United States Scooter Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Normal Scooter and Electric Scooter), By Electric Scooter Type (Conventional Electric Scooter and Swappable Electric Scooter), and United States Scooter Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Scooter Market Size Insights Forecasts to 2035

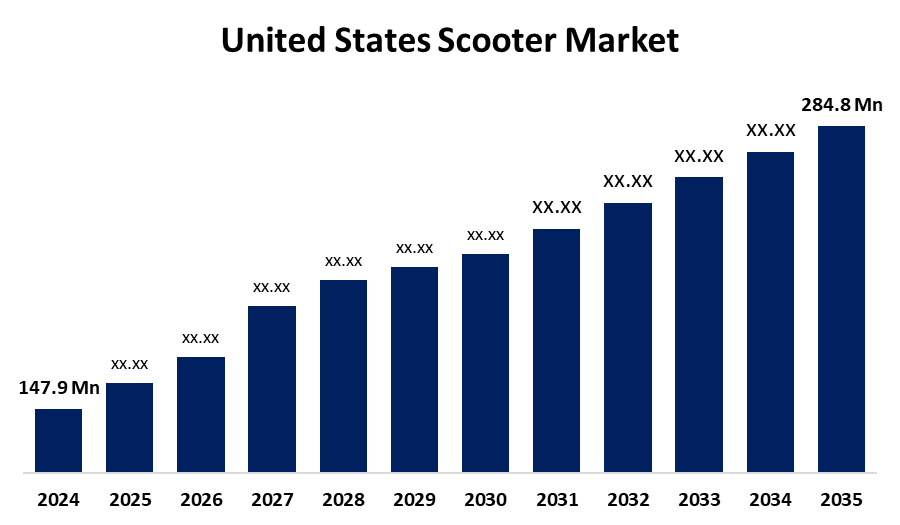

- The US Scooter Market Size Was Estimated at USD 147.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.14% from 2025 to 2035

- The US Scooter Market Size is Expected to Reach USD 284.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Scooter Market Size is anticipated to reach USD 284.8 million by 2035, growing at a CAGR of 6.14% from 2025 to 2035. The expansion of the United States Scooter market is propelled by the need for mobility has increased due to the quickening pace of urbanisation and better road connectivity.

Market Overview

A scooter is a two-wheeled personal vehicle that can be propelled by an electric motor or by hand. Increasing urbanisation and developing road networks in the US have led to a considerable demand for mobility. Due to the lack of public transport in remote areas, consumers are persuaded to purchase personal vehicles. Considering that e-scooter rentals are becoming an increasingly popular mode of transportation. Customers are encouraged to buy personal vehicles in remote areas where there are no public transport options available. Gasoline-powered scooters are commonplace since consumers want a mode of transportation that is inexpensive, lightweight, and easy to drive and manage. The industry has grown due to battery-powered electric scooters, as they do not consume fuel, nor exceed vehicle pollution. Due to the rise in disposable income, more individuals are feeling motivated to purchase scooters. Due to the increase in online shopping apps, logistics companies have become increasingly dependent on delivering products to consumers. A scooter is the greatest and most feasible way to transport large volumes of products. For logistics companies, scooters are a much lighter option that maximizes fuel economy and provides enough space for the delivery person and product due to the reduced excess baggage. All of these are the most encouraging aspects to indicate as a market growth opportunity for scooters.

Report Coverage

This research report categorizes the market for the United States scooter market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States scooter market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States scooter market.

United States Scooter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 147.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.14% |

| 2035 Value Projection: | USD 284.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 146 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Type, By Electric Scooter Type and COVID-19 Impact Analysis |

| Companies covered:: | Razor, GoTrax, Bird Global Inc. Class A, Uber Technologies Inc, Mahindra GenZe, Lime, Zero Motorcycles, NIU Technologies, Micro Mobility Systems, INOKIM, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States scooter market is boosted because electric scooters have been gaining popularity as more customers choose simple commuting and are increasingly interested in launching a unique travel transport with a personal vehicle. Customers are making the choice to purchase electric scooters instead of fuel-powered scooters because of growing awareness of pollution and climate change. The market for electric scooters is rapidly growing with the increased focus on lightweight vehicles. Electric scooters are growing in demand, spurred by the need for modern and green transportation. Electric scooters are more cost-efficient to maintain because they require less upkeep and consume much less power when charging. The increased interest in electric scooters is expected to increase market growth over the next years.

Restraining Factors

The United States scooter market faces obstacles like having a lower power capacity and therefore less range than other fuel-based source vehicles. Its cost is also higher than other fuel-based scooters. Bigger electric scooters may take longer to charge.

Market Segmentation

The United States scooter market share is classified into product type and electric scooter type.

- The normal scooter segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States scooter market is segmented by product type into normal scooter and electric scooter. Among these, the normal scooter segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by a growing public demand for a vehicle that offers comfortable rides, with gearless driving systems that can be operated with little expense. Regular scooters are part of the high share class because they continue to contribute effectively to body-enhanced manoeuvrability with great mileage.

- The conventional electric scooter segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the electric scooter type, the United States Scooter market is segmented into conventional electric scooter and swappable electric scooter. Among these, the conventional electric scooter segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because they are solid, lightweight, and cheaper to purchase and follow. Additionally, conventional electric scooter producers focus as much on the smooth launch of new models with reasonable additions that offer a respectable total price value, giving them a significant competitive edge.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States scooter market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Razor

- GoTrax

- Bird Global Inc. Class A

- Uber Technologies Inc

- Mahindra GenZe

- Lime

- Zero Motorcycles

- NIU Technologies

- Micro Mobility Systems

- INOKIM

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States scooter market based on the following segments:

United States Scooter Market, By Product Type

- Normal Scooter

- Electric Scooter

United States Scooter Market, By Electric Scooter Type

- Conventional Electric Scooter

- Swappable Electric Scooter

Need help to buy this report?