United States Refractories Market Size, Share, and COVID-19 Impact Analysis, By Product (Clay and Non-Clay), By End-User (Iron & Steel, Non-Ferrous Metals, Glass, Cement, and Others), and United States Refractories Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited States Refractories Market Insights Forecasts to 2035

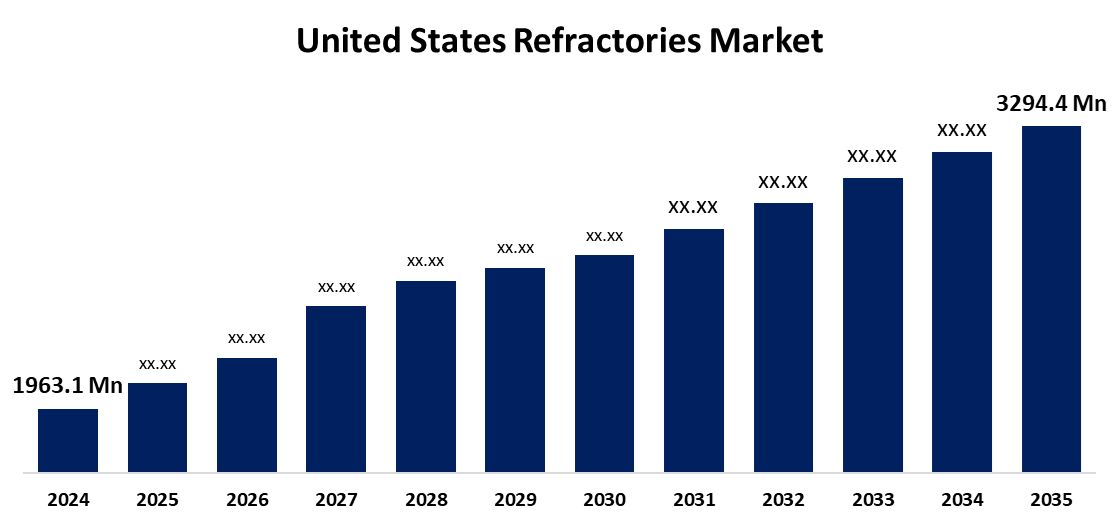

- The US Refractories Market Size Was Estimated at USD 1,963.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.82% from 2025 to 2035

- The US Refractories Market Size is Expected to Reach USD 3,294.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Refractories Market Size is anticipated to reach USD 3,294.4 Million by 2035, Growing at a CAGR of 4.82% from 2025 to 2035. The expansion of the United States refractories market is propelled by the continuous technological developments in refractory materials, the expansion of steel mining, and large-scale cement industry projects.

Market Overview

Refractory goods, referred to as ceramic materials that can tolerate high temperatures, are frequently utilised in a variety of industries to line hot surfaces. In addition, they are also resistant to corrosion and wear by chemical agents. The usefulness of refractories is seen in many shapes and sizes for various applications, including ladles, walls, boilers, and floors. Refractories are made up of several different synthetic and natural materials, often non-metallic, or a combination of minerals and compounds, like bauxite, fireclay, alumina, silica, magnesite, dolomite, chromite, zirconia, and silicon carbide. Each component plays an important role; however, alumina, silica, and magnesite are the three important materials used to produce refractories. The refractories market in the U.S. was the largest segment of the regional market in 2024. Refractories are critical in the production of steel, cement, and glass in high-temperature processing, and the U.S. government has made substantial investments in infrastructure development, contributing to the growth of the market. The White House fact sheet from November 2024 states that around USD 568 billion was allocated for 2023 under the bipartisan infrastructure package. This funding has contributed to ongoing construction in the U.S. Furthermore, the need for refractories remains strong. For example, U.S. raw steel production in January 2025 was 1.659 million net tons, with a capacity utilization of 74.5%. These developments are contributing to the overall demand for refractories in the country.

Report Coverage

This research report categorizes the market for the United States refractories market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States refractories market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States refractories market.

United States Refractories Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,963.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.82% |

| 2035 Value Projection: | USD 3,294.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-User |

| Companies covered:: | HarbisonWalker International (HWI), CoorsTek, Alsey Refractories Co., Plibrico Company, LLC, Seneca Ceramics, Metsch Refractories Inc., Ultramet, Industrial Refractory Services, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for refractories in the US is expanding because of the recent surge in the automobile sector, especially due to the surge of electric vehicles, which has provided traction to transportation manufacturing materials like steel, iron, and glass. Refractories are the important building blocks for achieving these future outcomes; the decline in take-up from the steel and glass industry has caught up to satisfy the auto industry opportunity. The growth of the product market should be fuelled by any carryovers that advance the automotive industry. High infrastructure investment spending, rapid industrialization, and the government's goal of domestic raw materials sources are all driving the U.S. refractories share during the prediction period.

Restraining Factors

The United States refractories market faces obstacles like these products generating significant carbon footprints due to their processes, namely, baking, mining, and recycling refractory products. Raw materials release high levels of CO2 / toxics (including carbon monoxide and volatile organic compounds) during manufacturing.

Market Segmentation

The United States refractories market share is classified into product and end-user.

- The clay segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States refractories market is segmented by product into clay and non-clay. Among these, the clay segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by an increase in demand in areas such as steel, cement, and glass manufacturing, where heat resistance is required, and advances the market. The availability, price, and ecological soundness of clay also help promote its essential role in the refractories industry.

- The iron & steel segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-user, the United States refractories market is segmented into iron & steel, non-ferrous metals, glass, cement, and others. Among these, the iron & steel segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Numerous applications, such as the ordering of all reactors, furnaces, and vessels when steel is being manufactured, are driving the segment's expansion. The refractory lining itself returns regularly, every 30 minutes to two days, through different steps in the steel manufacturing process, causing large consumption in the iron and steel industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States refractories market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HarbisonWalker International (HWI)

- CoorsTek

- Alsey Refractories Co.

- Plibrico Company, LLC

- Seneca Ceramics

- Metsch Refractories Inc.

- Ultramet

- Industrial Refractory Services

- Others

Recent Developments:

- In March 2024, RHI Magnesita announced the acquisition of Resco Group, a U.S. monolithic ans shaped refractory manufacturer, for up to USD 430 million. This move expands RHIs domestic alumina-based production footprint and strenlines supply chain for U.S. customers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States refractories market based on the following segments:

United States Refractories Market, By Product

- Clay

- Non-Clay

United States Refractories Market, By End-User

- Iron & Steel

- Non-Ferrous Metals

- Glass

- Cement

- Others

Need help to buy this report?