United States Semaglutide Market Size, Share, and COVID-19 Impact Analysis, By Product (Ozempic, Wegovy, and Rybelsus), By Application (Type 2 Diabetes Mellitus, Obesity, and Others), and United States Semaglutide Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Semaglutide Market Insights Forecasts to 2035

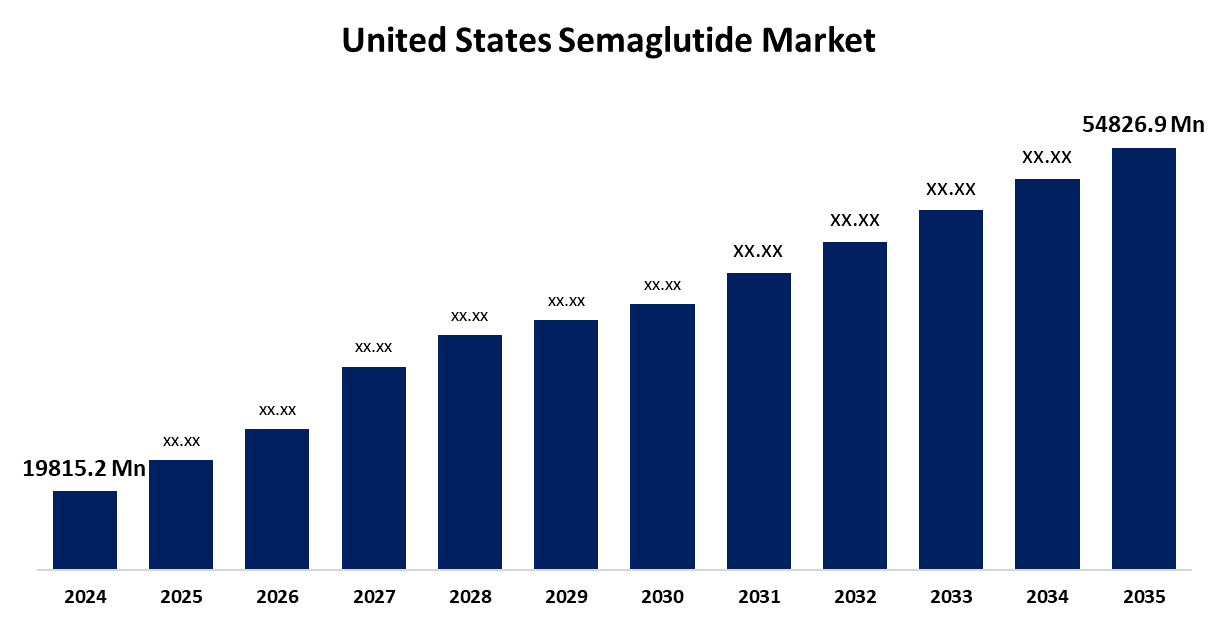

- The US Semaglutide Market Size Was Estimated at USD 19815.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.69% from 2025 to 2035

- The US Semaglutide Market Size is Expected to Reach USD 54826.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Semaglutide Market Size is Anticipated to reach USD 54826.9 Million by 2035, Growing at a CAGR of 9.69% from 2025 to 2035. The expansion of the United States semaglutide market is propelled by the rising incidence of obesity and type 2 diabetes, the growing need for GLP-1 receptor agonists, and the expanding use of weight-loss therapies.

Market Overview

Semaglutide is a synthetic medication that selectively activates receptors for the hormone glucagon-like peptide 1, promoting the release of insulin and inhibiting the release of glucagon. The market expansion is influenced by the strong sales numbers, with the increasing clinical indications and regulatory approvals also contributing to market growth. Key players are making R and D investments, and the market is growing as patients prefer once-weekly doses and reimbursement policies favor this option.Overall momentum in the market is influenced by geographical expansions and pharmaceutical partnerships. Diabetes rates are increasing, which serves as an important tailwind for the semaglutide market. Each year, millions of new Type 2 diabetes cases are diagnosed in both developed and developing markets, with healthcare systems seeking out more efficient means of managing glucose. The clinical profile of semaglutide is preferred by practitioners who are treating more complex patients in their practice, given the efficacy data that has shown that it can reduce HbA1c with weight loss benefits. Given that early intervention with effective therapy can greatly alter longer-term performance, medical practitioners are changing their treatment algorithms to include the advantages of semaglutide earlier in the disease trajectory to maximize therapy.

Report Coverage

This research report categorizes the market for the United States semaglutide market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States semaglutide market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States semaglutide market.

United States Semaglutide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19815.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 9.69% |

| 2035 Value Projection: | USD 54826.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 160 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Lexicon Pharmaceuticals, Viking Therapeutics, Inc., Eli Lilly and Co., Novo Nordisk, Biocon, AstraZeneca, Pfizer Inc., and others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The growth of the United States semaglutide market is boosted because early intervention with effective medications can significantly improve long-term outcomes. Clinicians and other health professionals will be changing treatment algorithms to capitalize on these early benefits in the evolution of diabetes. The changing demographic of diabetes is altering the commercial landscape for GLP-1 receptor agonists like semaglutide and affecting treatment models. Companies retailing semaglutide that offer extensive patient support options, including digital health monitoring, patient follow-up, and engagement tools, have improved patient outcomes and adherence, creating competitive advantages in this burgeoning area of therapeutics.

Restraining Factors

The United States semaglutide market faces obstacles like the competing high treatment costs pose significant financial hurdles, especially for uninsured populations with limited resources; insurance plans offer varying degrees of coverage and limitations. The complexity of manufacturing, challenges in production, and supply chain disruptions place reliability under duress and limit access to resources.

Market Segmentation

The United States semaglutide market share is classified into product and application.

- The ozempic segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States semaglutide market is segmented by product into ozempic, wegovy, and rybelsus. Among these, the ozempic segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the driven by increasing incidence of type 2 diabetes uptake, widespread approvals, and clinical competence. The competitive environment from demand, Ozempic's positioning has continued unchallenged due to favourable pricing, good supply chain management, and ongoing R&D.

- The type 2 diabetes mellitus segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States semaglutide market is segmented into type 2 diabetes mellitus, obesity, and others. Among these, the type 2 diabetes mellitus segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the advancement in innovative therapies and their growing footprint. Therapy trends have drastically shifted as a result of the increasing uptake of GLP-1 receptor agonists, like semaglutide. Market growth is also supported by positive reimbursement policies, increasing health systems access, and innovation with insulin formulationsa.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States semaglutide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lexicon Pharmaceuticals

- Viking Therapeutics, Inc.

- Eli Lilly and Co.

- Novo Nordisk

- Biocon

- AstraZeneca

- Pfizer Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End Users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States semaglutide market based on the following segments:

United States Semaglutide Market, By Product

- Ozempic

- Wegovy

- Rybelsus

United States Semaglutide Market, By Application

- Type 2 Diabetes Mellitus

- Obesity

- Others

Need help to buy this report?