United States Salt Market Size, Share, and COVID-19 Impact Analysis, By Source (Salt Mines and Brine), By Type (Solar Salt, Vacuum Pan Salt, Rock Salt, and Salt in Brine), By Application (Flavoring Agent, De-Icing, Water Treatment, Chemical Processing, Agriculture, Oil & Gas, and Others), and US Salt Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUSA Salt Market Insights Forecasts to 2035

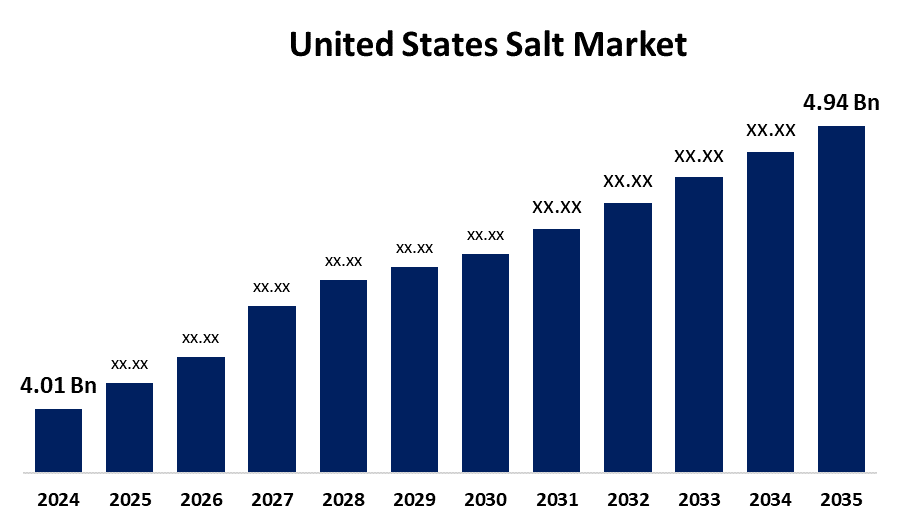

- The US Salt Market Size was Estimated at USD 4.01 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.91% from 2025 to 2035

- The USA Salt Market Size is Expected to Reach USD 4.94 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Salt Market Size is Anticipated to reach USD 4.94 Billion by 2035, Growing at a CAGR of 1.91% from 2025 to 2035.

Market Overview

The salt market in the United States includes the production, supply, and consumption of salt in cooking food, de-icing, and water treatment. Salt is referred to as sodium chloride. Salt is an essential mineral for industry and human, and animal health. It comes from the mineral halite, also known as rock salt, and is used as a seasoning or in iodized salt, which is used in places where iodine isn't found in the food. Livestock also need salt, which is frequently sold in solid blocks. Seawater is the primary source of salts. The Dead Sea, the United States, and the United Kingdom are among the nations that contain brine, a water with a high concentration of salt. Crystalline sodium chloride, or rock salt, is widely distributed in rock masses and beds and is found in rocks from all geologic eras. The salts are necessary to keep both people and animals healthy. Health-conscious consumers looking for natural, rich in minerals options, industrial demand for chemical and industrial applications, and concerns about the environment, driving ethical procedures like eco-friendly sourcing and creative packaging are some of the major trends shaping the U.S. salt market and driving its future.

Report Coverage

This research report categorizes the market for the US Salt market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US Salt market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US Salt market.

United States Salt Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.01 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 1.91% |

| 2035 Value Projection: | USD 4.94 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Source, By Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Compass Mineral International, Inc., US Salt LLC, Cargill Salt, Morton Salt, American Rock Salt, Jacobsen Salt Co., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The product's availability, affordability, and efficacy make it a popular choice for de-icing roads, walkways, and other surfaces. Additionally, it is simple to apply with spreaders or trucks that have spreader mechanisms, enabling effective distribution over wide stretches of roads and highways. Throughout the forecast period, the demand for de-icing applications is anticipated to propel the growth of the U.S. salt market. As a nutrient for cattle and a soil conditioner, the product is also essential to agriculture. The need to maintain nutrient solutions, control weeds, enhance soil conditions in soilless agriculture systems, preserve crops, and support livestock nutrition are the main factors driving the product's demand in the U.S. agriculture sector.

Restraining Factors

Health issues, environmental issues, seasonal weather patterns, distribution chain interruptions, and competition from alternative de-icing solutions, stricter regulations may impede the growth of the market.

Market Segmentation

The USA salt market share is classified into source, type, and application.

- The salt mines segment held a significant share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The US salt market is segmented by source into salt mines and brine. Among these, the salt mines segment held a significant share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment growth is attributed to minimizing the environmental footprint, availability in the underground, extensive usage in the chemical industry, and being safe and effective.

- The rock salt segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US salt market is segmented by type into solar salt, vacuum pan salt, rock salt, and salt in brine. Among these, the rock salt segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is attributed to the enhanced flavor, maintains the blood pressure, improves the digestion, and manages the constipation and bloating.

- The de-icing segment held the largest share in 2024 and is expected to grow at a CAGR of 1.78% during the forecast period.

The US salt market is segmented by application into flavoring agent, de-icing, water treatment, chemical processing, agriculture, oil & gas, and others. Among these, the de-icing segment held the largest share in 2024 and is expected to grow at a CAGR of 1.78% during the forecast period. The sector growth is attributed to the highly hydrophobic, non-toxic, cost-effectiveness, prevents the ice formation, and reduces the melting point of water.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US salt market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Compass Mineral International, Inc.

- US Salt LLC

- Cargill Salt

- Morton Salt

- American Rock Salt

- Jacobsen Salt Co.

- Others

Recent Developments:

- In March 2025, Michigan Potash & Salt Co. launched a new salt business, producing 1 million tons of food-quality salt. The facility, located in a high-demand US area, will be the nation's largest evaporative salt plant and the newest and lowest-cost salt producer. It will produce premium food-grade and low-sodium salt products, ensuring consistency and purity.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US salt market based on the below-mentioned segments:

US Salt Market, By Source

- Salt Mines

- Brine

US Salt Market, By Type

- Solar Salt

- Vacuum Pan Salt

- Rock Salt

- Salt in Brine

US Salt Market, By Application

- Flavoring Agent

- De-Icing

- Water Treatment

- Chemical Processing

- Agriculture

- Oil & Gas

- Others

Need help to buy this report?