United States Shapewear Market Size, Share, and COVID-19 Impact Analysis, By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, and Online), By End-use (Female and Male), and United States Shapewear Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Shapewear Market Insights Forecasts to 2035

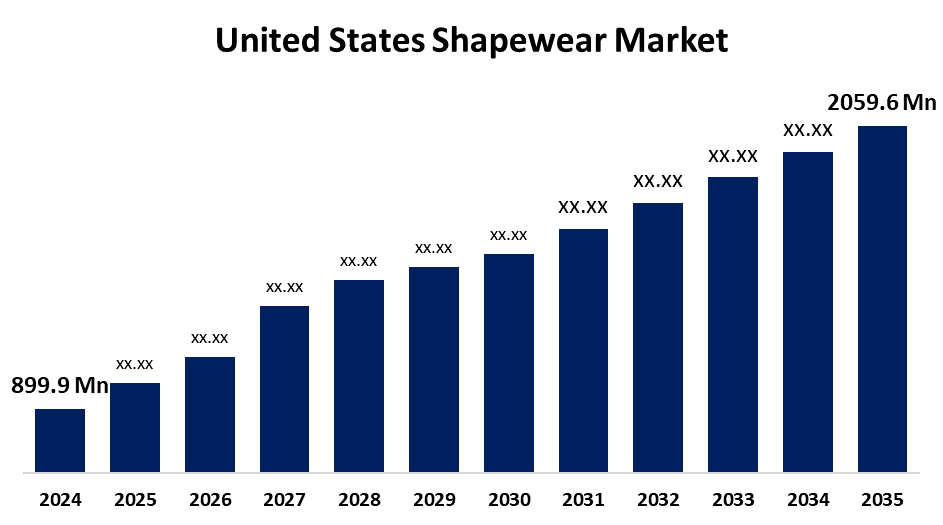

- The US Shapewear Market Size Was Estimated at USD 899.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.82% from 2025 to 2035

- The US Shapewear Market Size is Expected to Reach USD 2059.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Shapewear Market Size is anticipated to reach USD 2059.6 Million by 2035, growing at a CAGR of 7.82% from 2025 to 2035. The expansion of the United States' shapewear market is propelled by shifting customer preferences, fabric technology breakthroughs, and social media's rising influence on fashion trends.

Market Overview

The term shapewear describes a type of undergarment intended to temporarily modify and contour the body's natural contours, creating a more streamlined and smoother silhouette beneath clothing. The need for shapewear designed to contour the body and offer comfort is expected to increase as individuals continue to feel self-conscious about their looks and bodies. Various factors are influencing the shapewear industry, including growing interest in shapewear across demographics. For example, shapewear products have transitioned from a women's industry to men's shapewear. This shift illustrates a cultural trend of self-expression and body positivity, and many shapewear brands are promoting shapewear products made only for men, such as compression shorts and shaping vests. Having two different female and male product categories, brands have now attracted new buyers and incentivized more development and growth of their products.

The Fashioning Accountability and Building Real Institutional Change Act (FABRIC Act), which was introduced in 2022, intends to reform the U.S. apparel industry by eliminating piece-rate pay, establishing a national garment industry registry, and establishing a $40 million Domestic Garment Manufacturing Assistance Program. These initiatives aim to provide equitable pay, improve working conditions, and encourage the domestic production of apparel, especially shapewear.

Report Coverage

This research report categorizes the market for the United States shapewear market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States shapewear market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States shapewear market.

United States Shapewear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 899.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.82% |

| 2035 Value Projection: | USD 2059.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Distribution Channel and By End-use |

| Companies covered:: | Leonisa USA, Spanx, Nike Inc Class B, Under Armour Inc. Class A, SPANX, HanesBrands Inc, Jockey International, Inc, Nike, Inc., Adidas AG, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States' shapewear market is boosted by recent technological progress in fabric technology. Core items in the shapewear market, including compression tights, camisoles, and belly tuckers, etc. are benefiting from advancements in the fabric manufacturing process and use of high-quality fabrics, which will allow continuous enhancements in the market appeal. Many companies have been implementing new technologies to make shapewear items more comfortable and versatile for customers. Similarly, bonding and laser-cut technologies do away with seams, edges, bulky fasteners, and have truly innovated body shapewear items. Shapewear fabric manufacturers usually use nylon, spandex, polyester, lycra, and elastane. This has led to an increase in the production of these fabrics recently.

Restraining Factors

The United States shapewear market faces obstacles like specialty items and improved technology in terms of materials, which is higher than standard intimate apparel items. From a manufacturer's view, the bonding and laser cutting procedures required in the production phase of shapewear increase investment and upkeep costs.

Market Segmentation

The United States shapewear market share is classified into distribution channel and end-use.

- The specialty stores segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States shapewear market is segmented by distribution channel into hypermarkets & supermarkets, specialty stores, and online. Among these, the specialty stores segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it provides a tailored purchasing experience. Consumers can view a curated selection of sub-premium placements on shapewear that typically cannot be found in the larger retail stores, try on deposits, and receive personal assistance from knowledgeable staff. Consumers can find the right fit and style at a specialty store that has premium brands and styles designed for body-shaping needs.

- The female segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States shapewear market is segmented into female and male. Among these, the female segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the increased attention given by women towards fashion and physical appearance. In order to get a more attractive physique, this group has embraced shapewear as an essential piece of apparel. Products like the high-waisted shaping shorts that add support under clothing and provide a smooth finish have become popular among many women as they can be worn under formal wear or casual attire.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States shapewear market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Leonisa USA

- Spanx

- Nike Inc Class B

- Under Armour Inc. Class A

- SPANX

- HanesBrands Inc

- Jockey International, Inc

- Nike, Inc.

- Adidas AG

- Others

Recent Development

- In January 2025, Spanx introduced the AirEssentials Shapewear line, featuring ultra-lightweight, breathable fabric designed for all-day comfort. This collection blends functionality with athleisure aesthetics, targeting younger consumers seeking versatile shaping solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States shapewear market based on the following segments:

United States Shapewear Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Online

United States Shapewear Market, By End-use

- Female

- Male

Need help to buy this report?