United States Sequencing Market Size, Share, and COVID-19 Impact Analysis, By Product & Services (Platform, Software, Consumables, and Services), By Application (Oncology, Clinical Investigation, HLA Typing/Immune System Monitoring, Metagenomics, Epidemiology & Drug Development, Agrigenomics & Forensics, Consumer Genomics, and Reproductive Health), and United States Sequencing Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Sequencing Market Size Insights Forecasts to 2035

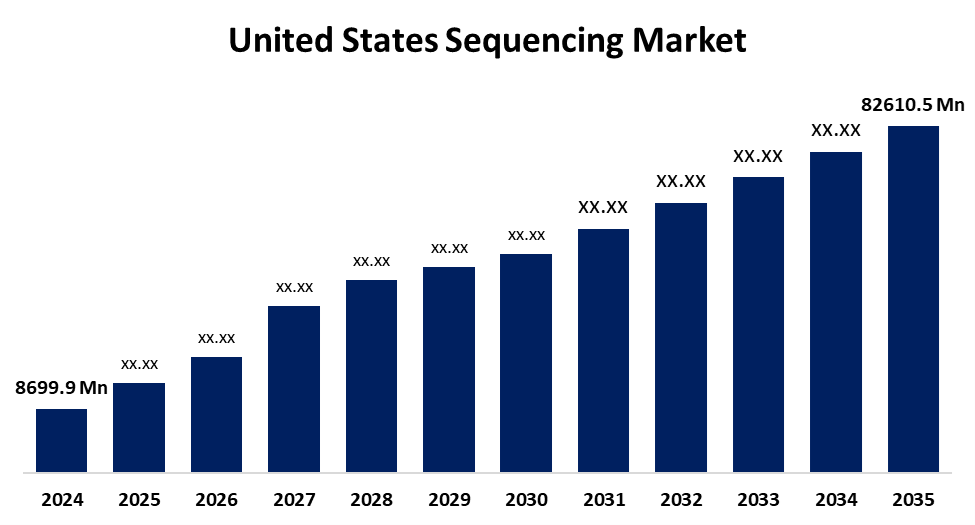

- The US Sequencing Market Size Was Estimated at USD 8699.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 22.71% from 2025 to 2035

- The US Sequencing Market Size is Expected to Reach USD 82610.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Sequencing Market Size is anticipated to reach USD 82610.5 million by 2035, growing at a CAGR of 22.71% from 2025 to 2035. The expansion of the United States sequencing market is propelled by rising demand for drug discovery, personalised medicine, gene therapy, and rising cancer rates, as well as a notable surge in consumer genomics demand in recent years.

Market Overview

A sequencing, as used in biology and biochemistry, is the precise configuration of monomer units, such as amino acids in proteins or nucleotides in DNA or RNA, that comprise a biopolymer. The increasing number of collaborations and joint ventures between market players is also expected to positively influence industry growth. For example, in June 2022, Allegheny Health Network and Illumina, Inc. announced a partnership for efficient evaluation of the results of in-house Comprehensive Genomic Profiling (CGP) to improve patient care. Furthermore, many large companies have enhanced their capabilities for research and development. Throughout the projection period, positive conditions for market growth are expected based on factors such as the typical use of NGS technologies for clinical diagnostics, as these technologies tend to provide quicker results and processing.

The U.S. government has actively supported the sequencing industry through targeted research funding, public-health infrastructure projects, and regulatory help. The NIH has given millions of dollars in grants to organisations like the NHLBI and NHGRI under the Clinical Sequencing Exploratory Research program to develop clinical sequencing tools and incredibly quick and affordable DNA sequencing technologies.

Report Coverage

This research report categorizes the market for the United States sequencing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States sequencing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States sequencing market.

United States Sequencing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8699.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 22.71% |

| 2035 Value Projection: | USD 82610.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 196 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Product & Services, By Application and COVID-19 Impact Analysis |

| Companies covered:: | PierianDx, DNAstar, PerkinElmer, Bio-Rad Laboratories Inc, Illumina Inc, Thermo Fisher Scientific Inc, Pacific Biosciences, Agilent Technologies, QIAGEN, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States sequencing market is boosted due to the increase in demand for personalised therapy, stemming from a rise in cancer and hereditary disorders. Industry growth is also due to the proliferation of direct-to-consumer genetic testing like 23andMe and AncestryDNA. Also, sequencing research and applications are being funded by governmental programs and funding as the NIH's All of US Research Program.

Restraining Factors

The United States sequencing market faces obstacles as high-throughput sequencers like Illumina NovaSeq can cost anywhere up to 1 million USD, preventing small research organizations and start-ups from adopting them.

Market Segmentation

The United States sequencing market share is classified into product & services and application.

- The consumables segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States sequencing market is segmented by product & services into platform, software, consumables, and services. Among these, the consumables segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because sequencing remains a continuous process that requires continuous access to consumables, so there is a large share for the consumables segment. Consumables have grown because of advances in technologies such as shotgun or de novo sequencing, and increased demand for high-throughput sequencing.

- The oncology segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States sequencing market is segmented into oncology, clinical investigation, HLA typing/immune system monitoring, metagenomics, epidemiology & drug development, agrigenomics & forensics, consumer genomics, and reproductive health. Among these, the oncology segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the need for sequencing to aid in cancer diagnosis and treatment. By sequencing patients' DNA, researchers can identify specific genetic mutations associated with specific cancer types.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States sequencing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PierianDx

- DNAstar

- PerkinElmer

- Bio-Rad Laboratories Inc

- Illumina Inc

- Thermo Fisher Scientific Inc

- Pacific Biosciences

- Agilent Technologies

- QIAGEN

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States sequencing market based on the following segments:

United States Sequencing Market, By Product & Services

- Platform

- Software

- Consumables

- Services

United States Sequencing Market, By Application

- Oncology

- Clinical Investigation

- HLA Typing/Immune System Monitoring

- Metagenomics

- Epidemiology & Drug Development

- Agrigenomics & Forensics

- Consumer Genomics

- Reproductive Health

Need help to buy this report?