United States Sailboat Market Size, Share, and COVID-19 Impact Analysis, By Hull Type (Monohull and Multi-hull), By Length (Up to 20ft, 20-50 ft., and Above 50 ft.), and United States Sailboat Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Sailboat Market Size Insights Forecasts to 2035

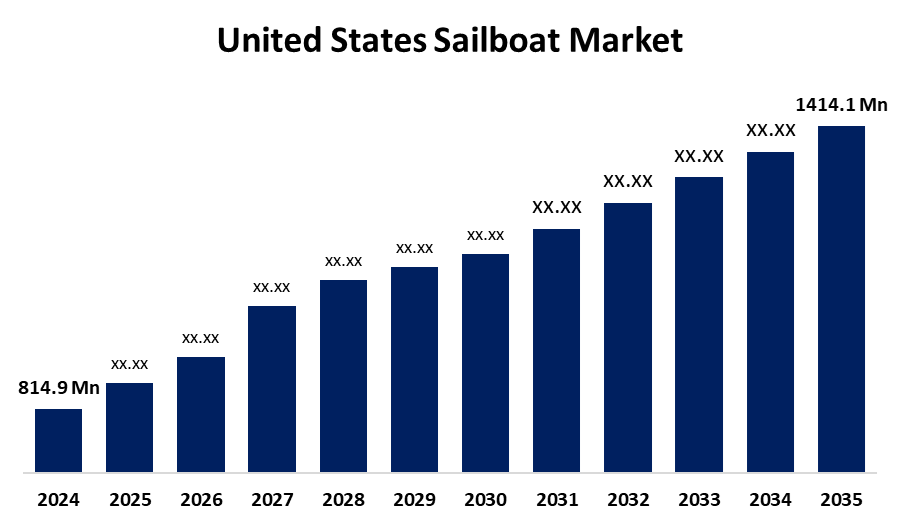

- The US Sailboat Market Size Was Estimated at USD 814.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.14% from 2025 to 2035

- The US Sailboat Market Size is Expected to Reach USD 1414.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Sailboat Market Size is anticipated to reach USD 1414.1 million by 2035, growing at a CAGR of 5.14% from 2025 to 2035. The expansion of the United States sailboat market is propelled by a rise in levels of disposable income, making it more appealing to a larger group of individuals.

Market Overview

A sailing boat is referred to as a kind of watercraft that uses sails to generate power, either fully or partially. Manufacturers are investing in R&D to design products that are sustainable and efficient while using electric propulsion and renewable energy sources. There are lots of new technical developments that are having an extraordinary impact on business, as well as fascinating new innovations in sailboat construction and navigation systems. Innovation has improved the complete sailing experience with innovative automated sail controls and sophisticated navigational aids. In addition, new environmental regulations have resulted in manufacturers making cleaner products, using cleaner production methods and materials in their operations, with manufacturing heavily regulated regarding emissions and waste disposal. In the sailboat market, the option of luxury design and customization of the sailboat is becoming more mainstream. Customers are asking for distinct boats that are more comfortable and highlight their taste. This trend forces manufacturers to offer quality materials and custom designs. Consumers increasingly care about the environment and are creating demand for electric-powered sailboats. The experiential segment of the sailing business is gaining traction with new clients who want to enjoy sailing and do not want to own a sailboat with experiential sailing tours and charters.

Report Coverage

This research report categorizes the market for the United States sailboat market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States sailboat market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States sailboat market.

United States Sailboat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 814.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.14% |

| 2035 Value Projection: | USD 1414.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 196 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Hull Type, By Length and COVID-19 Impact Analysis |

| Companies covered:: | Melges Performance Sailboats, Catalina Yachts, Hallberg- Rassy Varvs AB, Tartan Marine, W.D. Schock Corp, Pacific Seacraft, Marlow-Hunter, Morris Yachts, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States sailboat market is boosted because sailing sports and recreational boating continue to increase in popularity, and the market for sailboats is steadily high. With increased interest in sailing as a hobby and recreational activity, the demand for sailboats is also growing. Areas with a strong water sport culture, i.e., lakes and waterfronts, have benefited the most from sailing growth. The increasing disposable income is another driver for the sailboat market. The greater the rising disposable income means the demand for luxury sailboats is increasing since more individuals are looking to spend money on leisure activities. These luxury yachts entice affluent consumers, who see sailing as a sport and status symbol, with their high quality and comfort in design.

Restraining Factors

The United States sailboat market faces obstacles like the high-cost initial investment. In addition to the purchase price, there are high maintenance costs in terms of repairs, storage, and common maintenance. Inexperienced sailing abilities also limit the ability of the market to grow.

Market Segmentation

The United States sailboat market share is classified into hull type and length.

- The monohull segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States sailboat market is segmented by hull type into monohull and multi-hull. Among these, the monohull segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because recreational sailors were often drawn to the style and the classic appearance of monohulls. Many individuals engage in sailing recreation and appreciate the classic monohull design. Monohulls are often used in many types of sailing races and regattas, which keeps their popularity alive.

- The 20-50 ft segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the length, the United States sailboat market is segmented into up to 20ft, 20-50 ft., and above 50 ft. Among these, the 20-50 ft segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by advancements in materials, ranging from carbon fibre to modern composites, which greatly influence the weight, strength, and overall performance of sailboats between 20–50 feet. Advances in navigation hardware and software, safety equipment, and energy-efficient motor technologies have also served to make sailing safer and more fun.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States sailboat market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Melges Performance Sailboats

- Catalina Yachts

- Hallberg- Rassy Varvs AB

- Tartan Marine

- W.D. Schock Corp

- Pacific Seacraft

- Marlow-Hunter

- Morris Yachts

- Others

Recent Development

- In April 2025, Bill Crane and Karl Ziegler’s Storm Marine Group unveiled the storm 18, a modern evolution of the Ideal 18 designed as an institutional keelboat for clubs, schools, and sailing centers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States sailboat market based on the following segments:

United States Sailboat Market, By Hull Type

- Monohull

- Multi-hull

United States Sailboat Market, By Length

- Up to 20ft

- 20-50 ft.

- Above 50 ft

Need help to buy this report?