United States Sclerotherapy Market Size, Share, and COVID-19 Impact Analysis, By Agents (Detergents, Chemical Irritants, and Osmotic Agents), By Type (Ultrasound Sclerotherapy, Liquid Sclerotherapy, and Foam Sclerotherapy), and United States Sclerotherapy Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited States Sclerotherapy Market Insights Forecasts to 2035

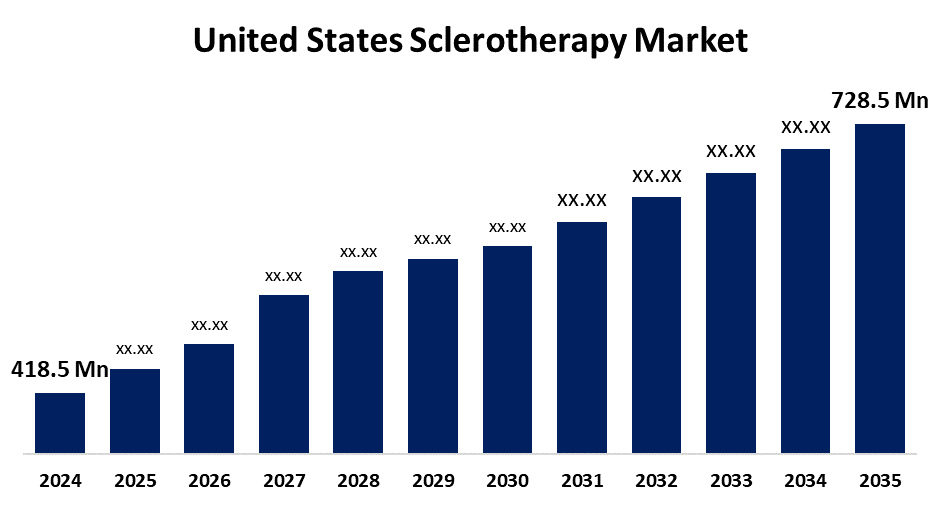

- The US Sclerotherapy Market Size Was Estimated at USD 418.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.17% from 2025 to 2035

- The US Sclerotherapy Market Size is Expected to Reach USD 728.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Sclerotherapy Market Size is anticipated to reach USD 728.5 Million by 2035, growing at a CAGR of 5.17% from 2025 to 2035. The expansion of the United States Sclerotherapy market is propelled by the rising incidence of venous conditions that impact a sizable section of the population, such as varicose veins and chronic venous insufficiency.

Market Overview

Spider veins, varicose veins, and other vascular abnormalities can be treated with a minimally invasive medical treatment called sclerotherapy. This involves injecting a chemical solution with a sclerosant directly into the affected vein. Advances in techniques and equipment of sclerotherapy are improving the safety and efficacy of sclerotherapy treatment. Patients' results have been improved with new procedures like foam sclerotherapy and ultrasound-guided sclerotherapy treatments. As the number of sclerotherapy treatments utilising foam sclerosing agents keeps increasing, technological improvements enable the conclusion that these new processes are either enhancing or enabling new venous use with sclerotherapy. The sclerotherapy market is evolving, driven by patients' increasing preference for minimally invasive treatment options. As the benefits of sclerotherapy versus traditional surgical techniques become more widely accepted, more patients are choosing sclerotherapy as their treatment of choice, benefiting from improved recovery times, fewer complications, and less scarring. Further supporting growth in the sclerotherapy market are improvements in patient knowledge of the procedure and education for less invasive treatment options, which increases patient requests for sclerotherapy and compliance with treatment. The market for the sclerotherapy approach to addressing a patient's venous condition will continue to increase as healthcare infrastructure, as well as access to this innovative therapy, improves.

The United States healthcare system, which includes private insurers and Medicare, offers different amounts of compensation for sclerotherapy operations, especially when they are considered medically necessary. Both patient access and market expansion are impacted by this.

Report Coverage

This research report categorizes the market for the United States sclerotherapy market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States sclerotherapy market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States sclerotherapy market.

United States Sclerotherapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 418.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.17% |

| 2035 Value Projection: | USD 728.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Agents, By Type |

| Companies covered:: | LGM Pharma, Mylan, Viatris Inc., Medtronic, AngioDynamics, Boston Scientific Corporation, AngioDynamics Inc., Perrigo Company PLC, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for sclerotherapy in the US is expanding due to the necessity for less intrusive treatments like sclerotherapy is partly due to the demographics of ageing populations, obesity, and more sedentary lifestyles. Technological advances have improved treatment accuracy, and practitioners are using these advancements. Increased awareness and preference for sclerotherapy treatments compared to traditional vein stripping procedures are leading patients to non-surgical procedures and vein treatments for cosmetic reasons. Additionally, expanded reimbursement policies and regulatory approvals, such as the FDA-approved (sodium tetradecyl sulphate STS) and polidocanol (Asclera) are driving market growth. Pharmaceutical companies are always investing in R&D to develop sclerosants that will increase the safety and effectiveness of the treatment.

Restraining Factors

The United States sclerotherapy market faces obstacles such as hyperpigmentation, thrombosis, ulcerations, and allergic reactions are some complications that create concerns for patients and doctors. Additionally, the growth of the market has been limited by a serious lack of practitioners with the skills needed to perform advanced sclerotherapy procedures.

Market Segmentation

The United States sclerotherapy market share is classified into agents and type.

- The detergents segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States sclerotherapy market is segmented by agents into detergents, chemical irritants, and osmotic agents. Among these, the detergents segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the commonly understood idea that detergents successfully irritate the vein wall and close varicose veins and other venous disorders. This explains the growing number of medical professionals using detergent-based sclerotherapy, as the FDA approval also leads to widespread adoption in clinical practices. Because there are low chances of negative reactions, both patients and specialists will decide that detergent sclerotherapy is a popular treatment.

- The foam sclerotherapy segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States Sclerotherapy market is segmented into ultrasound sclerotherapy, liquid sclerotherapy, and foam sclerotherapy. Among these, the foam sclerotherapy segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by its advantage of providing improved visibility and contact with the vein wall when compared with conventional liquid sclerosants, which increase clinical success rates. Furthermore, due to an increase in patient choices, foam sclerotherapy is gaining popularity and use, as patients are expressing a preference for minimally invasive procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States sclerotherapy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LGM Pharma

- Mylan

- Viatris Inc.

- Medtronic

- AngioDynamics

- Boston Scientific Corporation

- AngioDynamics Inc.

- Perrigo Company PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States sclerotherapy market based on the following segments:

United States Sclerotherapy Market, By Agents

- Detergents

- Chemical Irritants

- Osmotic Agents

United States Sclerotherapy Market, By Type

- Ultrasound Sclerotherapy

- Liquid Sclerotherapy

- Foam Sclerotherapy

Need help to buy this report?