United States Rum Market Size, Share, and COVID-19 Impact Analysis, By Product (Dark & Golden Rum, White Rum, Flavored & Spiced Rum, and Others), By Distribution Channel (Off-Trade and On-Trade), and United States Rum Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Rum Market Insights Forecasts to 2035

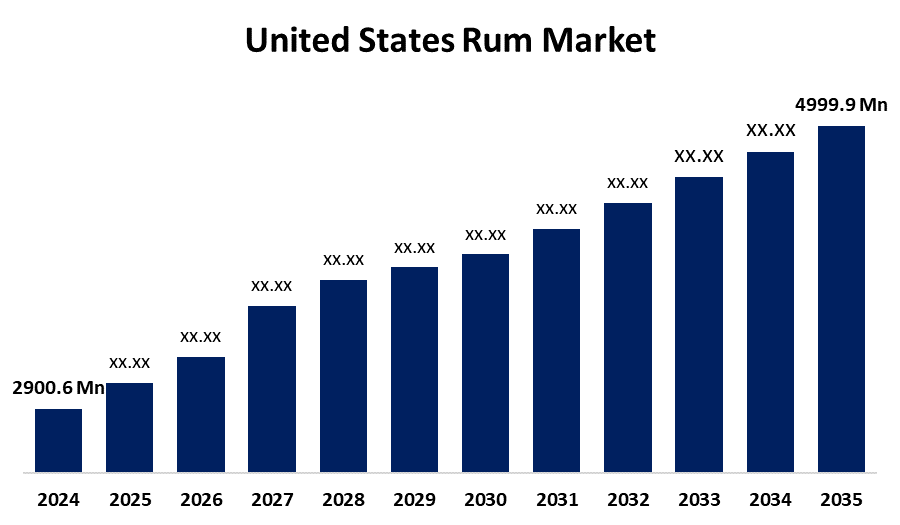

- The US Rum Market Size Was Estimated at USD 2900.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.07% from 2025 to 2035

- The US Rum Market Size is Expected to Reach USD 4999.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Rum Market is anticipated to reach USD 4999.9 million by 2035, growing at a CAGR of 5.07% from 2025 to 2035. The expansion of the United States rum market is propelled by a growing demand for artisanal and premium spirits from consumers, a comeback of rum-based mixed drinks in homes and bars, and more inventive distillers producing aged, spiced, and flavoured types.

Market Overview

Rum is a spirit that ranges from light to dark varieties and is made by distilling fermented sugarcane products, like molasses or sugarcane juice, and then ageing or blending the resulting alcohol. It is typically bottled at 80 proof or higher and has flavours that are influenced by fermentation, the distillation process, barrel ageing, and additives like caramel. The expansion of the U.S. rum market is being driven by a significant shift in consumer preferences toward premiumization and artisanal quality. Consumers, especially those ages 25 to 44, want high-quality, handmade spirits made through unique production processes with authentic stories. Just as it has happened with whisky and tequila, this shift has led to increased interest in aged, small-batch, and single-estate rums. In the super-premium space, companies have successfully carved out a path and drawn customers with unique flavor profiles, heritage, and transparency in their sourcing. Customers are very interested in flavored rum, which begins with fermenting molasses or sugarcane juice but is almost always strengthened with citrus or fruity flavors. Rums can be found flavoured in a range of varieties, including fruit, coffee, sweet, buttery, caramel, and vanilla. Customers are enthusiastic about trying new-tasting rums, creating very large growth opportunities for the segment.

Report Coverage

This research report categorizes the market for the United States rum market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States rum market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States rum market.

United States Rum Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2900.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.07 |

| 2035 Value Projection: | USD 4999.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Demerara Distillers, Bacardi Limited, Davide Campari-Milano N.V., Demerara Distillers Ltd. (DDL), Diageo Plc, Pernod Ricard SA, William Grant & Sons Ltd., Captain Morgan, Malibu, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States rum market is boosted by the premium category of spirits, which is rum, that is used to create the highest quality cocktails. The cocktail market is growing rapidly as individuals' living standards improve and their GDP per capita rises. The cocktail market is important for the rum market because rum plays a critical role in cocktails, such that it is the only spirit to is easily adaptable to a plethora of cocktails. Rum spirit is one of the most frequently consumed drinks when served as part of a cocktail. Cocktails appeal to a variety of drinkers because they provide drinkers with both traditional and exotic flavours. As a consequence of this trend, more spiced rum is now being sold in pubs, restaurants, and bars.

Restraining Factors

The United States rum market faces obstacles as alcohol consumption contributes to poor health through liver disease, hypertension, heart disease, stroke, and digestive problems. Additionally, alcohol consumption increases the lifetime risk of breast, mouth, throat, larynx, liver, and rectal cancers are all possible malignancies for a rum abuser.

Market Segmentation

The United States rum market share is classified into product and distribution channel.

- The dark & golden rum segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States rum market is segmented by product into dark & golden rum, white rum, flavored & spiced rum, and others. Among these, the dark & golden rum segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because consumers are increasingly opting for premium, supple spirits that have complex flavour elements. These rums often have richer notes of caramel, vanilla, spice, and dried fruit, which possess both sipping and elegant cocktail options. The perception of quality and versatility of these rums has helped persuade drinkers to switch from lighter, flavoured formulations, aligned with the premiumization trend.

- The off-trade segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States rum market is segmented into off-trade and On-Trade. Among these, the off-trade segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the steady increase in at-home consumption, the end of shopping in retail, and the growing availability of rum in liquor stores, grocery stores, and online. Off-trade channels also deliver greater brand options, competitive pricing, and promotional deals, which are attractive to budget-minded consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States rum market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Demerara Distillers

- Bacardi Limited

- Davide Campari-Milano N.V.

- Demerara Distillers Ltd. (DDL)

- Diageo Plc

- Pernod Ricard SA

- William Grant & Sons Ltd.

- Captain Morgan

- Malibu

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States rum market based on the following segments:

United States Rum Market, By Product

- Dark & Golden Rum

- White Rum

- Flavored & Spiced Rum

- Others

United States Rum Market, By Distribution Channel

- Off-Trade

- On-Trade

Need help to buy this report?