United States Proteomics Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Reagents & Consumables, Instruments, and Services), By Technology (Chromatography, Electrophoresis, X-Ray Crystallography, Spectroscopy, Surface Plasma Resonance System, Microarray Systems, and Protein Fractionization Systems), By Application (Clinical Diagnosis, Drug Discovery, Molecular Medicine, and Others), and US Proteomics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Proteomics Market Insights Forecasts to 2035

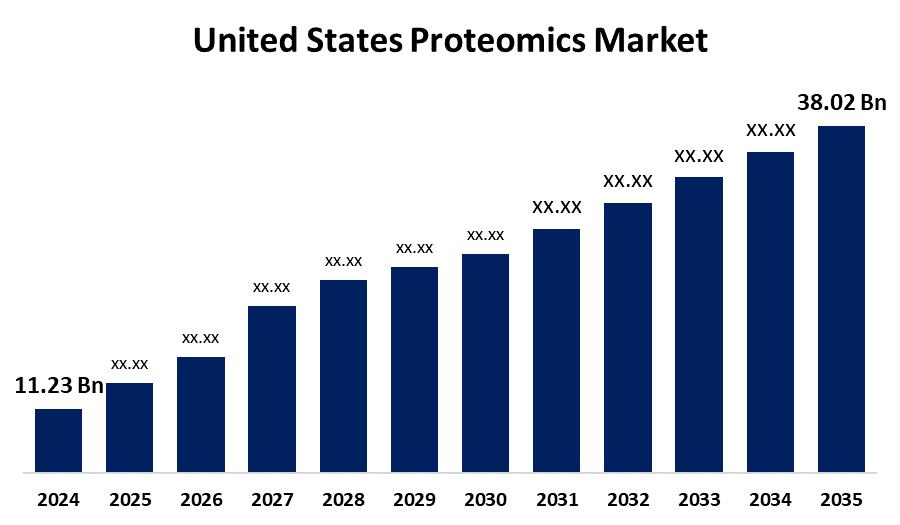

- The US Proteomics Market Size was Estimated at USD 11.23 Billion in 2024

- The Market Size is Expected to grow at a CAGR of around 11.72% from 2025 to 2035

- The USA Proteomics Market Size is Expected to reach USD 38.02 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the US Proteomics Market Size is Anticipated to reach USD 38.02 Billion by 2035, Growing at a CAGR of 11.72% from 2025 to 2035.

Market Overview

The US proteomics market focuses on studying proteins, their structures, functions, and interactions, crucial for drug discovery, disease diagnostics, personalized medicine, and biomarker identification. Compared to genomics, proteomics offers a more comprehensive understanding of the structure and function of organisms by examining the interactions, activities, composition, and structures of proteins. Proteomes, a collection of proteins produced in an organism or biological setting, are the subject of this extensive study. One essential post-genomic strategy for enhancing gene function is proteomics. It evaluates posttranslational modifications, molecular interactions, isoforms, protein localization, and amount. Protein localization on cell surfaces, protein content mapping, LAB adaptability to fermentation conditions, and molecular biology research have all been accomplished by proteomics of LAB. Proteomic technologies include matrix-assisted laser desorption/ionization time-of-flight mass spectrometry, SDS-PAGE, MS, LC/MS, and RP-HPLC. Investments in customized medicine, advancements in protein analysis technology, and an increase in infectious and chronic diseases are all driving the proteomics market's growth. Proteomics is essential for identifying disease-specific biomarkers, developing tailored therapeutics, and enhancing diagnostic precision as healthcare systems transition to precision medicine. This expansion has been made possible by developments in technology like as mass spectrometry and liquid chromatography.

Report Coverage

This research report categorizes the market for the US proteomics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US proteomics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US proteomics market.

United States Proteomics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.23 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 11.72% |

| 2035 Value Projection: | USD 38.02 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | United States Proteomics Market |

| Companies covered:: | Roche Holding AG, ThermoFisher Scientific Inc., Illumina Inc., Danaher Corp, Promega, Bio-Rad Laboratories Inc., Bruker Corporation, Agilent Technologies Inc. and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The proteomics market is growing as a result of mass spectrometry advancements that make it possible to precisely identify and quantify proteins in biological samples. Innovations like as data-dependent collection techniques and high-resolution tandem improve the instrument's capacity to examine protein interactions and post-translational changes, while new mass spectrometers provide increased sensitivity and resolution. The demand for proteomics is increasing in several industries as a result of the revolution in data interpretation and analysis brought about by artificial intelligence and machine learning. AI and ML can manage large-scale proteomic data, facilitating more precise protein patterns and biomarker detection. This trend is increasing treatment outcomes and lowering side effects by propelling the development of specialized diagnostics and medicines.

Restraining Factors

The high equipment and service prices, complicated data analysis, regulatory obstacles, a lack of standardization, a paucity of skilled workers, and competition from other omics technologies may impede the market growth.

Market Segmentation

The USA proteomics market share is classified into product type, technology, and application.

- The reagents & consumables segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US proteomics market is segmented by product type into reagents & consumables, instruments, and services. Among these, the reagents & consumables segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by proteomic investigations, reagents are vital for protein extraction, purification, labeling, and analysis. As proteomics develops, there is a growing need for specific reagents.

- The spectroscopy segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US proteomics market is segmented by technology into chromatography, electrophoresis, x-ray crystallography, spectroscopy, surface plasma resonance system, microarray systems, and protein fractionization systems. Among these, the spectroscopy segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. This is attributed to the widespread use in proteomics for protein identification and quantification, its versatility, and sensitivity in analyzing complex protein mixtures across various applications.

- The drug discovery segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US proteomics market is segmented by end-user into clinical diagnosis, drug discovery, molecular medicine, and others. Among these, the drug discovery segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the support of ongoing research and development initiatives, and the pharmaceutical industry's market domination is mostly attributable to the application of proteomics in determining therapeutic targets, comprehending pharmacological mechanisms, and assessing efficacy and toxicity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US proteomics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roche Holding AG

- ThermoFisher Scientific Inc.

- Illumina Inc.

- Danaher Corp

- Promega

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- Agilent Technologies Inc.

- Others

Recent Developments:

- In June 2024, Bruker Corporation launched the timsTOF Ultra 2 system, which offers enhanced sensitivity for deep profiling of small cells and subcellular organelles. The system, along with Spectronaut 19 software and PreOmics ENRICHplus kit, sets new 4D-Proteomics standards for large-scale, deep plasma proteomics.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US proteomics market based on the below-mentioned segments:

US Proteomics Market, By Product Type

- Reagents & Consumables

- Instruments

- Services

US Proteomics Market, By Technology

- Chromatography

- Electrophoresis

- X-Ray Crystallography

- Spectroscopy

- Surface Plasma Resonance System

- Microarray Systems

- Protein Fractionization Systems

US Proteomics Market, By Application

- Clinical Diagnosis

- Drug Discovery

- Molecular Medicine

- Others

Need help to buy this report?