United States Revenue Cycle Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Services and Software), By Function (Clinical Documentation Improvement, Insurance, Medical Coding & Billing, Claims Management, Electronic Health Record, and Others), By End-User (Diagnostic Centers & Laboratories, Ambulatory Surgical Centers, Hospitals, Physician Back Office, Clinics, and Others), and US Revenue Cycle Management Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Revenue Cycle Management Market Insights Forecasts to 2035

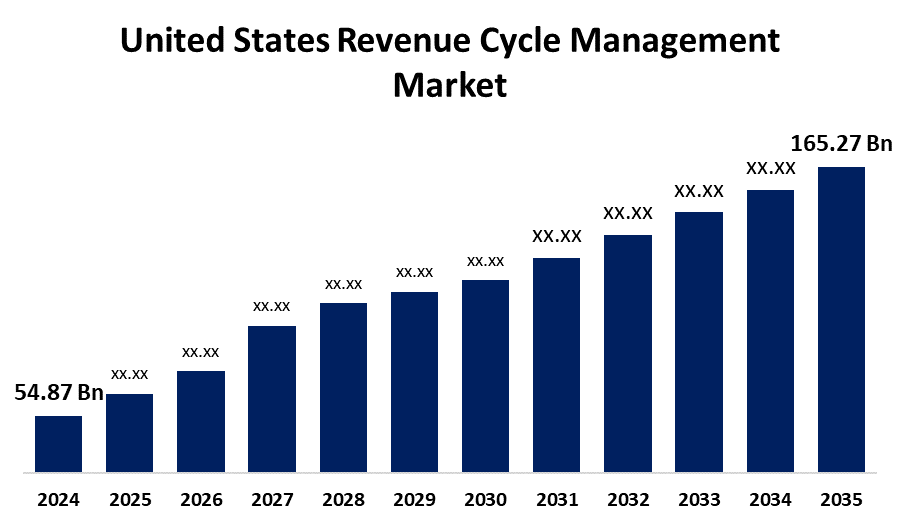

- The US Revenue Cycle Management Market Size was estimated at USD 54.87 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.54% from 2025 to 2035

- The USA Revenue Cycle Management Market Size is expected to reach USD 165.27 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Revenue Cycle Management Market Size is Anticipated to Reach USD 165.27 Billion by 2035, Growing at a CAGR of 10.54% from 2025 to 2035. The market growth is attributed to the acceleration in the revenue cycle management, technological developments, and rising proportion of patients due to the increasing prevalence of the chronic diseases.

Market Overview

The US revenue cycle management (RCM) market involves healthcare providers tracking patient care from registration to payment, integrating billing, claims processing, reimbursement models, and financial management to optimize revenue collection and reduce administrative burdens. From patient registration to final payment, healthcare facilities use revenue cycle management (RCM), a financial process, to track patient care episodes. Through the combination of administrative data, patient treatment, medical history, and available healthcare data, it unifies the clinical and business aspects of healthcare. Preregistration minimizes time-consuming rework and aids in RCM optimization. The need for sophisticated RCM solutions is rising as a result of the healthcare sector's quick digital transformation. RCM includes codes, guidelines, payment models, and third-party payers. To be successful, a healthcare practice must acquire the appropriate resources. The growing need for workflow optimization and the use of synchronized management software systems are driving the market expansion in healthcare organizations.

Report Coverage

This research report categorizes the market for the US revenue cycle management market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US revenue cycle management market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US revenue cycle management market.

United States Revenue Cycle Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 54.87 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.54% |

| 2035 Value Projection: | USD 165.27 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Component, By Function, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Cerner Corporation, The SSI Group, Inc., Oncospark, Inc., NXGN Management, LLC, Epic Systems Corporation, Veradigm LLC, McKesson Corrporation, Athenahealth, Inc., eClinical Works, Experian, Oracle, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for revenue cycle management (RCM) is being driven by government investments in medical technology and sophisticated diagnostic equipment as well as the growing demand for portable diagnostics. In order to guarantee accurate billing and lower errors and claim denials, RCM systems combine data. Billing and claims procedures are made more difficult by the increasing digitization of healthcare, which includes the use of EHRs and telemedicine platforms. RCM is frequently used by healthcare organizations to handle clinical and administrative tasks pertaining to revenue generation, payment, and claims processing. By locating and fixing flaws, RCM seeks to raise accurate revenue.

Restraining Factors

Complex insurance policies, labour-intensive procedures, data security issues, high implementation costs, regulatory complexity, staff shortages, and resistance to technology adoption are some of the issues facing the US revenue cycle management (RCM) market that could impede its expansion.

Market Segmentation

The USA revenue cycle management market share is classified into component, function, and end-user.

- The services segment held the largest market share of 66.32% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US revenue cycle management market is segmented by component into services and software. Among these, the services segment held the largest market share of 66.32% in 2024 and is expected to grow at a significant CAGR during the forecast period. This is ascribed to the optimization of healthcare providers' financial procedures. To improve revenue cycle performance, this involves incorporating automation and artificial intelligence. In the healthcare industry, this trend is lowering operating expenses and increasing productivity.

- The diagnostic centers segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US Revenue Cycle Management market is segmented by end-user into hospitals, blood banks, diagnostic centers, research labs, pharmacies, and others. Among these, the diagnostic centers segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is ascribed to the extensive usage of the Revenue Cycle Management in diagnostic centers, flexibility in use, and use for the storage of diagnostic agents and storage materials.

- The claims management segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US revenue cycle management market is segmented by function into clinical documentation improvement, insurance, medical coding & billing, claims management, electronic health record, and others. Among these, the claims management segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Growth is being driven by the aging population, growing patient pool, and government health insurance programs. More specifically for vulnerable and high-risk patient groups, risk-based reimbursement models are enhancing supervision and revenue cycle forecasting.

- The physician back office management segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US revenue cycle management market is segmented by end-user into diagnostic centers & laboratories, ambulatory surgical centers, hospitals, physician back office, clinics, and others. Among these, the physician back office management segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by increasing the number of physicians and medical facilities, despite economic challenges like reimbursement, operating expenses, and patient content.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US revenue cycle management market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cerner Corporation

- The SSI Group, Inc.

- Oncospark, Inc.

- NXGN Management, LLC

- Epic Systems Corporation

- Veradigm LLC

- McKesson Corrporation

- Athenahealth, Inc.

- eClinical Works

- Experian

- Oracle

- Others

Recent Developments:

- In May 2025, Infinx, an AI-powered revenue cycle management (RCM) provider, has acquired the Healthcare Revenue Cycle Management Business of i3 Verticals, Inc. for $96 million. The acquisition will strengthen Infinx's market presence in the healthcare RCM space and expand its customer base to academic medical centers and large provider groups. The acquisition aligns with Infinx's long-term strategy.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US revenue cycle management market based on the below-mentioned segments:

US Revenue Cycle Management Market, By Component

- Services

- Software

US Revenue Cycle Management Market, By Function

- Clinical Documentation Improvement

- Insurance

- Medical Coding & Billing

- Claims Management

- Electronic Health Record

- Others

US Revenue Cycle Management Market, By Function

- Diagnostic Centers & Laboratories

- Ambulatory Surgical Centers

- Hospitals

- Physician Back Office

- Clinics

- Others

Need help to buy this report?