoothies market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States smoothies market.

United States Smoothies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5,429.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.23% |

| 2035 Value Projection: | USD 11,699.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Tropical Smoothie Cafe, Suja Life, Smoothie King, Jamba Juice, Barfresh Food Group Inc, Bolthouse Farms, The Coca-Cola Company, The Hain Celestial Group Inc, Starbucks Corporation, Chick-fil-A, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States smoothies market is boosted by the increased health consciousness among US consumers. Approximately 39.8% of US adults are currently obese according to the Centers for Disease Control and Prevention (CDC), which drives the need for more health-focused food choices (vitamin and nutrient-dense smoothies). The increasing number of health-focused consumers working from home has also contributed to an expanding market in smoothies. Popular brands, Smoothie King and Jamba Juice, have reported sales increases, indicating that healthy smoothie options are becoming increasingly visible in the US.

Restraining Factors

The United States smoothies market faces obstacles, including free sugars, that reducing free sugars is important because consumers prioritize dental health, and it has become customary for consumers to manage energy intake to maintain weight. The growth potential for the market continues to diminish because of increased awareness of the detrimental health effects associated with free sugars.

Market Segmentation

The United States smoothies market share is classified into product and distribution channel.

- The fruit-based segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States smoothies market is segmented by product into fruit-based, dairy-based, and others. Among these, the fruit-based segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the nutritional value of fruits, which contain important vitamins, minerals, and antioxidants, and is widely recognised. As a result of this, fruit-based smoothies are now often associated with health and well-being. Additionally, fruits are naturally sweet, and watery fruits, such as watermelon and berries, add to the hydrating and refreshing elements of smoothies. These elements have all contributed to fruit-based smoothies in the market.

- The smoothie bars segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States smoothies market is segmented into restaurants, smoothie bars, supermarkets & convenience stores, and others. Among these, the smoothie bars segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as consumers prefer their drinks by selecting specific fruits, vegetables, bases, and add-ins. In addition, specialty smoothie bars commonly carry a diverse menu of flavours and combinations. Additionally, several companies in the smoothie industry are growing by opening smoothie bars in response to the rising demand for smoothies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States smoothies market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tropical Smoothie Cafe

- Suja Life

- Smoothie King

- Jamba Juice

- Barfresh Food Group Inc

- Bolthouse Farms

- The Coca-Cola Company

- The Hain Celestial Group Inc

- Starbucks Corporation

- Chick-fil-A

- Others

Recent Development

- In January 2025, Smoothie King announced that it had opened 84 new stores across the US in 2024, including a record 11 in December. The brand ended the year with 1,200 US locations and announced plans for 105 openings in 2025.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States smoothies market based on the following segments:

United States Smoothies Market, By Product

- Fruit-based

- Dairy-based

- Others

United States Smoothies Market, By Distribution Channel

- Restaurants

- Smoothie Bars

- Supermarkets & Convenience Stores

- Others

Need help to buy this report?