United States Pulse Oximeter Market Size, Share, and COVID-19 Impact Analysis, By Product (Handheld Oximeters, Fingertip Oximeters, Tabletop Oximeters, and Others), By Technology (Smart and Conventional), By Age Groups (Pediatrics and Adults), By End-User (Ambulatory Surgical Centers, Home Healthcare, Clinics, Hospitals, and Others), and US Pulse Oximeter Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Pulse Oximeter Market Insights Forecasts to 2035

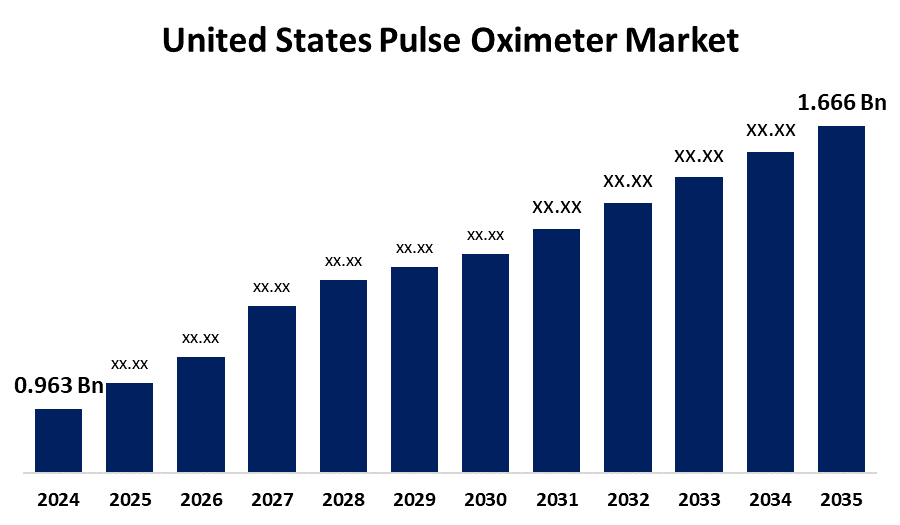

- The US Pulse Oximeter Market Size was Estimated at USD 0.963 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.11% from 2025 to 2035

- The USA Pulse Oximeter Market Size is Expected to reach USD 1.666 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Pulse Oximeter Market Size is anticipated to reach USD 1.666 Billion by 2035, Growing at a CAGR of 5.11% from 2025 to 2035.

Market Overview

Producing, distributing, and using medical devices such as pulse oximeters to test blood oxygen saturation levels and pulse rate, which are mostly utilized in hospitals, clinics, and home healthcare settings, are the main objectives of the US pulse oximeter market. A device called pulse oximetry measures a person's pulse rate and blood oxygen level (oxygen saturation) using laser beams. Usually, it displays two or three numbers: PR, SpO2, and a third value that represents signal intensity. Healthy people have oxygen saturation levels between 95% and 100%, but those with heart and lung conditions and those who live at higher elevations may have lower levels. PPG signal analysis has been transformed by artificial intelligence, which offers excellent accuracy and dependability. Because AI-enhanced PPG analysis can handle unpredictability and noise in PPG signals and provide more accurate readings under challenging situations, it may improve clinical outcomes in anesthesia, critical care, and perioperative medicine settings and accelerate the market growth.

Report Coverage

This research report categorizes the market for the US Pulse Oximeter market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US Pulse Oximeter market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US Pulse Oximeter market.

United States Pulse Oximeter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.963 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 5.11% |

| 2035 Value Projection: | USD 1.666 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Technology, By Age Groups, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Nonin, Beurer GmbH, NIHON KOHDEN CORPORATION, Medtronic, GE Healthcare, Masimo, Smiths Medical, VYAIRE, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market's expansion is ascribed to a non-invasive technique that provides important details about respiratory function. Artificial intelligence has transformed PPG signal analysis, offering excellent accuracy and reliability. AI-enhanced PPG analysis has the potential to improve clinical results in anesthesia, critical care, and perioperative medicine settings. It can deliver more precise readings in challenging situations, such as low perfusion or motion. Advancements in artificial intelligence can overcome limitations by providing real-time monitoring across various physiological and environmental conditions. The growing use of wireless pulse oximeters among healthcare providers and home users is anticipated to boost global pulse oximeter sales. Specifically in home care environments, the rising popularity of wrist and fingertip pulse oximeters is driven by the portability of wireless devices. The superior wireless features of the Masimo Rad-5 wireless pulse oximeter have contributed to its increased popularity.

Restraining Factors

The high cost of sophisticated devices, accuracy issues, regulatory obstacles, competition from other monitoring technologies, supply chain interruptions, and little awareness outside of hospitals restrict adoption among customers on a tight budget, and increase distrust among medical professionals, which may impede the market growth.

Market Segmentation

The USA pulse oximeter market share is classified into product type, technology, age group, and end-user.

- The tabletop oximeters segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US pulse oximeter market is segmented by technology into handheld oximeters, fingertip oximeters, tabletop oximeters, and others. Among these, the tabletop oximeters segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the growing prevalence of respiratory disease and cardiovascular diseases, and the rising demand for the diagnosis of COPD in the US.

- The smart segment accounted for a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US pulse oximeter market is segmented by technology into smart and conventional. Among these, the smart segment accounted for a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. The development of technologically improved smart devices and the growing need for virtual consultation have been responsible for the segment's growth.

- The adult segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US pulse oximeter market is segmented by age group into pediatrics and adults. Among these, the adult segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. The increasing prevalence of COPD in adults and asthma escalates the need for pulse oximeters among adults, which drives the sectoral growth.

- The hospitals segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US pulse oximeter market is segmented by end-user into ambulatory surgical centers, home healthcare, clinics, hospitals, and others. Among these, the hospitals segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing hospital admissions of patients suffering from respiratory diseases.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US pulse oximeter market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nonin

- Beurer GmbH

- NIHON KOHDEN CORPORATION

- Medtronic

- GE Healthcare

- Masimo

- Smiths Medical

- VYAIRE

- Others

Recent Developments:

- In February 2024, Masimo announced the FDA clearance of its MightySat Medical, making it the first and only FDA-cleared medical fingertip pulse oximeter available over-the-counter without a prescription. The device, powered by Masimo SET® pulse oximetry, is used by hospitals and clinics to monitor over 200 million patients annually and has no clinically significant difference in accuracy or bias between light- and dark-skinned individuals.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US pulse oximeter market based on the below-mentioned segments:

US Pulse Oximeter Market, By Product

- Handheld Oximeters

- Fingertip Oximeters

- Tabletop Oximeters

- Others

US Pulse Oximeter Market, By Technology

- Smart

- Technology

US Pulse Oximeter Market, By Age Groups

- Pediatric

- Adults

US Pulse Oximeter Market, By End-User

- Ambulatory Surgical Centers

- Home Healthcare

- Clinics

- Hospitals

- Others

Need help to buy this report?