United States Sawmill Machinery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fixed Sawmill and Portable Sawmill), By Type of Headrig (Frames Saw, Circular Saw, and Band Saw), By Mounting Type (Horizontal and Vertical), By Application (Forestry, Woodworking, Paper Industry, and Others), and United States Sawmill Machinery Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Sawmill Machinery Market Insights Forecasts to 2035

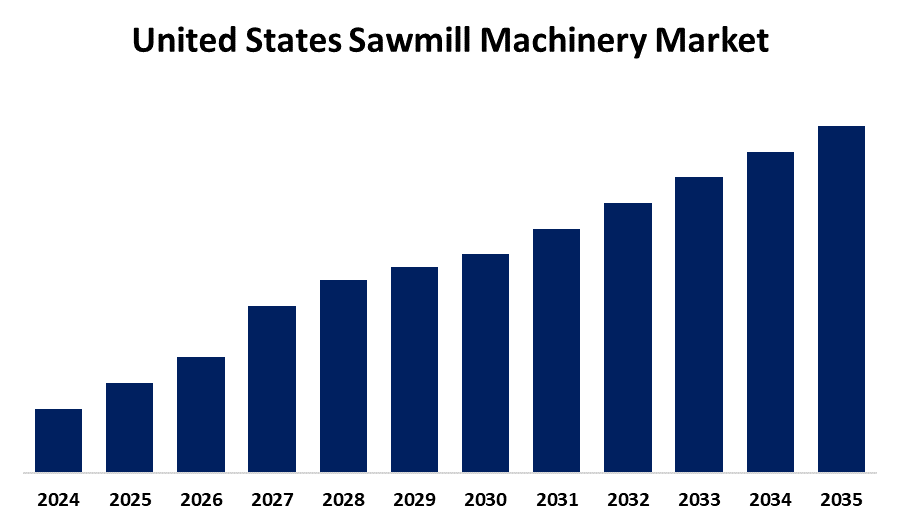

- The USA Sawmill Machinery Market Size is Expected to Grow at a CAGR of around 4.7% from 2025 to 2035.

- The United States Sawmill Machinery Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Sawmill Machinery Market Size is Expected to hold a Significant Share by 2035, Growing at a CAGR of 4.7% from 2025 to 2035. The growth is fueled by technological advancements, such as automation and digital monitoring, which are enhancing productivity and reducing labor costs, encouraging sawmill upgrades. The growth of sustainable forestry practices and an increased focus on renewable resources are also supporting market expansion. Additionally, the housing market's recovery and rising renovation activities across the country have led to increased consumption of lumber.

Market Overview

The United States sawmill machinery market refers to the sale and distribution of equipment used in sawmills to convert logs into lumber. This involves a range of machinery, from basic saws to advanced systems like infeed tables, outfeed belts, and edgers. The rising demand for wood and wood-based products, particularly in the construction and furniture industries, urbanization, infrastructure development, and technological advancements in wood processing, further contribute to market growth. Additionally, population growth and economic expansion play a vital role in increasing the demand for lumber. North America’s strong position in the global market and the continued preference for high-quality wooden products support the U.S. market's strength. Growth opportunities are expanding due to innovation in sawmill technology and sustained product demand. The U.S. government bolsters the sector through initiatives such as the USDA’s Wood Innovations Program and the Community Wood Grant Program, which fund sawmill upgrades, new technologies, and sustainable practices, aiming to enhance efficiency, support sustainable forestry, and stimulate rural economic development.

Report Coverage

This research report categorizes the market for the United States sawmill machinery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States sawmill machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States sawmill machinery market.

United States Sawmill Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product, By Type of Headrig, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Wood-Mizer, Corley Manufacturing, Baxley Equipment, Salem Equipment, McDonough Manufacturing, Brewco, SERRA Maschinenbau, Logosol, Norwood Sawmill Equipment, HewSaw, BID Group Technologies Ltd, Advanced Sawmill Machinery Inc., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for wood products in construction, furniture, and packaging industries significantly boosts the need for efficient sawmill operations. Technological advancements, such as automation and digital monitoring, are enhancing productivity and reducing labor costs, encouraging sawmill upgrades. The growth of sustainable forestry practices and an increased focus on renewable resources are also supporting market expansion. Additionally, the housing market's recovery and rising renovation activities across the country have led to increased consumption of lumber. Government incentives and support for modernizing manufacturing infrastructure further stimulate investment in advanced machinery.

Restraining Factors

High initial investment costs and maintenance expenses can restrain small and medium enterprises. Additionally, increasing environmental regulations and sustainability concerns have led to restrictions on logging activities, limiting raw material availability. Labor shortages and the need for skilled operators further hinder operational efficiency.

Market Segmentation

The United States sawmill machinery market share is classified into product type, type of headrig, mounting type, and application.

- The fixed sawmill segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States sawmill machinery market is segmented by product type into fixed sawmill, and portable sawmill. Among these, the fixed sawmill segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to consistent performance and reliability, operating under various weather conditions, and is capable of handling large-scale processing with enhanced automation. These machines are preferred for their ability to maintain high production volumes and meet the demands of industries reliant on quality timber output.

- The band saw segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States sawmill machinery market is segmented by type of headrig into frames saw, circular saw, and band saw. Among these, the band saw segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their versatility, safety, and efficiency in producing high-quality lumber, and they are highly valued for their ease of portability, allowing for efficient use in various sawmill setups. Additionally, they are known for producing smoother surfaces with minimal milling, leading to cost-effectiveness and high-quality end products.

- The horizontal segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States sawmill machinery market is segmented by mounting type into horizontal and vertical. Among these, the horizontal segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their high demand for large-scale lumber production, the superior performance of horizontal sawmills, and their ability to meet industry needs. These mills are frequently used in large-scale lumber operations and have demonstrated their effectiveness in recent years, contributing to the industry's growth.

- The woodworking segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States sawmill machinery market is segmented by application into forestry, woodworking, paper industry, and others. Among these, the woodworking segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to high demand for wood products like furniture, fencing, and insulation, which all rely heavily on lumber as a base material. The well-established woodworking industry in North America, coupled with strong urban areas and disposable income, further fuels demand for wooden products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States sawmill machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wood-Mizer

- Corley Manufacturing

- Baxley Equipment

- Salem Equipment

- McDonough Manufacturing

- Brewco

- SERRA Maschinenbau

- Logosol

- Norwood Sawmill Equipment

- HewSaw

- BID Group Technologies Ltd

- Advanced Sawmill Machinery Inc.

- Others

Recent Developments:

- In January 2025, Wood-Mizer, a global sawmill and woodworking equipment manufacturer, has opened a new Authorized Sales Center in Linden, Michigan. Located an hour from Detroit and Lansing, Wood-Mizer Michigan is the 17th sales location in the United States and reflects the company’s ongoing commitment to sell, support and serve the sawmilling and forest industry throughout the world.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA sawmill machinery market based on the below-mentioned segments:

U.S. Sawmill Machinery Market, By Product Type

- Fixed Sawmill

- Portable Sawmill

U.S. Sawmill Machinery Market, By Type of Headrig

- Frames Saw

- Circular Saw

- Band Saw

U.S. Sawmill Machinery Market, By Mounting Type

- Horizontal

- Vertical

U.S. Sawmill Machinery Market, By Application

- Forestry

- Woodworking

- Paper Industry

- Others

Need help to buy this report?