United States Seed Drill and Broadcast Seeder Machinery Market Size, Share, and COVID-19 Impact Analysis, By Machinery Type (Seed Drills, Broadcast Seeders, Precision Seeders, and Multi-Crop Seeders), By Crop Type (Cereals, Pulse Crops, Oilseed Crops, and Vegetables), By Application (Farming Cooperatives, Individual Farmers, and Agricultural Enterprises), and United States Seed Drill and Broadcast Seeder Machinery Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited States Seed Drill and Broadcast Seeder Machinery Market Insights Forecasts to 2035

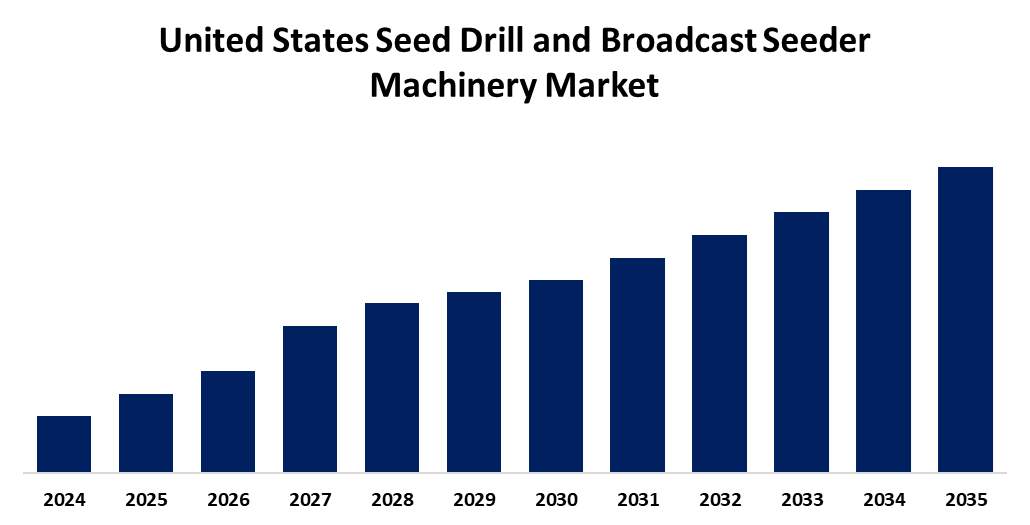

- The USA Seed Drill and Broadcast Seeder Machinery Market Size is Expected to Grow at a CAGR of around 6.9% from 2025 to 2035.

- The United States Seed Drill and Broadcast Seeder Machinery Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Seed Drill and Broadcast Seeder Machinery Market Size is Expected to hold a significant share by 2035, Growing at a CAGR of 6.9% from 2025 to 2035. The market Size is experiencing development fueled by technological breakthroughs and innovations, including IoT integration and AI capabilities, to monitor in real-time and make data-driven decisions, further streamlining planting operations. Government subsidies and incentives for farmers to use modern seeding equipment make it accessible to them.

Market Overview

The United States Broadcast Seeder and Seed Drill Machinery Market Size defines the sale of machinery to plant seeds into soil, covering seed drills and broadcast seeders, and other related machinery. The major drivers are technological innovations in precision agriculture, which enhance the accuracy of planting and minimize seed waste, and increasing demand for sustainable farming practices. The increase in population and food requirements is also promoting efficient farming equipment. Growth opportunities are found in the incorporation of digital technology like AI and remote sensing, which provide data-based decision-making capabilities. The advantages of the market are reduced labor costs and improved efficiency, as mechanized sowing reduces manual labor to a large extent. These advantages, in addition to government incentives, provide a good outlook for the continued growth of the seed drill and broadcast seeder machinery market in the USA. It is supported by government programs providing financial support and training initiatives to incentivize the use of state-of-the-art machinery.

Report Coverage

This research report categorizes the market for the United States seed drill and broadcast seeder machinery market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States seed drill and broadcast seeder machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States seed drill and broadcast seeder machinery market.

United States Seed Drill and Broadcast Seeder Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.9% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Machinery Type, By Crop Type, By Application |

| Companies covered:: | Great Plains Manufacturing, Kubota Corporation, Horsch Maschinen, Kverneland Group, Buhler Industries, John Deere, AGCO Corporation, Lemken GmbH, CNH Industrial, Claas, Kuhn Group, Yanmar, Rostselmash, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States seed drill and broadcast seeder machinery market is experiencing growth due to advancements in precision agriculture, including GPS-guided systems and automated seed calibration, which have enhanced planting accuracy and efficiency, reducing input waste and labor costs. Government incentives and subsidies are making modern seeding equipment more accessible to farmers, encouraging adoption. The increasing focus on sustainable farming practices, such as conservation tillage and soil health preservation, is promoting the use of machinery that minimizes soil disturbance. Technological innovations, such as IoT integration and AI capabilities, are enabling real-time monitoring and data-driven decision-making, further optimizing planting operations.

Restraining Factors

High initial investment costs pose a significant barrier, particularly for smallholder farmers with limited budgets. Additionally, maintenance and repair expenses can further strain financial resources. The lack of skilled labor to operate and maintain advanced machinery hampers efficient utilization. Fluctuating raw material prices impact production costs, affecting pricing strategies and profit margins.

Market Segmentation

The United States seed drill and broadcast seeder machinery market share is classified into machinery type, crop type, and application.

- The seed drills segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United States seed drill and broadcast seeder machinery market is segmented by machinery type into seed drills, broadcast seeders, precision seeders, and multi-crop seeders. Among these, the seed drills segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This growth is driven by farmers increasingly recognizing the benefits of precision planting, such as better yields and accurate seed placement, especially as labor becomes scarce and awareness grows about how seed drills can improve efficiency and productivity.

- The cereals segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States seed drill and broadcast seeder machinery market is segmented by crop type into cereals, pulse crops, oilseed crops, and vegetables. Among these, the cereals segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is attributed to the increased demand for cereals like corn, wheat, and soybeans, which are major crops grown in the US. These crops are widely planted using specialized machinery like seed drills and broadcast seeders, making the segment a significant driver for the machinery market.

- The agricultural enterprises segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States seed drill and broadcast seeder machinery market is segmented by application into farming cooperatives, individual farmers, and agricultural enterprises. Among these, the agricultural enterprises segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the growing demand for large agricultural production operations which are more likely to invest in advanced seeding technologies, increased advancements in precision farming, and government support for mechanization.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States seed drill and broadcast seeder machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Great Plains Manufacturing

- Kubota Corporation

- Horsch Maschinen

- Kverneland Group

- Buhler Industries

- John Deere

- AGCO Corporation

- Lemken GmbH

- CNH Industrial

- Claas

- Kuhn Group

- Yanmar

- Rostselmash

- Others

Recent Developments:

- In July 2024, Manufacturer Vogelsang officially launched the Split Separator in the U.S. The separator was showcased at the recent North American Manure Expo through Skinner Ag, a partner of Vogelsang.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States seed drill and broadcast seeder machinery market based on the below-mentioned segments:

USA Seed Drill and Broadcast Seeder Machinery Market, By Machinery Type

- Seed Drills

- Broadcast Seeders

- Precision Seeders

- Multi-Crop Seeders

USA Seed Drill and Broadcast Seeder Machinery Market, By Crop Type

- Cereals

- Pulse Crops

- Oilseed Crops

- Vegetables

USA Seed Drill and Broadcast Seeder Machinery Market, By Application

- Farming Cooperatives

- Individual Farmers

- Agricultural Enterprises

Need help to buy this report?