United States Selective Laser Sintering Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Polymers, Metals, Ceramics, Composites, and Biomaterials), By Application (Prototyping, Production of Functional Parts, Medical and Dental Applications, Aerospace and Defense, Automotive, Consumer Electronics, and Art and Design), and United States Selective Laser Sintering Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Selective Laser Sintering Market Size Insights Forecasts to 2035

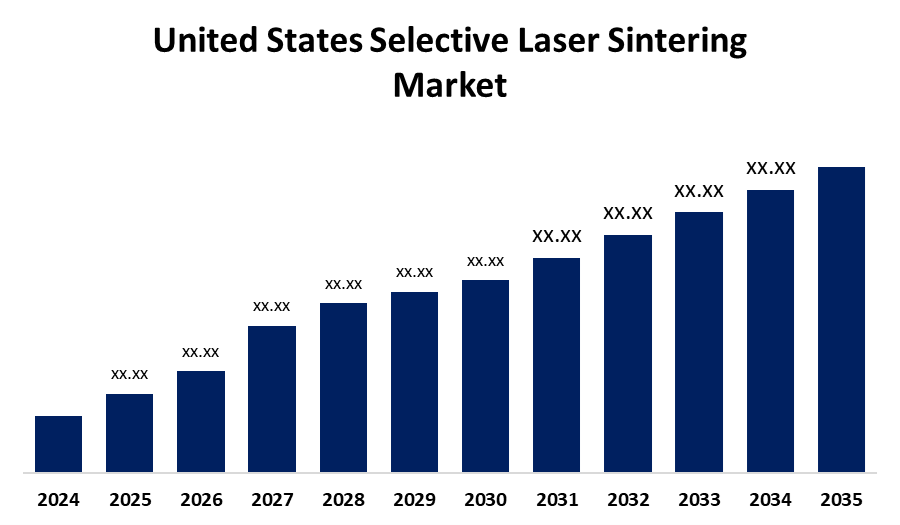

- The USA Selective Laser Sintering Market Size is Expected to Grow at a CAGR of around 5.2% from 2025 to 2035.

- The United States Selective Laser Sintering Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the U.S. Selective Laser Sintering Market Size is Expected to hold a significant share by 2035, growing at a CAGR of 5.2% from 2025 to 2035. The U.S. Selective Laser Sintering Market grows due to rising demand for rapid prototyping, lightweight and complex parts in aerospace, automotive, and healthcare. Advances in materials and technology enable functional components. Government support and reshoring boost adoption, while on-demand manufacturing increases flexibility, reducing supply chain risks and driving sustained market expansion.

Market Overview

The United States Selective Laser Sintering Market refers to the use of advanced additive manufacturing technology to create complex parts by fusing powdered materials such as metals, polymers, ceramics, composites, and biomaterials. This technology is widely utilized across diverse industries, including aerospace, automotive, medical and dental, consumer electronics, and prototyping. Key market drivers include increasing demand for lightweight, durable, and customized components, especially in aerospace and automotive sectors, where fuel efficiency and performance are critical. SLS enables rapid production of intricate geometries that traditional manufacturing methods cannot easily achieve, reducing lead times and material waste. The market’s strengths lie in its ability to produce functional, high-performance parts with cost-effective tooling and sustainable processes. Opportunities are growing with advancements in biocompatible materials for medical use, integration of AI to improve print accuracy, and the rise of decentralized micro-factories supporting localized manufacturing. Furthermore, U.S. government initiatives such as Manufacturing USA and funding for advanced manufacturing technologies promote SLS adoption, innovation, and domestic competitiveness.

Report Coverage

This research report categorizes the market for the United States selective laser sintering market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' selective laser sintering market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States' selective laser sintering market.

United States Selective Laser Sintering Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 136 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Material Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | 3D Systems Inc., EOS GmbH, Farsoon Technologies, Prodways Group, Formlabs Inc., Ricoh Company Ltd, Concept Laser GmbH, Renishaw PLC, Sinterit Sp. Zoo, Sintratec AG, Sharebot SRL, Red Rock SLS, Natural Robotics, Z Rapid Tech, Aerosint, Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for rapid prototyping and customized production across industries like automotive, aerospace, and healthcare fuels market growth. SLS technology enables the creation of complex geometries and lightweight, durable parts that are difficult to achieve with traditional manufacturing methods. Rising adoption in the medical and dental sectors for personalized implants and prosthetics further boosts demand. Additionally, advancements in material science, particularly in metal powders, have expanded SLS applications to functional parts and end-use components. The push for lightweight materials in automotive and aerospace to improve fuel efficiency also supports growth. Government investments in advanced manufacturing technologies and reshoring initiatives encourage domestic adoption, making SLS an essential part of the evolving U.S. manufacturing landscape.

Restraining Factors

The high equipment and material costs are limiting adoption among small and medium enterprises. Additionally, the process requires skilled labor and has slower production speeds compared to traditional manufacturing. Limited availability of diverse metal powders and post-processing challenges also hinder broader market growth.

Market Segmentation

The United States' selective laser sintering market share is classified into material type and application.

- The metals segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States selective laser sintering market is segmented by material type into polymers, metals, ceramics, composites, and biomaterials. Among these, the metals segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its superior strength, durability, and heat resistance. Metals like titanium and aluminum enable the production of complex, high-performance parts essential for aerospace, automotive, and medical industries, driving demand for metal-based SLS in functional, load-bearing, and critical applications.

- The automotive segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States selective laser sintering market is segmented by application into prototyping, production of functional parts, medical and dental applications, aerospace and defense, automotive, consumer electronics, and art and design. Among these, the automotive segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the demand for lightweight, durable, and complex parts that improve fuel efficiency and performance. SLS enables rapid prototyping and production of customized components, supporting innovation and the shift toward electric vehicles, making it essential for modern automotive manufacturing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States selective laser sintering market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3D Systems Inc.

- EOS GmbH

- Farsoon Technologies

- Prodways Group

- Formlabs Inc.

- Ricoh Company Ltd

- Concept Laser GmbH

- Renishaw PLC

- Sinterit Sp. Zoo

- Sintratec AG

- Sharebot SRL

- Red Rock SLS

- Natural Robotics

- Z Rapid Tech

- Aerosint

- Others

Recent Developments:

- In November 2024, 3D Systems (NYSE: DDD) announced several new products it showcased at Formnext 2024, including advanced printing technologies and materials engineered to help customers meet a variety of application needs and accelerate innovation. The company introduced next-generation products in its Stereolithography (SLA) and Figure 4® portfolios, PSLA 270 full solution, including the Wash 400/Wash 400F and Cure 400, Figure 4 Rigid Composite White, and Accura® AMX Rigid Composite White, to address true production applications and accelerate the time to part.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States selective laser sintering market based on the below-mentioned segments:

United States Selective Laser Sintering Market, By Material Type

- Polymers

- Metals

- Ceramics

- Composites

- Biomaterials

United States Selective Laser Sintering Market, By Application

- Prototyping

- Production of Functional Parts

- Medical and Dental Applications

- Aerospace and Defense

- Automotive

- Consumer Electronics

- Art and Design

Need help to buy this report?