United States Smart Agriculture Market Size, Share, and COVID-19 Impact Analysis, By Offering (Hardware, Software, and Services), By Application (Precision Farming, Livestock Monitoring, and Smart Greenhouse), and US Smart Agriculture Market Insights, Industry Trend, Forecasts to 2035.

Industry: AgricultureUnited States Smart Agriculture Market Insights Forecasts to 2035

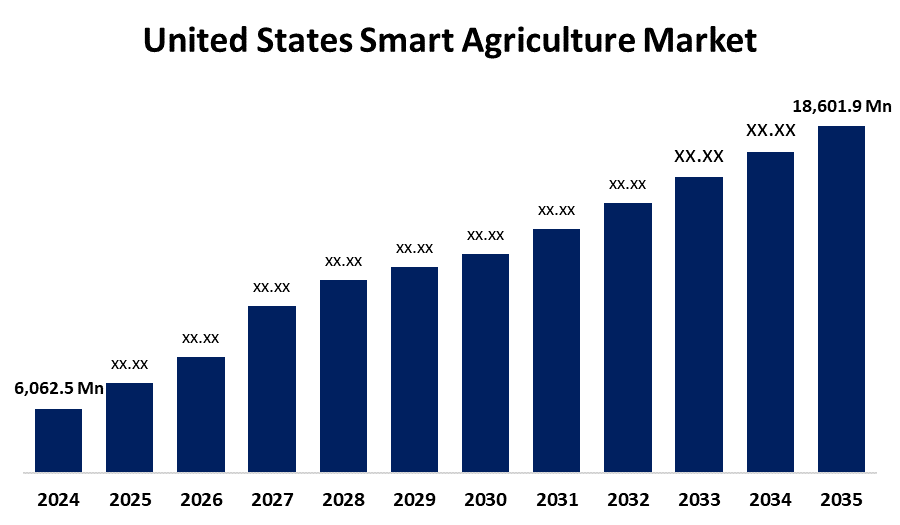

- The US Smart Agriculture Market Size Was Estimated at USD 6,062.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.73% from 2025 to 2035

- The US Smart Agriculture Market Size is Expected to Reach USD 18,601.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The US Smart Agriculture Market Size is Anticipated to reach USD 18,601.9 Million By 2035, Growing at a CAGR of 10.73% from 2025 to 2035. The expansion of the US smart agriculture market is mainly driven by demand, which includes the growing automation of commercial greenhouses and the expanding usage of the controlled environment agriculture (CEA) concept in greenhouses to maintain ideal growth conditions and increase production.

Market Overview

Smart agriculture is referred to as the incorporation of new technologies and data-directed practices to enhance agricultural production, profitability, and sustainability. Smart agriculture, an approach based on a range of digital technologies (e.g., sensors, drones, global positioning system (GPS), and data analytics), deploys the precision monitoring and management of land, animals, and crops. Smart agriculture transmits real-time conditions to farmers about crop, weather, soil moisture, and other properties to inform farm decisions about irrigation, fertilization, pest management, and many other activities. Smart agriculture (also referred to as precision agriculture) applies new technologies and data-driven practices to agriculture so that agricultural productivity, profitability, and sustainability can be increased. Smart agriculture, which is an ecosystem-type of practice drawing on a number of digital technologies (sensors, drones, global positioning system (GPS), and data analytics), allows for the discrete monitoring and management of land, animals, and crops. Smart agriculture delivers real-time informational conditions to farmers regarding crops, climate, soil moisture, and other conditions and disturbances that help farmers make informed decisions about irrigation, fertilization, pest control, and many other farm activities. The ramifications include a more precise and effective way to do necessary household chores like fertilization, irrigation, and insect control.

Report Coverage

This research report categorizes the market for the US smart agriculture market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US smart agriculture market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US smart agriculture market.

United States Smart Agriculture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6,062.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.73% |

| 2035 Value Projection: | USD 18,601.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Offering, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Deere & Company, Trimble Inc., AGCO Corporation, Raven Industries, Topcon, Innovasea Systems Inc., AgriData Incorporated, GrowneticsInc, AGEagle Aerial Systems Inc., Precision Planting LLC., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the US smart agriculture market is further enhanced by the ability of farmers to see the development of their products using the Internet of Things (IoT), which is now rapidly growing in popularity in the agricultural sector. The combining of IoT applications with traditional agricultural practices means farmers can concentrate on providing consumers with safe and quality food, and potentially save time and resources, including land, water, and energy. Precision farming techniques have reduced the usage of fertilizers and pesticides, permitting organic food to reach more kinds of end customers.

Restraining Factors

The US smart agriculture market faces obstacles, like the expensive nature of precision agricultural equipment. Smart sensors, drones, VRT, GPS, GNSS, guiding tools, and receivers are some of the expensive and advanced equipment used in precision agriculture. While extremely effective techniques and technologies are also very costly.

Market Segmentation

The US smart agriculture market share is classified into offering and application.

- The hardware segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The US smart agriculture market is segmented by offering into hardware, software, and services. Among these, the hardware segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by indoor agricultural equipment, automation and control systems, sensors, and navigation systems. Many hardware solutions are available for uses like sensing analytical data, automating and managing agricultural equipment, and maintaining and preserving the ideal atmosphere in indoor farming facilities. The most significantly created and marketed hardware component in the world is sensor technology. The hardware market for smart farming is anticipated to expand, and sensors are an essential component of sensor-based agricultural solutions.

- The precision farming segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the US smart agriculture market is segmented into precision farming, livestock monitoring, and smart greenhouse. Among these, the precision farming segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is propelled by the increased use of drones and unmanned aerial vehicles (UAVs) for agricultural monitoring. Multispectral imagery and mapping drones give farmers wide images of both crop health and variability within fields, allowing farmers to instantly spot problems and optimize their solutions. The costs of drones are decreasing along with the regulatory situation for farmers due to the developing technology, making drones increasingly important in precision agricultural practice as another facet of data-driven agriculture.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US smart agriculture market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Deere & Company

- Trimble Inc.

- AGCO Corporation

- Raven Industries

- Topcon

- Innovasea Systems Inc.

- AgriData Incorporated

- GrowneticsInc

- AGEagle Aerial Systems Inc.

- Precision Planting LLC.

- Others

Recent Developments:

- In July 2023, Smart Apply, Inc. was acquired by Deere & Company. The business intended to use Smart Apply's precision spraying technology to help growers deal with issues related to labour costs, input costs, legal requirements, and environmental objectives.

- In April 2023, Hexagon and AGCO Corporation announced a strategic partnership aimed at expanding AGCO's factory-fit and aftermarket guiding services. It was intended for the new guidance system to be marketed as the Fuse Guide for Massey Ferguson and Valtra tractors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the US, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US Smart Agriculture market based on the following segments

US Smart Agriculture Market, By Offering

- Hardware

- Software

- Services

US Smart Agriculture Market, By Application

- Precision Farming

- Livestock Monitoring

- Smart Greenhouse

Need help to buy this report?