United States Protein Supplements Market Size, Share, and COVID-19 Impact Analysis, By Source (Animal-Based and Plant-Based), By Product (Protein Bars, Ready to Drink, Protein Powder, and Others), By Distribution Channel (Online Stores, Specialty Stores, and Others), and US Protein Supplements Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Protein Supplements Market Size Insights Forecasts to 2035

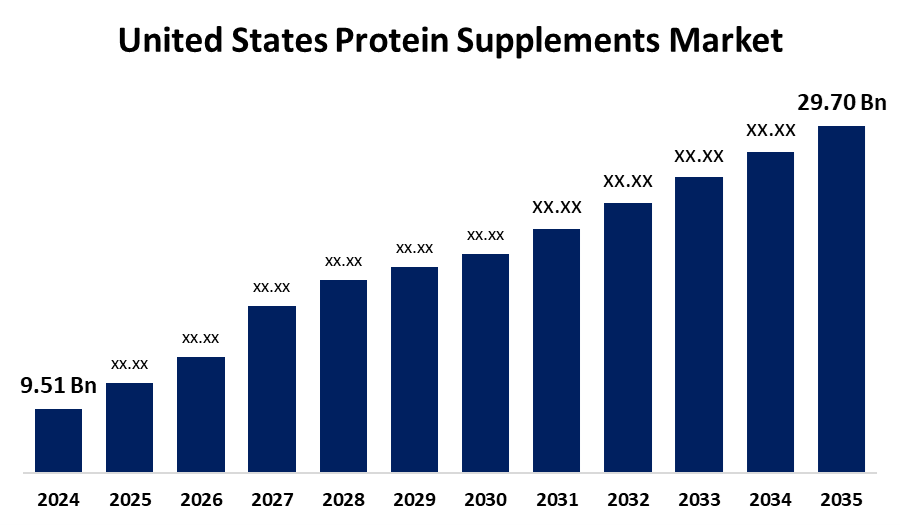

- The US Protein Supplements Market Size was Estimated at USD 9.51 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.91% from 2025 to 2035

- The USA Protein Supplements Market Size is Expected to reach USD 29.70 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Protein Supplements Market Size is anticipated to reach USD 29.70 Billion by 2035, growing at a CAGR of 10.91% from 2025 to 2035. The growing awareness of diseases and healthy lifestyles, nutrition deficiencies in working personnel, laymen, and special populations, including the geriatric population and the pediatric population.

Market Overview

The US protein supplements market involves the production, distribution, and consumption of protein-based dietary supplements in various forms like powders, bars, and beverages for muscle growth, weight management, and health benefits. The human body needs protein to promote growth throughout infancy, the metabolism of muscles and bones, the maintenance of a healthy neurological system, and the maintenance of muscular mass and athletic performance. Protein supplements fall into three categories: over 50% marine resources protein, 30%–50% oilseed meals, and 20%–30% plant-based ingredients. These supplements are intended to address certain dietary requirements or to augment daily protein consumption in cases when it is inadequate. Protein supplements are available as shakes, bars, powders, and capsules. They include proteins made from plant-based sources, including hemp, rice, soy, and peas, as well as animal sources like casein, whey, and egg proteins. Casein digests more slowly, thus, it is best consumed at night, but whey protein is best for muscle repair after exercise. Vegetarians, vegans, and people with lactose intolerance can use plant-based proteins such as peas, rice, soy, or hemp, while those who are lactose intolerant can use egg protein as an alternative. Protein dietary supplements are intended to help with weight management, promote muscle growth, speed up recovery, and make up for inadequate intake. They are essential for both muscle fiber growth and repair, recuperation, weight management, and compensating for inadequate intake.

Report Coverage

This research report categorizes the market for US protein supplements market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US protein supplements market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US protein supplements market.

United States Protein Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.51 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.91% |

| 2035 Value Projection: | USD 29.70 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 163 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Source, By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | The Beachbody Company, PepsiCo, Inc., Abbott Laboratories, Kellogg Company, Glanbia Plc, Post Holdings, Inc., Mondelez International, General Nutrition Centers, Inc., Others and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market growth is escalated by rising concerns about the environment and animal welfare have led to a global increase in the popularity of veganism. It is found that plant-based protein supplements are a better option than animal-based protein because they contain fiber, which facilitates digestion and supports gut flora. Sports nutritional supplements are being created to promote muscle building, regulate hunger, and preserve general health. These supplements include protein-based drinks, bars, shakes, powders, and drinks. Sports nutrition supplements are becoming more and more popular in the US market due to consumer preferences for bodybuilding and fitness. Another factor driving up demand for ready-to-drink products is time constraints, busy schedules, and urban lifestyles. Meal replacement options that contain protein, like bars and ready-to-drink beverages, have become popular. As fitness and muscle enthusiasts gain popularity, commercially available whey protein isolate products that are amino-based, bio-based, and easily digestible have been developed. Therefore, considering a broad range of applications of the protein supplements drives the market growth.

Restraining Factors

The supply chain interruptions, customer distrust, market saturation, fluctuating raw material prices, and regulatory obstacles, high price, and production costs can be impacted by changes in essential ingredients like milk and soybeans, delay in product approvals, presence of artificial ingredients may impede the growth of the market.

Market Segmentation

The USA protein supplements market share is classified into source, product, and distribution channel.

- The animal-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US protein supplements market is segmented by source into animal-based and plant-based. Among these, the animal-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to aid in muscle building and metabolism, and the growing concern about fitness among adult customers. Animal-based supplements, such as whey, casein, collagen, and egg, are well-liked in nutrition and sports because of their potent amino profile and simple mixing method.

- The protein powder segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US protein supplements market is segmented by product into protein bars, ready to drink, protein powder, and others. Among these, the protein powder segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. This is attributed to the build muscle strength, easy to administer, repairs the tissue, improves the immunity level, and is widely used by the geriatric population due to its ease of swallowing.

- The specialty stores segment dominated the United States protein supplements market in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US protein supplements market is segmented by distribution channel into online stores, specialty stores, and others. Among these, the specialty stores segment dominated the United States protein supplements market in 2024 and is predicted to grow at a significant CAGR during the forecast period. The segmental expansion is attributed to the presence of skilled personnel, selling high-quality products, operative customer service, easy access to products, and personalized experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US Protein Supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Beachbody Company

- PepsiCo, Inc.

- Abbott Laboratories

- Kellogg Company

- Glanbia Plc

- Post Holdings, Inc.

- Mondelez International

- General Nutrition Centers, Inc.

- Others

Recent Developments:

- In March 2025, GNC India launched GNC Pro Performance 100% Whey + Nitro Surge, a protein supplement developed and formulated to enhance performance and support cardiovascular health. The innovative product, developed indigenously, combines performance-boosting ingredients with heart health benefits, offering a unique cardio-protective formulation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US protein supplements market based on the below-mentioned segments:

US Protein Supplements Market, By Source

- Animal-Based

- Plant-Based

US Protein Supplements Market, By Product

- Protein Bars

- Ready to Drink

- Protein Powder

- Others

US Protein Supplements Market, By Distribution Channel

- Online Stores

- Specialty Stores

- Others

Need help to buy this report?