United States Renal Disease Market Size, Share, and COVID-19 Impact Analysis, By Type (chronic kidney disease, and End-Stage Renal Disease), By Treatment (Dialysis, Medication, and Kidney Transplantation), and United States Renal Disease Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Renal Disease Market Insights Forecasts to 2035

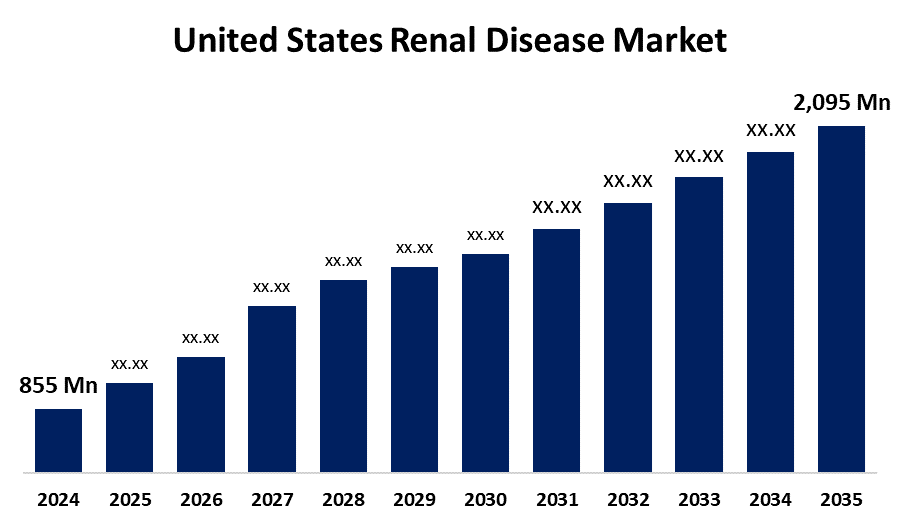

- The USA Renal Disease Market Size was Estimated at USD 855 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.49% from 2025 to 2035

- The U.S. Renal Disease Market Size is Expected to Reach USD 2,095 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Renal Disease Market Size is anticipated to reach USD 2,095 Million by 2035, Growing at a CAGR of 8.49% from 2025 to 2035. The U.S. renal disease market is growing due to rising incidences of diabetes and hypertension, an aging population, increasing awareness, and technological advancements in dialysis and kidney transplant procedures. Government support, improved healthcare infrastructure, and expanded insurance coverage further drive demand. Additionally, the prevalence of chronic kidney disease (CKD) fuels the need for effective treatment options.

Market Overview

The United States renal disease market encompasses chronic kidney disease (CKD), end-stage renal disease (ESRD), and related treatments like dialysis and kidney transplantation. Key drivers include the rising prevalence of diabetes, hypertension, and an aging population, which contribute to increased kidney disease. Technological advancements in dialysis modalities, such as home-based peritoneal dialysis and automated systems, have improved patient outcomes and quality of life. Additionally, the development of novel pharmacotherapies, including SGLT2 inhibitors, has enhanced disease management. The market’s strengths stem from a well-developed healthcare infrastructure, leading research expertise, and a thorough Medicare reimbursement program. Improving healthcare accessibility for underserved communities, adopting digital health systems, and accelerating regenerative medicine development offer promising opportunities. Government initiatives, notably the 2019 Executive Order on Advancing American Kidney Health, aim to reduce kidney failure cases by 25% by 2030. This initiative promotes preventive care, expands access to home dialysis, and increases kidney transplant availability

Report Coverage

This research report categorizes the market for the United States renal disease market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA renal disease market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. renal disease market.

United States Renal Disease Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 855 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.49% |

| 2035 Value Projection: | USD 2,095 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Treatment, and COVID-19 Impact Analysis |

| Companies covered:: | Fresenius Medical Care North America, Quanta Dialysis Technologies (USA), American Renal Associates, Baxter International Inc., Azura Vascular Care, Satellite Healthcare, CVS Kidney Care, Outset Medical, Medtronic USA, Dialyze Direct, US Renal Care, Nuwellis Inc., DaVita Inc., Renalogic, Somatus, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing prevalence of diabetes and hypertension which are leading causes of chronic kidney disease (CKD) and end-stage renal disease (ESRD). An aging population further contributes to the increasing incidence of renal disorders. Advancements in treatment modalities, such as home-based dialysis, automated peritoneal dialysis, and innovative pharmacotherapies like SGLT2 inhibitors, have significantly improved patient outcomes and quality of life. The growing emphasis on early detection and disease management, supported by public health campaigns and improved diagnostic tools, also fuels market expansion. Additionally, favourable government policies and Medicare reimbursement for dialysis and kidney transplant procedures further encourage the adoption of renal disease treatments.

Restraining Factors

The high treatment costs, particularly for dialysis and transplantation, which can limit access for uninsured or underinsured patients. Additionally, disparities in healthcare access across regions and socioeconomic groups hinder early diagnosis and treatment. Limited organ availability for transplant and workforce shortages in nephrology care also challenge market growth.

Market Segmentation

The United States renal disease market share is classified into type and treatment.

- The chronic kidney disease segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. renal disease market is segmented by type into chronic kidney disease and end-stage renal disease. Among these, the non-ferrous segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its higher prevalence and earlier stage diagnosis. Early detection and management increase demand for treatments and monitoring. CKD’s long progression period drives consistent healthcare utilization, making it a larger market segment compared to the more advanced but less common end-stage renal disease.

- The dialysis segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA renal disease market is segmented by treatment into dialysis, medication, and kidney transplantation. Among these, the dialysis segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the large number of patients with advanced kidney failure requiring regular treatment. Dialysis offers life-sustaining support for end-stage renal disease when transplantation is not immediately available. Its widespread use, ongoing technological improvements, and reimbursement coverage drive market growth over medication and transplantation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States renal disease market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fresenius Medical Care North America

- Quanta Dialysis Technologies (USA)

- American Renal Associates

- Baxter International Inc.

- Azura Vascular Care

- Satellite Healthcare

- CVS Kidney Care

- Outset Medical

- Medtronic USA

- Dialyze Direct

- US Renal Care

- Nuwellis Inc.

- DaVita Inc.

- Renalogic

- Somatus

- Others

Recent Developments:

- In March 2024, Fresenius Medical Care launched the Ready4 multiFiltratePRO AR, an augmented reality (AR) training application designed to enhance education for ICU nursing staff on the company's Continuous Kidney Replacement Therapy system. Utilizing AR glasses and digital learning modules, the program offers immersive, self-guided training on-site within intensive care units. This initiative aims to address nursing shortages and improve training accessibility. A limited U.S. launch is planned for later in 2024, with a full rollout anticipated in 2025 following the completion of the Safety of Regional Citrate Anticoagulation trial.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. renal disease market based on the below-mentioned segments:

United States Renal Disease Market, By Type

- Chronic Kidney Disease

- End-Stage Renal Disease

United States Renal Disease Market, By Treatment

- Dialysis

- Medication

- Kidney Transplantation

Need help to buy this report?