United States Razor Market Size, Share, and COVID-19 Impact Analysis, By Product (Cartridge, Disposable, and Electric), By Consumer (Men and Women), and United States Razor Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Razor Market Insights Forecasts to 2035

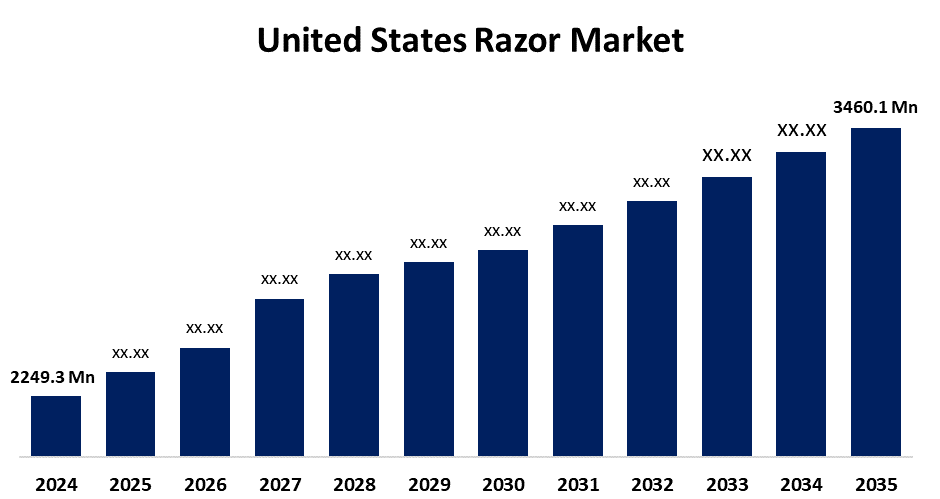

- The US Razor Market Size Was Estimated at USD 2249.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.99% from 2025 to 2035

- The US Razor Market Size is Expected to Reach USD 3460.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Razor Market is anticipated to reach USD 3460.1 million by 2035, growing at a CAGR of 3.99% from 2025 to 2035. The expansion of the United States razor market is propelled by growing emphasis on hygiene and personal grooming, as evidenced by an increase in the purchase of high-quality shaving products.

Market Overview

A razor is a tool with a sharp edge that is mainly used for shaving, which removes body hair. Straight razors, safety razors, disposable razors, cartridge razors, and electric razors are examples of common types. Disruptive technologies that create new shaving experiences are transforming the United States razor industry. Leading companies leverage materials science, advanced engineering, and extraordinary convenience, comfort, and precision in razors. Multi-blade cartridge systems offer the closest shave with the least amount of irritation, with the most common two, three, and four-blade systems, but recent entrants are increasing the number of flexing blades with protectors to even seven blades. In addition, breakthrough coating technologies on the blades, both diamond-like carbon coatings and skin-protecting products such as vitamin E or aloe-filled lubricating strips, significantly reduce friction and razor burn. Perhaps the most notable inventions are smart razors with integrated electronics. Smart razors boast many features, such as built-in LED lighting for precise shaving, bluetooth connection that tracks the user's shaving patterns, and even heated blades that add warmth in a comforting spa-like experience. As consumers take the plunge into premium shaving systems, these technological advances add functional benefits and new premium categories.

Report Coverage

This research report categorizes the market for the United States razor market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States razor market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States razor market.

United States Razor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024` |

| Market Size in 2024`: | USD 2249.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.99% |

| 2035 Value Projection: | USD 3460.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product, By Consumer |

| Companies covered:: | Harry’s, Edgewell Personal Care Co, Procter & Gamble Co, BIC USA Inc., Dorco USA, AccuTec, Inc., The Razor Blade Company, Dollar Shave Club, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States razor market is boosted by the growing focus on grooming. Men and women are spending more on their appearance as new beauty standards begin to shift the way that they think about looks, increasing the market for higher-quality shaving items. The beard culture has also sparked a rise in sales for the men’s market on precision trimmers and specialty razors for trim and precise grooming. The women's market is also expanding substantially as companies introduce razors that are ergonomically designed with skin-friendly innovations to meet the needs of female consumers' shaving. This growing focus on personal care is more than just shaving, but a more detailed grooming experience.

Restraining Factors

The United States razor market faces obstacles like the intense competition in the razor industry. There are several different known brands and rising competitors in the industry, so price competition is fierce and differentiation in branding is difficult.

Market Segmentation

The United States razor market share is classified into product and consumer.

- The cartridge segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States razor market is segmented by product into cartridge, disposable, and electric. Among these, the cartridge segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because they are effective, easy to use, and convenient. They usually have several blades, providing a close and smooth shave, and accommodating many customers. In addition to their appeal, cartridge razors use various systems, providing consumers with many options. Importantly, the continued use of cartridge razors is also supported by well-developed brands and strong marketing efforts, provided by the personal care companies.

- The men segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the consumer, the United States razor market is segmented into men and women. Among these, the men segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled due to the contemporary popularity of facial hair grooming and styles, and razor-related products have seen strong demand from male consumers. In addition, the vast assortment of various types of razors, from advanced electric shavers to cartridge and safety razors, grows to meet a man’s grooming or shaving need. Male consumers constantly reinforce this leading positioning through the many marketing campaigns and developments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States razor market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Harry's

- Edgewell Personal Care Co

- Procter & Gamble Co

- BIC USA Inc.

- Dorco USA

- AccuTec, Inc.

- The Razor Blade Company

- Dollar Shave Club, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States razor market based on the following segments:

United States Razor Market, By Product

- Cartridge

- Disposable

- Electric

United States Razor Market, By Consumer

- Men

- Women

Need help to buy this report?