United States Railroad Market Size, Share, and COVID-19 Impact Analysis, By Type (Passenger Rail and Rail Freight), By End Use (Mining, Construction, Agriculture, and Others), and United States Railroad Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Railroad Market Insights Forecasts to 2035

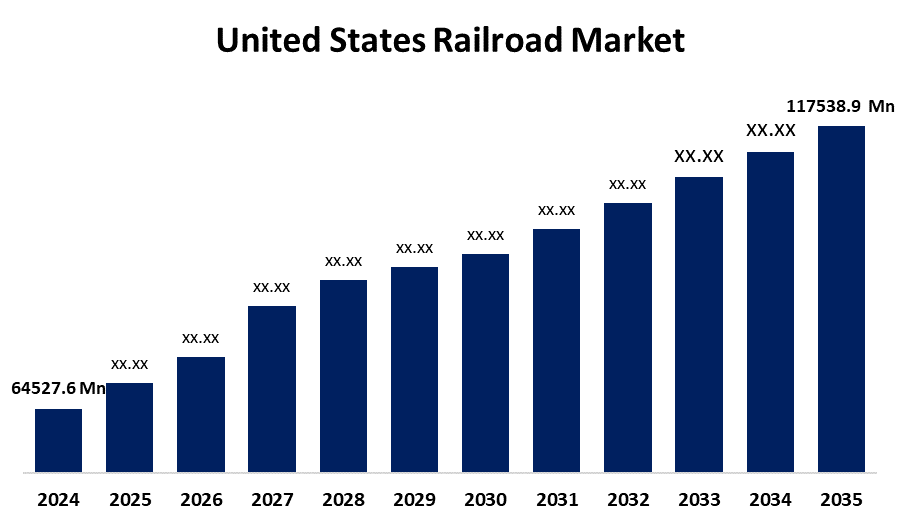

- The US Railroad Market Size Was Estimated at USD 64527.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.6% from 2025 to 2035

- The US Railroad Market Size is Expected to Reach USD 117538.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Railroad Market is anticipated to reach USD 117538.9 million by 2035, growing at a CAGR of 5.6% from 2025 to 2035. The expansion of the United States railroad market is propelled by ongoing expenditures for railway line projects and network expansion.

Market Overview

Railroads are permanent roads with parallel steel rails attached to ties and placed on a roadbed to create a track that is used for the transportation of individuals, goods, or mail by locomotives and rail carriages. The development of many domestic railroad projects, mostly, that are currently in the planning, development, or construction stage, is a positive sign for the future growth of the railroad industry. Growth is also on the horizon for rail transportation due to the fact that railcar leasing is now a common way of doing business. In addition to being a more secure logistics process, using rail transportation is a cheaper way to move goods, depending on the type of goods, and using modern technology in the rail sector. Other developments will lead to even more growth in the rail sector in terms of power sources, storage facilities, and scheduling of transportation. In the USA, demand is primarily driven by government policies and spending. The governments, federal, state, and local, are spending large amounts of money on building high-speed tracks to be used and often shared with freight trains in order to allow for either quicker movement of individuals and freight, more securely and reliably. The funding is evident in the annual allotments made to different transport entities through grant money and rail acts.

Report Coverage

This research report categorizes the market for the United States railroad market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States railroad market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States railroad market.

Driving Factors

The growth of the United States railroad market is boosted because rail transportation may face drawbacks from the energy prices, especially diesel prices, which are often used in rail transport. Railroads consume fuel in much less quantity than automobiles; therefore, fluctuation of energy prices along with fuel efficiency orientation can influence the rail transportation in either positive or negative form, sanctioned by fuel efficiency improvements. Complementing the aforementioned observation, the demand for rail transport is influenced by the supply management and logistics optimization need alluded to above, as rail transport provides a preferable, cost-effective, and reliable means of transporting high-volume cargo over long distances. The rail industry may benefit from the newfound emphasis on supply chain optimization and logistics efficiency.

Restraining Factors

The United States railroad market faces obstacles like the barriers to digitization, or adopting new technology may include cybersecurity concerns, legacy technology incompatibilities, or barriers to change. Limited digitization and technology adoption can affect the pace of the existing railroads industry from growing and can affect rail transportation's efficiencies, safety, and competitiveness.

Market Segmentation

The United States railroad market share is classified into type and end use.

- The passenger rail segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States railroad market is segmented by type into passenger rail and rail freight. Among these, the passenger rail segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the tourism sector continues to gain momentum. The category is expected to grow over the coming few years because of cheap passenger train fares. Moreover, the passenger rail segment is expected to grow, due in part to increased investment in growing passenger rail networks and recent investment in high-speed and new, faster trains.

- The agriculture segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end use, the United States railroad market is segmented into mining, construction, agriculture, and others. Among these, the agriculture segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by in rural areas, which recycled insulated maritime transportation routes, rail transport is often the only low-cost shipping option available for low-value, bulk commodities. There are a variety of historical factors that have driven the agricultural rail segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States railroad market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BNSF Railway Company

- Union Pacific Corporation

- CSX Transportation

- Norfolk Southern Railway

- Genesee & Wyoming Inc.

- Watco Companies

- Patriot Rail Company

- Regional Rail, LLC

- Others

Recent Development

- In March 2025, OmniTRAX and Coast Belle Rail launched a joint venture to enhance freight operations on California's Santa Maria Valley Railroad, aiming for improved logistics on the Central Coast.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States railroad market based on the following segments:

United States Railroad Market, By Type

- Passenger Rail

- Rail Freight

United States Railroad Market, By End Use

- Mining

- Construction

- Agriculture

- Others

Need help to buy this report?