United States Rubber Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural and Synthetic), By End-Use (Automotive, Construction, Industrial, Healthcare, Consumer goods, and Packaging), and United States Rubber Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Rubber Market Insights Forecasts to 2035

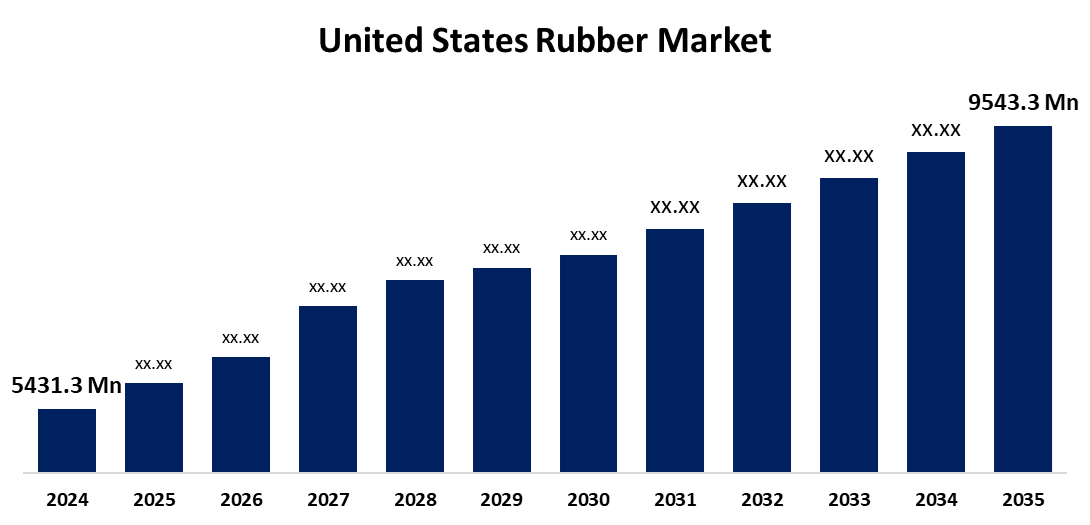

- The US Rubber Market Size Was Estimated at USD 5,431.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.26% from 2025 to 2035

- The US Rubber Market Size is Expected to Reach USD 9,543.3 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Rubber Market Size is anticipated to reach USD 9,543.3 Million by 2035, Growing at a CAGR of 5.26% from 2025 to 2035. The expansion of the United States rubber market is propelled by outstanding qualities displayed by the product, including resistance to heat and abrasion, and its use as a valuable raw material in a variety of end-use industries, including consumer products, automotive, electrical, and industrial.

Market Overview

Rubber is a highly elastic substance, an elastomer that can stretch and regain its original shape. It can be made synthetically by polymerising petroleum-derived monomers or by coagulating natural latex sap from plants like Hevea brasiliensis. Rubber is a valuable and versatile material utilized by a wide range of sectors. This unique material has certain properties that create demand and necessity for its use across many applications. The latex used in rubber is the sap of rubber trees, and when the tree's bark is tapped, the milky, white liquid is composed primarily of polyisoprene, which is a polymer, specifically cis-1,4-polyisoprene. Natural rubber, with its outstanding elasticity and durability, is well-suited to create a variety of goods such as medical gloves, rubber bands, tires, and shoes. Natural rubber is a popular material used in many applications because of its resistance to ripping and abrasion as well as its capacity to tolerate high temperatures. Furthermore, a number of techniques for creating synthetic rubber from petrochemical feedstocks rely on chemical reactions. This technique was developed in response to the growing need for rubber during World War II, when natural rubber was in short supply. Synthetic rubber has great durability, flexibility, and toughness against many environmental factors. It's commonly found in industrial belts, automobile tires, and a number of consumer items. In the present day, rubber is very important in the production of hoses and conveyor belts, as well as for other items of equipment.

Report Coverage

This research report categorizes the United States rubber market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States rubber market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States rubber market.

United States Rubber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5,431.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.26% |

| 2035 Value Projection: | USD 9,543.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-Use |

| Companies covered:: | The Goodyear Tire & Rubber, Exxon Mobil Corp, Dow Inc, Cooper Tire & Rubber Company, General Tire, Michelin North America, Eastman Chemical Company, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States rubber market is boosted by the automotive industry and ongoing infrastructure projects in the country. As the automotive market, which is the primary driver of the rubber market, continues to grow, the demand for rubber in tyre manufacture has also become increasingly important to ensure optimal vehicle performance and safety. The increase in the production and sales of vehicles only increases the demand for high-quality rubber compounds. Many factors can produce volatility in the prices of raw materials, including geopolitical events (which would affect trade), factors that produce economic uncertainty economy, and weather factors that impact rubber tree plantations.

Restraining Factors

The United States rubber market faces obstacles like the largely fluctuating cost of raw materials. The cost of key feedstocks for natural and synthetic rubber, in particular, is important to the rubber industry. Price fluctuations can affect a manufacturer's ability to manage cost, pricing, and profits, and these quick, unpredictable swings create difficulty for manufacturers in scheduling production in an already time-constrained business.

Market Segmentation

The United States rubber market share is classified into type and end-use.

- The synthetic segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States rubber market is segmented by type into natural and synthetic. Among these, the synthetic segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The part is propelled because it is inexpensive and lightweight. Synthetic rubber is used extensively in a variety of industries, including defence, automotive, textiles, construction, and pharmaceuticals. One significant and sizable segment of the synthetic rubber business is the automobile end-use sector. Synthetic rubber is used to manufacture waste tubes, tires, pipes, hoses, roll covers, gaskets, adhesives and roll covers etc.

- The automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States rubber market is segmented into automotive, construction, industrial, healthcare, consumer goods, and packaging. Among these, the automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by its increasing demand in the automotive sector due to the unique properties of rubber, which include factors such as combined tensile strength, dampening of vibration, tear, and anti-abrasion, amongst others, which continue to expand rubber use for tires, seals, and other products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States rubber market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Goodyear Tire & Rubber

- Exxon Mobil Corp

- Dow Inc

- Cooper Tire & Rubber Company

- General Tire

- Michelin North America

- Eastman Chemical Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States rubber market based on the following segments:

United States Rubber Market, By Type

- Natural

- Synthetic

United States Rubber Market, By End-Use

- Automotive

- Construction

- Industrial

- Healthcare

- Consumer goods

- Packaging

Need help to buy this report?