United States Railway Maintenance Machinery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Tamping Machine, Stabilizing Machinery, Rail Handling Machinery, Ballast Cleaning Machinery, and Others), By Application (Ballast Track, Non-Ballast Track), By Sales Type (New Sales, Aftermarket), and United States Railway Maintenance Machinery Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationUnited States Railway Maintenance Machinery Market Insights Forecasts to 2035

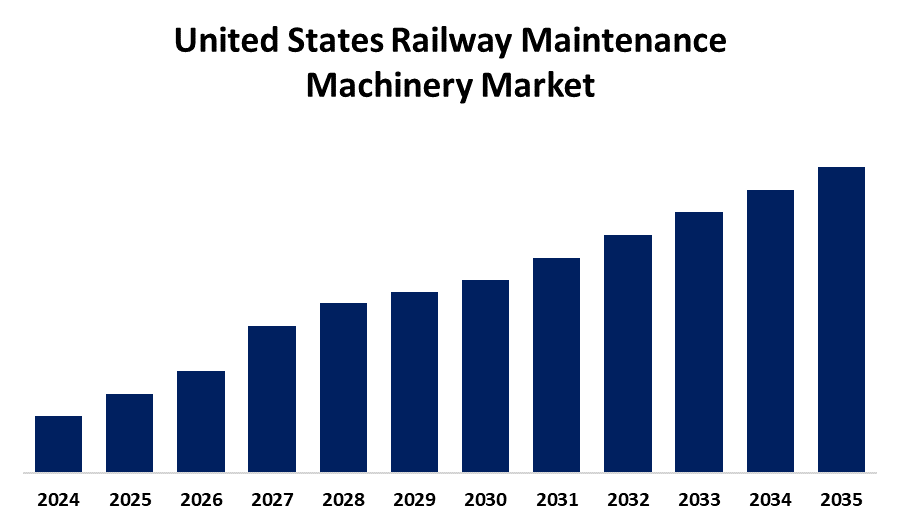

- The United States Railway Maintenance Machinery Market Size is Expected to Grow at a CAGR of around 5.5% from 2025 to 2035.

- The U.S. Railway Maintenance Machinery Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Railway Maintenance Machinery Market Size is Expected to hold a significant share by 2035, Growing at a CAGR of 5.5% from 2025 to 2035. The U.S. railway maintenance machinery market is growing due to rising rail traffic, the need to modernize aging infrastructure, increased government investment, and the demand for efficient, automated machinery to maintain the country’s extensive and vital freight and passenger rail networks.

Market Overview

The United States railway maintenance machinery market defines the machinery specifically used for the maintenance, repair, and upgrade of the country's rail infrastructure, such as track maintenance systems, signaling equipment, and overhead line machinery. The market is fueled mainly by the vast American freight rail network, increasing rail traffic, and requirements for safer, more efficient, and automated maintenance. One of the core strengths is the vast and established railway network in the country that needs to be maintained around the clock to deliver quality and reliability. The primary opportunities are arising from infrastructure upgrades, implementing fuel-efficient and autonomous equipment, and the development of freight and passenger rail operations. Higher demand for sustainable and long-term transportation options is also driving investment in newer technologies. Government policy has an important role, with large investments in upgrading the current infrastructure, new rail expansion, and helping technology move forward.

Report Coverage

This research report categorizes the market for the United States railway maintenance machinery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States railway maintenance machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States railway maintenance machinery market.

United States Railway Maintenance Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.5% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product Type, By Application, By Sales Type and COVID-19 Impact Analysis |

| Companies covered:: | Plasser & Theurer,, Vossloh AG, Harsco Corporation, Caterpillar Inc., Speno International SA, Loram Maintenance of Way, Inc., Mitsubishi Heavy Industries, Ltd., Knorr-Bremse AG, American Equipment Company Inc., MATISA Industrial Materials S.A., Coril Holding Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

This market is expanding due to growth in rail traffic, the need to modernize aging infrastructure, and the need for safer, more efficient, and automated maintenance solutions. The country's extensive freight rail system, one of the world's largest, provides consistent demand for maintenance and innovation. Increased attention to high-speed rail and enhanced passenger service also drives market expansion. Integration of intelligent technologies like real-time tracking and predictive upkeep is adding operational efficiency. Increased government expenditure in infrastructure, added to the requirement for green as well as efficient transport, is also promoting development.

Restraining Factors

The U.S. railway maintenance equipment market is subject to constraints like high capital investment requirements, intricate regulatory compliance, limited skilled labor, and aging infrastructure. Furthermore, slower uptake of advanced technology and environmental issues are challenges that are hindering the quick modernization and growth of railway maintenance activities in the country.

Market Segmentation

The United States railway maintenance machinery market share is classified into product type, application, and sales type.

- The tamping machines segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United States railway maintenance machinery market is segmented by product type into tamping machines, stabilizing machinery, rail handling machinery, ballast cleaning machinery, and others. Among these, the tamping machines segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because they play a crucial role in the stability, alignment, and safety of the tracks. Demand for track maintenance efficiency is fueled by high-speed rail development, aging infrastructure, and higher freight traffic, necessitating efficient tamping machines to provide reliability in operations and reduce service interruptions.

- The ballast track segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States railway maintenance machinery market is segmented by application into ballast track and non-ballast track. Among these, the ballast track segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its cost-effectiveness, ease of installation, and better drainage capabilities. This conventional track system carries heavy loads and alleviates vibrations, leading to improved safety and comfort. Its popularity is fueled by the continuous development of infrastructure and government policies to minimize carbon emissions.

- The aftermarket segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States railway maintenance machinery market is segmented by sales type into new sales and aftermarket. Among these, the aftermarket segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the requirement for constant maintenance, spare parts, and service upgrades of current equipment. Operators turn more to aftermarket suppliers as equipment gets older and rely more on them for components and services to maintain optimal performance and increase equipment life.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States railway maintenance machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Plasser & Theurer,

- Vossloh AG

- Harsco Corporation

- Caterpillar Inc.

- Speno International SA

- Loram Maintenance of Way, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Knorr-Bremse AG

- American Equipment Company Inc.

- MATISA Industrial Materials S.A.

- Coril Holding Ltd.

- Others

Recent Developments:

- In April 2024, Alstom, a global leader in smart and sustainable mobility, announced the sale of its North American conventional signalling business. An important milestone in the implementation of the group’s deleveraging plan, aiming at reinforcing its leadership position in the Rail industry.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States railway maintenance machinery market based on the below-mentioned segments

U.S. Railway Maintenance Machinery Market, By Product Type

- Tamping Machine

- Stabilizing Machinery

- Rail Handling Machinery

- Ballast Cleaning Machinery

- Others

U.S. Railway Maintenance Machinery Market, By Application

- Ballast Track

- Non-Ballast Track

U.S. Railway Maintenance Machinery Market, By Sales Type

- New Sales

- Aftermarket

Need help to buy this report?