United States Pumps Market Size, Share, and COVID-19 Impact Analysis, By Type (Centrifugal Pumps and Positive Displacement Pumps), By End Use (Machinery & Equipment, Water & Wastewater, Oil & Gas, Mining, Infrastructure Application (HDD), and Other), and United States Pumps Market Insights, Industry Trend, Forecasts to 2035.

Industry: Machinery & EquipmentUnited States Pumps Market Insights Forecasts to 2035

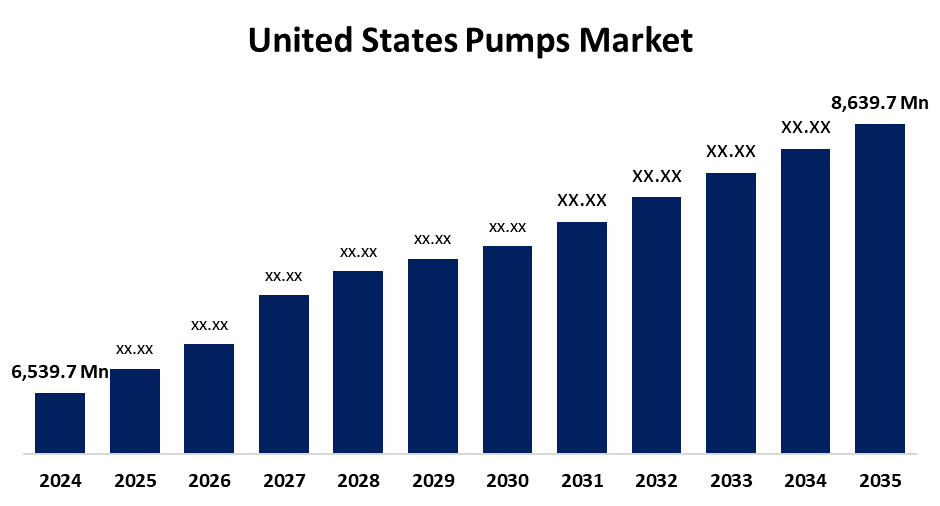

- The US Pumps Market Size Was Estimated at USD 6,539.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.56% from 2025 to 2035

- The US Pumps Market Size is Expected to Reach USD 8,639.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Pumps Market Size is anticipated to reach USD 8,639.7 Million by 2035, growing at a CAGR of 2.56% from 2025 to 2035. The expansion of the United States' pump market is propelled as they function, creating fluid pressure and transporting fluid at a fluid flow rate.

Market Overview

A pump is a mechanical device that transforms mechanical energy, typically from an electric motor or engine, into hydraulic or pneumatic energy to move fluids, such as liquids, gases, or slurries. Factors such as renewed and modernised infrastructure, tougher environmental regulations, and advancements in energy-efficient pump technology are driving the growth of the pumps market in the United States. The growth is partially driven by increasing exploratory activity in the oil and gas market. Moreover, an emerging trend that is expected to positively impact market growth is the use of smart pumps incorporating IoT technologies for efficiency optimisation and predictive maintenance. Pumps provide the functionality of increasing fluid pressure and dosing reagents and reactants accurately during infrastructure application (HDD) synthesis operations in various applications such as oil and gas exploration and HDD production. Therefore, as long as the oil and gas exploration industry continues to thrive, it can be expected that throughout the forecast period, demand for pumps will increase. The increasing demand for fluid management in growing sectors such as construction will drive the demand for pumps. Market growth will be supported by wastewater treatment contamination, urbanisation, and potential agricultural expenditures. Furthermore, the market will drive growth with technological improvements and growth in major industries such as agricultural, infrastructure application (HDD), and water and wastewater treatment.

Report Coverage

This research report categorizes the market for the United States pumps market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States pumps market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States pumps market.

United States Pumps Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6,539.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.56% |

| 2035 Value Projection: | USD 8,639.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 206 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | Iwaki America, SPX FLOW, ITT Inc, Flowserve Corp, Xylem Inc, Pentair, Baker Hughes, Gorman-Rupp, Vaughan Chopper Pumps, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States' pumps market is boosted as increasing pressure on the demand for treated water, having a source of water straight out of the ground is mandatory when using a pump system. A domestic pump can deliver drilled water directly to the house. Making it more of an experience, rather than a chore. With the combination of greater population density, changes in land use, and a changing climate, there can be no doubt that the demand for fresh water, in many areas, is going to increase and the supply diminish. The market for pumps is expected to rise steadily as more municipalities and industrialised organisations use them.

Restraining Factors

The United States pumps market faces obstacles like the it requires a large initial investment. Intelligent pumps are significantly more expensive than regular pumps because they have advanced technologies, such as sensors, variable motors, and some form of digital control system.

Market Segmentation

The United States pumps market share is classified into type and end use.

- The positive displacement pumps segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States pumps market is segmented by type into centrifugal pumps and positive displacement pumps. Among these, the positive displacement pumps segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by its preference in the oil and gas extraction industries, particularly in upstream exploration and production operations. They are also widely used for transferring highly viscous materials, including paints and resins, in the building services and construction sector. The demand for positive displacement pumps is set to increase over the forecast period due to the anticipated growth in the demand for oil and gas and construction.

- The water & wastewater segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end use, the United States pumps market is segmented into machinery & equipment, water & wastewater, oil & gas, mining, infrastructure application (HDD), and other. Among these, the water & wastewater segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The demand for pumps used in the water and wastewater industry is rising due to the growing requirement for water treatment and distribution infrastructure, which is driving the segment's expansion. As the population continues to grow, cities become more crowded, and people start to realize the importance of cleaning wastewater and conserving water, projects related to water infrastructure, such as building sewage treatment facilities, flood control systems, and desalination plants, are receiving significant funding from both public and commercial organizations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States pumps market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Iwaki America

- SPX FLOW

- ITT Inc

- Flowserve Corp

- Xylem Inc

- Pentair

- Baker Hughes

- Gorman-Rupp

- Vaughan Chopper Pumps

- Others

Recent Development

- In May 2023, Xylem Inc. acquired Evoquq Water Technologies Corp, a leader in mission-critical water treatment solutions and services, to create the most advanced platform to tackle critical water challenges faced by customers and communities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States pumps market based on the following segments:

United States Pumps Market, By Type

- Centrifugal Pump

- Positive Displacement Pump

United States Pumps Market, By End-Use

- Machinery & Equipment

- Water & Wastewater

- Oil & Gas, Mining

- Infrastructure Application (HDD)

- Other

Need help to buy this report?