United States Satellite Internet Market Size, Share, and COVID-19 Impact Analysis, By Band Type (C-band, X-band, L-band, K-band, and Others), By End User (Commercial Users and Individual), and the United States Satellite Internet Market Insights Forecasts 2023 – 2033

Industry: Electronics, ICT & MediaUnited States Satellite Internet Market Insights Forecasts to 2033

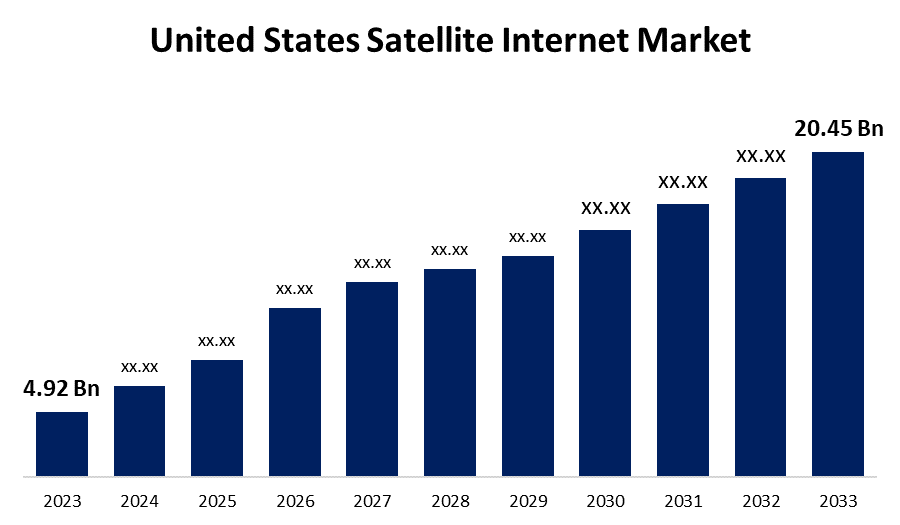

- The United States Satellite Internet Market Size was valued at USD 4.92 Billion in 2023

- The Market Size is Growing at a CAGR of 15.31% from 2023 to 2033.

- The United States Satellite Internet Market Size is Expected to Reach USD 20.45 Billion by 2033.

Get more details on this report -

The United States Satellite Internet Market size is expected to reach USD 20.45 Billion by 2033, at a CAGR of 15.31% during the forecast period 2023 to 2033.

Market Overview

Satellite internet is a wireless network that connects satellite dishes in orbit and on earth. It provides access to current information while also connecting people in different parts of the world. Accessing satellite internet requires high-speed network connectivity provided by orbiting satellites. It differs from land-based broadband services such as digital subscriber line (DSL) and cable and is faster than traditional internet service. Satellite communication also provides a land-based interface with audio, video, and information that can be accessed from anywhere on earth. One of the main benefits of satellite internet for businesses is the ability to send a link over inaccessible areas such as oceans and mountains at speeds of many megabits per second. However, a private and secure connection can connect several remote locations spread across a large area. The United States satellite internet market is rapidly expanding and transforming, due to rising demand for high-speed connectivity, digital inclusion initiatives, and advancements in satellite technology. With a focus on closing the digital divide, satellite internet services are playing a critical role in expanding broadband access to rural and underserved areas throughout the country. Furthermore, the market is being shaped by the ongoing digital transformation, IoT connectivity, and the integration of satellite solutions into government and defense applications, highlighting the diverse and strategic role of satellite internet in supporting national security, public safety, and critical infrastructure.

Report Coverage

This research report categorizes the market for the United States satellite internet market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States satellite internet market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States satellite internet market.

United States Satellite Internet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.92 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | By Band Type, By End User |

| 2033 Value Projection: | USD 20.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Band Type, By End User |

| Companies covered:: | SpaceX, Hughes Network Systems, Viasat Inc., Echostar Corporation, Inmarsat, Intelsat, OneWeb, Telesat, ViaSat, SES S.A., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The imperative to bridge the digital divide and provide reliable connectivity to rural and underserved areas, as well as the pursuit of ubiquitous coverage and mobility, are key drivers propelling the growth of the United States satellite internet market. Furthermore, the need for disaster recovery and resilience is a compelling driver for the United States satellite internet market, as satellite connectivity is critical to maintaining communication and connectivity during emergencies. The ongoing digital transformation and proliferation of Internet of Things (IoT) applications are significant factors driving demand for satellite internet services in the United States. Government and defense applications are a significant driver for the United States satellite internet market, as satellite connectivity plays a pivotal role in supporting national security, defense operations, and government communications.

Restraining Factors

One of the main obstacles for the United States satellite internet market is the inherent latency and throughput limitations of satellite communications. The United States satellite internet market faces significant obstacles related to regulatory and spectrum constraints, which impact the deployment, operation, and expansion of satellite internet services, in addition to cost and affordability.

Market Segment

- In 2023, the C-band segment accounted for the largest revenue share over the forecast period.

Based on band type, the United States satellite internet market is segmented into the C-band, X-band, L-band, K-band, and others. Among these, the C-band segment has the largest revenue share over the forecast period. Several key factors contribute to the C-band's dominance. For starters, its ability to strike a balance between data capacity and signal strength makes it a popular choice for satellite internet services, particularly in the United States, where there is a growing demand for high-speed and dependable internet access in both urban and rural areas. Furthermore, the C-band's favorable propagation characteristics, which allow it to penetrate atmospheric conditions and foliage with relative ease, add to its appeal for satellite internet applications, particularly in areas with diverse geographical and environmental challenges. Furthermore, ongoing technological advancements and innovations aimed at optimizing the performance and efficiency of C-band satellite systems are expected to solidify its dominance, as industry players continue to invest in improving the capabilities and coverage of C-band satellite internet services, thereby maintaining its leadership in the United States satellite internet service market.

- In 2023, the commercial users segment accounted for the largest revenue share over the forecast period.

Based on the end user, the United States satellite internet market is segmented into commercial users and individuals. Among these, the commercial user segment has the largest revenue share over the forecast period. To begin, the growing demand for high-speed and dependable internet connectivity in various commercial sectors, such as businesses, government agencies, educational institutions, and healthcare facilities, has contributed significantly to the commercial user segment's dominance. These organizations need reliable internet connectivity to support their operations, communication, data transfer, and information access, making satellite internet an appealing and necessary solution, particularly in remote or underserved areas where traditional terrestrial broadband infrastructure may be limited. As such, the commercial user’s segment is expected to maintain its dominance in the United States satellite internet market, due to ongoing technological advancements, tailored service offerings, and strategic partnerships aimed at meeting commercial entities' specific connectivity needs and maintaining their competitive advantage in an increasingly digital and interconnected business landscape.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States satellite internet market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SpaceX

- Hughes Network Systems

- Viasat Inc.

- Echostar Corporation

- Inmarsat

- Intelsat

- OneWeb

- Telesat

- ViaSat

- SES S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Recent Development

- In January 2023, StellarNet, a well-known satellite internet provider, expanded its satellite coverage footprint, providing improved connectivity to previously underserved areas across the United States. The expanded coverage extends to rural and remote communities, meeting the demand for widespread and inclusive Satellite Internet access. StellarNet's focus on expanding its service reach reflects the growing demand for comprehensive and accessible satellite internet coverage that caters to a wide range of user needs and geographic locations in the United States.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Satellite Internet Market based on the below-mentioned segments:

United States Satellite Internet Market, By Type

- C-band

- X-band

- L-band

- K-band

- Others

United States Satellite Internet Market, By End User

- Commercial Users

- Individual

Need help to buy this report?