United States Robotics End of Arm Tooling (EOAT) Market Size, Share, and COVID-19 Impact Analysis, By Industry (Automotive, Electronics, Aerospace, Food and Beverage, Pharmaceuticals, and Consumer Products), By Type of Robotics EOAT (Grippers, Vacuum Cup Systems, Tooling Systems, End Effectors, and Specialized Chucks and Jaws), and United States Robotics End of Arm Tooling (EOAT) Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Robotics End of Arm Tooling (EOAT) Market Insights Forecasts to 2035

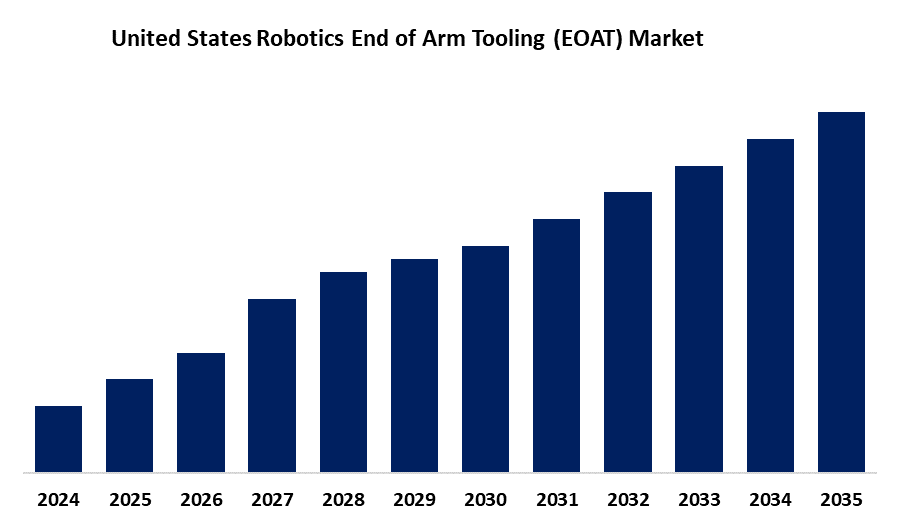

- The United States Robotics End of Arm Tooling (EOAT) Market Size is Expected to Grow at a CAGR of around 5.2% from 2025 to 2035.

- The United States Robotics End of Arm Tooling (EOAT) Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States robotics end of arm tooling (EOAT) market is expected to hold a significant share by 2035, growing at a CAGR of 5.2% from 2025 to 2035. The U.S. EOAT market grows due to rising automation demands, technological advances like AI-enhanced tooling, and labor shortages driving robotic adoption. Industry 4.0 integration and expanding applications in sectors such as healthcare and e-commerce further boost growth. Customizable, efficient EOAT solutions meet diverse industrial needs, fueling continued market expansion.

Market Overview

The United States robotics end of arm tooling (EOAT) market refers to the specialized tools attached to robotic arms that enable precise interaction with objects during manufacturing processes, such as gripping, welding, and inspection. This market is rapidly growing due to increased automation driven by industries aiming to boost efficiency and reduce labor costs, particularly in automotive manufacturing. Technological advancements like AI and machine learning have enhanced EOAT systems’ adaptability and precision. The market’s strength lies in the ability to customize tooling solutions to meet diverse industrial needs and the rising adoption of collaborative robots (cobots) that safely work alongside humans. Significant opportunities exist in emerging sectors like healthcare, logistics, and e-commerce, which increasingly require EOAT for material handling and packaging. Sustainability trends also push innovation toward eco-friendly and energy-efficient EOAT designs. Government initiatives, such as the Advanced Robotics for Manufacturing (ARM) Institute, support research, development, and workforce training, further strengthening the market’s growth potential.

Report Coverage

This research report categorizes the market for the United States robotics end of arm tooling (EOAT) market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA robotics end of arm tooling (EOAT) market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. robotics end of arm tooling (EOAT) market.

United States Robotics End of Arm Tooling (EOAT) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Industry, By Type of Robotics EOAT and COVID-19 Impact Analysis |

| Companies covered:: | ATI Industrial Automation, Schunk Intec Inc., Destaco, Piab USA, Robotiq USA, Bastian Solutions, Zimmer Group US, Applied Robotics, JH Robotics, Soft Robotics Inc., SAS Automation, PHD Inc., Festo USA, OnRobot US, Schmalz USA, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing adoption of automation across various industries is aimed at improving efficiency and reducing labor costs. Manufacturing sectors, especially automotive, rely heavily on EOAT for tasks like welding, assembly, and material handling, fueling demand. Technological advancements, including the integration of artificial intelligence and machine learning, have enhanced EOAT capabilities, allowing for greater precision, adaptability, and real-time monitoring. Additionally, persistent labor shortages push companies to automate more processes using robotic tooling. The rise of Industry 4.0 and smart factories creates a need for EOAT that can seamlessly integrate with digital systems, driving innovation. Emerging applications in healthcare, logistics, and e-commerce also present new growth avenues, expanding the market’s reach and adoption.

Restraining Factors

The high initial costs and integration complexity with existing robotic systems deter small and medium enterprises. Limited standardization across tooling types hinders interoperability. Additionally, skilled labor shortages for EOAT setup and maintenance, along with concerns over operational reliability in dynamic environments, can slow wider adoption and deployment.

Market Segmentation

The United States robotics end of arm tooling (EOAT) market share is classified into industry and type of robotics EOAT.

- The automotive segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States robotics end of arm tooling (EOAT) market is segmented by industry into automotive, electronics, aerospace, food and beverage, pharmaceuticals, and consumer products. Among these, the automotive segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its early and extensive adoption of industrial robotics for tasks like welding, assembly, and material handling. High production volumes, stringent precision requirements, and continuous automation investments drive EOAT demand. Automotive manufacturers prioritize efficiency and consistency, making advanced tooling essential for maintaining competitiveness and quality.

- The grippers segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States robotics end of arm tooling (EOAT) market is segmented by type of robotics EOAT into grippers, vacuum cup systems, tooling systems, end effectors, and specialized chucks and jaws. Among these, the grippers segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their versatility and widespread use in automation tasks like pick-and-place, assembly, and packaging. They are essential across industries for handling various object shapes and sizes. Their adaptability, ease of integration, and ability to improve efficiency make them the most in-demand tooling type in robotic applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States robotics end of arm tooling (EOAT) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ATI Industrial Automation

- Schunk Intec Inc.

- Destaco

- Piab USA

- Robotiq USA

- Bastian Solutions

- Zimmer Group US

- Applied Robotics

- JH Robotics

- Soft Robotics Inc.

- SAS Automation

- PHD Inc.

- Festo USA

- OnRobot US

- Schmalz USA

- Others

Recent Developments:

- In March 2024, Productivity Inc. announced new advancements in EOAT technology, showcasing the QC-11 tool changer and RCT-151 radially-compliant deburring tool. These innovations enhanced robotic flexibility and precision in manufacturing by enabling efficient tool exchange and improved deburring processes, helping robots perform more complex tasks with higher productivity and reduced downtime.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. robotics end of arm tooling (EOAT) market based on the below-mentioned segments:

United States Robotics End of Arm Tooling (EOAT) Market, By Industry

- Automotive

- Electronics

- Aerospace

- Food and Beverage

- Pharmaceuticals

- Consumer Products

United States Robotics End of Arm Tooling (EOAT) Market, By Type of Robotics EOAT

- Grippers

- Vacuum Cup Systems

- Tooling Systems

- End Effectors

- Specialized Chucks and Jaws

Need help to buy this report?