United States Public Affairs and Advocacy Software Market Size, Share, and COVID-19 Impact Analysis, By Type (Cloud-Based, On-Premises), By Application (Enterprises, Nonprofits & Associations), and United States Public Affairs and Advocacy Software Market Insights Forecasts to 2033

Industry: Electronics, ICT & MediaUnited States Public Affairs and Advocacy Software Market Insights Forecasts to 2033

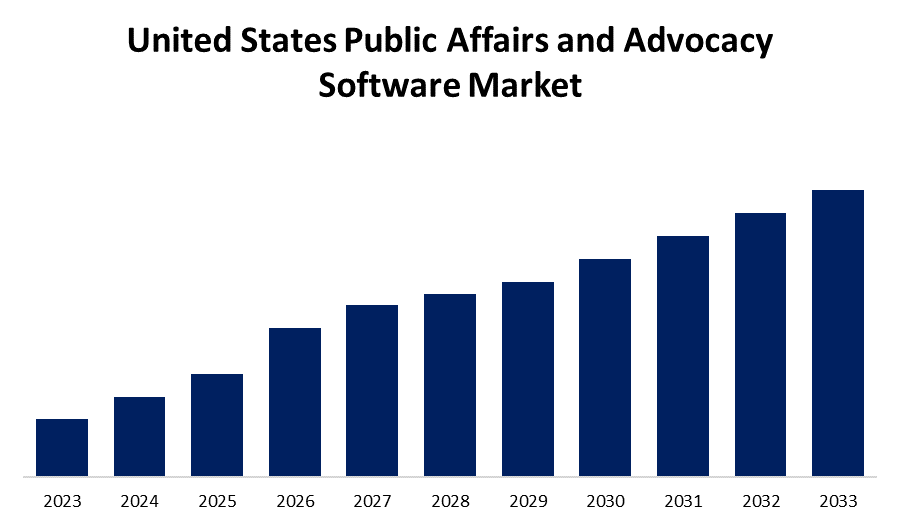

- The Market Size is Growing at a CAGR of 6.7% from 2023 to 2033.

- The United States Public Affairs and Advocacy Software Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States Public Affairs and Advocacy Software Market Size is Expected to Hold a Significant Share by 2033, at a CAGR of 6.7% during the forecast period 2023 to 2033.

Market Overview

The United States public affairs and advocacy software market is a dynamic sector that facilitates strategic advocacy initiatives across a wide range of industries. This market provides a suite of software solutions for streamlining advocacy campaigns, engaging stakeholders, and navigating complex regulatory landscapes. These software platforms, which focus on digitization and data-driven decision-making, enable organizations, businesses, nonprofits, and associations to develop targeted advocacy strategies. These solutions, which use advanced analytics, communication tools, and compliance features, allow for more efficient management of lobbying efforts, constituent engagement, and regulatory compliance. The market's expansion is driven by rising civic engagement, the need for transparent and ethical advocacy practices, and the demand for scalable software solutions that can adapt to changing regulatory environments. The ongoing evolution of technology, as well as a greater emphasis on targeted stakeholder interactions, position this market as an indispensable asset for driving effective advocacy and public affairs initiatives in the United States.

Report Coverage

This research report categorizes the market for United States public affairs and advocacy software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States public affairs and advocacy software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States public affairs and advocacy software market.

United States Public Affairs and Advocacy Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.7% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | FiscalNote, Quorum Analytics, CQ Roll Call, Meltwater, Phone2Action, RAP Index, Beekeeper Group, Influitive, NationBuilder, VoterVOICE, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid evolution of technology is a primary driver behind the expansion of the public affairs and advocacy software market in the United States. Artificial intelligence, machine learning, big data analytics, and cloud computing have transformed the way organizations interact with stakeholders, develop strategies, and carry out advocacy campaigns. These technological advancements enable software developers to create more sophisticated tools that can efficiently manage massive amounts of data, enable targeted outreach, and provide actionable insights. Furthermore, the ongoing digital transformation of industries has increased the demand for agile, scalable, and integrated software solutions tailored to the unique requirements of public affairs and advocacy. Organizations, whether governmental, non-profit, or corporate, are increasingly recognizing the importance of engaging stakeholders and maintaining open communication channels. As a result, there is a greater reliance on software solutions that enable robust stakeholder management, streamline communication, and real-time engagement across multiple platforms.

Market Segment

- In 2023, the cloud-based segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States public affairs and advocacy software market is segmented into cloud-based and on-premises. Among these, the cloud-based segment has the largest revenue share over the forecast period. The cloud-based segment has emerged as the dominant force in the United States public affairs and advocacy software market, and it is expected to maintain its dominance throughout the forecast period. The public affairs and advocacy sector's shift to cloud-based solutions reflects a growing preference for software that is scalable, accessible, and flexible. Cloud-based solutions provide unrivaled benefits, including remote access, seamless collaboration, and cost effectiveness. These platforms provide real-time updates, allowing stakeholders to easily participate in advocacy efforts from multiple locations.

- In 2023, the enterprises segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States public affairs and advocacy software market is segmented into enterprises and nonprofits & associations. Among these, the enterprises segment has the largest revenue share over the forecast period. Enterprises, including a wide range of corporations, businesses, and larger entities, demonstrated a strong preference for sophisticated software solutions tailored to their advocacy and public affairs needs. These organizations are looking for robust, comprehensive software that can manage multifaceted advocacy campaigns, navigate complex regulatory landscapes, and coordinate strategic public affairs initiatives. This segment's dominance has been driven by enterprise demand for software with advanced features such as analytics, campaign management, donor and volunteer engagement tools, and integrated communication platforms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States public affairs and advocacy software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FiscalNote

- Quorum Analytics

- CQ Roll Call

- Meltwater

- Phone2Action

- RAP Index

- Beekeeper Group

- Influitive

- NationBuilder

- VoterVOICE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, AdvocacyGuard, a well-known advocacy software provider, launched its comprehensive compliance and engagement monitoring suite, demonstrating its commitment to ethical advocacy practices and stakeholder engagement. The program includes features like transparency tools, compliance trackers, and stakeholder interaction analytics to ensure regulatory compliance and meaningful engagement. AdvocacyGuard's emphasis on responsible advocacy practices reflects the industry's commitment to ethical engagement and regulatory compliance.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States public affairs and advocacy software market based on the below-mentioned segments:

United States Public Affairs and Advocacy Software Market, By Type

- Cloud-Based

- On-Premises

United States Public Affairs and Advocacy Software Market, By Application

- Enterprises

- Nonprofits & Associations

Need help to buy this report?