United States Seed Processing Machinery Market Size, Share, and COVID-19 Impact Analysis, By Seed Type (Cereals & Grains, Oilseeds & Pulses, Vegetables & Fruits, Forage & Turf Seeds, and Flowers & Ornamentals), By Processing Method (Cleaning & Sizing, Drying & Conditioning, Grading & Sorting, Coating & Pelleting, and Others), By End-User (Agriculture, Food & Beverage, Pharmaceuticals, Cosmetics, and Others), and United States Seed Processing Machinery Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Seed Processing Machinery Market Insights Forecasts to 2035

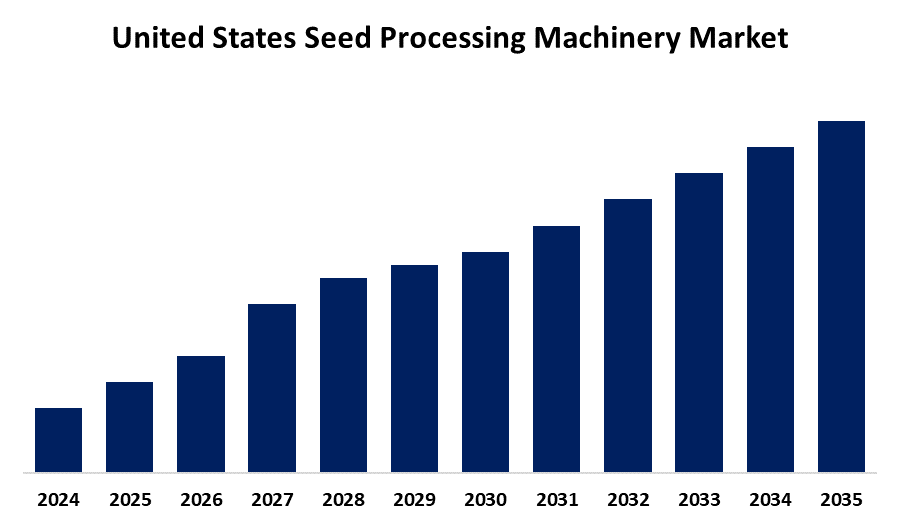

- The USA Seed Processing Machinery Market Size is Expected to Grow at a CAGR of around 7.8% from 2025 to 2035.

- The United States Seed Processing Machinery Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Seed Processing Machinery market Size is Expected to hold a Significant share by 2035, Growing at a CAGR of 7.8% from 2025 to 2035. The U.S. seed processing machinery market is experiencing growth due to advancements and technological innovations, with the increasing focus on sustainable farming practices promoting the use of machinery that minimizes soil disturbance and reduces the need for excessive pesticide application.

Market Overview

The United States seed processing machinery market encompasses equipment such as seed cleaners, graders, dryers, and coaters, essential for preparing seeds for planting. Key drivers include the increasing global population, which heightens the demand for high-quality seeds to ensure food security. Advancements in technology, including automation, artificial intelligence (AI), and the Internet of Things (IoT), have revolutionized seed processing by improving efficiency and precision. The market's strengths lie in its ability to meet stringent quality standards and adapt to diverse seed types, from tiny clover seeds to large maize kernels. Growth opportunities are evident in the rising adoption of sustainable and organic farming practices, which necessitate advanced seed processing solutions. Government initiatives, such as funding for seed processing plants and certification programs, support the industry's expansion. Furthermore, the shortage of agricultural labor has accelerated the demand for automated machinery, ensuring consistent seed quality and processing efficiency.

Report Coverage

This research report categorizes the market for the United States seed processing machinery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States seed processing machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States seed processing machinery market.

United States Seed Processing Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.8% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Seed Type, By Processing Method, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | Lewis M. Carter Manufacturing Co., Seedburo Equipment Co., Bratney Companies, Inc., Universal Industries Inc., Lindquist Machine Corp., Mayfran International, AGCO Corporation, O’Mara AG Services, Westrup USA, Agra Industries, Inc., Q-Sage Inc., Satake USA, Inc., Rotex Global LLC, JBT Corporation, Baker Perkins, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States seed processing machinery market is experiencing growth due to advancements in technology, such as automation, artificial intelligence (AI), and the Internet of Things (IoT), which have revolutionized seed processing by improving efficiency and precision. The increasing focus on sustainable farming practices promotes the use of machinery that minimizes soil disturbance and reduces the need for excessive pesticide application. Additionally, the adoption of advanced farming practices, such as precision agriculture and vertical farming, has increased globally, creating a demand for high-quality seeds and efficient processing machinery. Government initiatives, including financial assistance and training programs, support the industry's expansion.

Restraining Factors

The expensive initial investment in technologies in the form of sophisticated machinery discourages small-scale farmers from using these technologies. The sophistication of equipment and the need for special training may also restrict access. Regulatory requirements for seed quality and environmental regulations may raise the cost of operations and make compliance difficult, especially for small and medium-sized enterprises.

Market Segmentation

The United States seed processing machinery market share is classified into seed type, processing method, and end-user.

- The cereals & grains segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United States seed processing machinery market is segmented by seed type into cereals & grains, oilseeds & pulses, vegetables & fruits, forage & turf seeds, and flowers & ornamentals. Among these, the cereals & grains segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This is due to widespread use of seed treatment in key cereal crops such as wheat, rice, corn, sorghum, oats, and barley. Industry analysts say seed treatment is now an important starting point of disease control for seed-borne diseases in wheat and cereals, with the use of fungicide and biocide treatment notably enhancing germination rates.

- The cleaning & sizing segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States seed processing machinery market is segmented by processing method into cleaning & sizing, drying & conditioning, grading & sorting, coating & pelleting, and others. Among these, the cleaning & sizing segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to significance for the elimination of impurities, weed seeds, and other contaminants from harvested seeds, ultimately leading to the rise in germination levels as well as seed quality. The needs for high-quality seeds, as well as for improving seed production and storage.

- The agriculture segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States seed processing machinery market is segmented by end-user into agriculture, food & beverage, pharmaceuticals, cosmetics, and others. Among these, the agriculture segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to the demand for reliable, high-quality seeds for commercial-scale crop production, combined with the region's strong infrastructure and organized supply chains.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States seed processing machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lewis M. Carter Manufacturing Co.

- Seedburo Equipment Co.

- Bratney Companies, Inc.

- Universal Industries Inc.

- Lindquist Machine Corp.

- Mayfran International

- AGCO Corporation

- O'Mara AG Services

- Westrup USA

- Agra Industries, Inc.

- Q-Sage Inc.

- Satake USA, Inc.

- Rotex Global LLC

- JBT Corporation

- Baker Perkins

- Others

Recent Developments:

- In February 2024, John Deere has launched an entire new lineup up of C-Series air carts, including tech updates to the popular C650 and C850, to ensure producers of all sizes, and those with Control Traffic Farming (CTF) requirements, can optimise seeding performance.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States seed processing machinery market based on the below-mentioned segments:

U.S. Seed Processing Machinery Market, By Seed Type

- Cereals & Grains

- Oilseeds & Pulses

- Vegetables & Fruits

- Forage & Turf Seeds

- Flowers & Ornamentals

U.S. Seed Processing Machinery Market, By Processing Method

- Cleaning & Sizing

- Drying & Conditioning

- Grading & Sorting

- Coating & Pelleting

- Others

U.S. Seed Processing Machinery Market, By End-User

- Agriculture

- Food & Beverage

- Pharmaceuticals

- Cosmetics

- Others

Need help to buy this report?