United States Printer Market Size, Share, and COVID-19 Impact Analysis, By Type (Multi-functional Printers and Standalone Printers), By Technology (Dot Matrix, 3D, Inkjet, LED, Thermal, Laser, and Others), and United States Printer Market Insights, Industry Trend, Forecasts to 2035

Industry: Electronics, ICT & MediaUnited States Printer Market Insights Forecasts to 2035

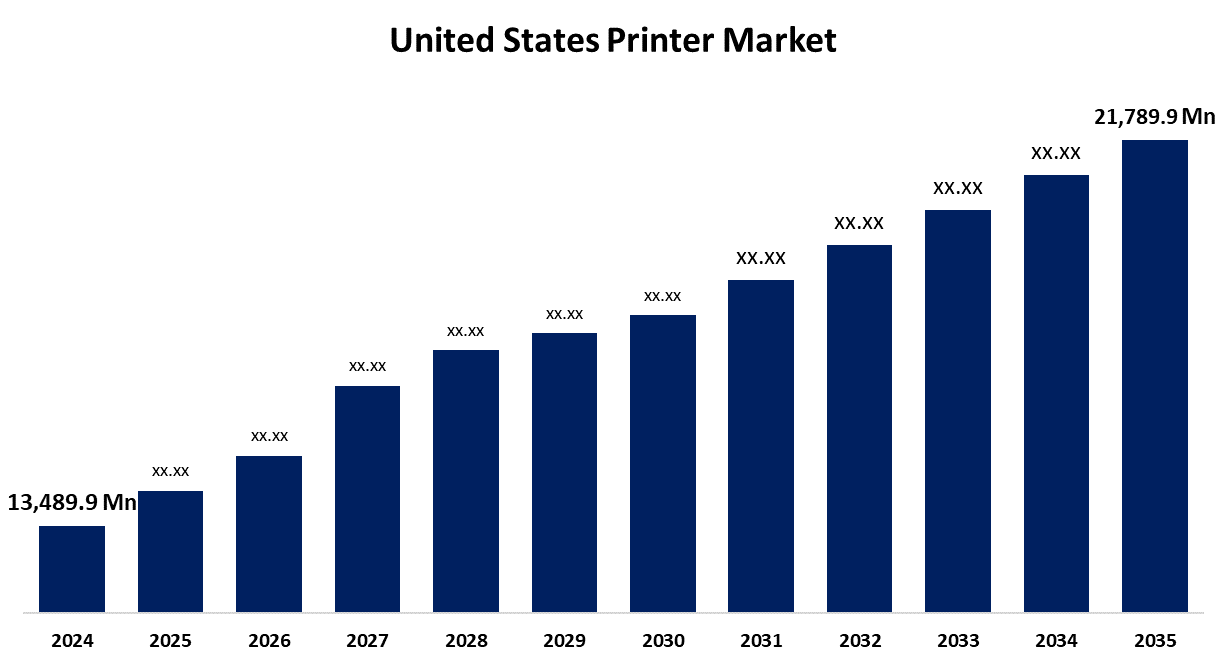

- The US Printer Market Size Was Estimated at USD 13,489.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.46% from 2025 to 2035

- The US Printer Market Size is Expected to Reach USD 21,789.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Printer Market Size is Anticipated to Reach USD 21,789.9 Million by 2035, Growing at a CAGR of 4.46% from 2025 to 2035. The expansion of the United States Printer market is propelled by the growing need for advertising among businesses.

Market Overview

A printer is an electronic device that creates a long-lasting image or text representation, usually on paper or film. Because of the requirements for high-resolution printing for business, educational, and healthcare initiatives, the demand for printers has continued unabated in the commercial sector. This is one of the primary reasons that more companies are investing in new and innovative inkjet or laser printer technologies to enable and enhance productivity, save costs, and increase reliability during the rush to digitise. For instance, professional marketing materials like brochures and packaging require top-notch printers for speed, more accurate, and durable capabilities. The rise in remote work and hybrid office settings also contributed to the demand for printers. As such, a large number of these workers need printers, and multifunction printers (MFPs) provide customers additional capabilities for scanning, copying, and faxing, particularly in the commercial sector. Companies are also adopting more flexible remote working arrangements that permit ongoing remote work styles, which will only strengthen this trend and all levels of maximum productivity moving forward.

Report Coverage

This research report categorizes the market for the United States printer market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States printer market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States printer market.

United States Printer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13,489.9 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.46% |

| 2035 Value Projection: | USD 21,789.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Technology and COVID-19 Impact Analysis. |

| Companies covered:: | Xerox Holdings Corp, HP Inc., Canon U.S.A, Epson America, Inc, Lexmark International, Inc, Brother Industries, Ltd, RR Donnelley, Deluxe Corporation, Stratasys Ltd and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States printer market is boosted by the transition away from wired and traditional printer technology to wireless and cloud-based printing solutions. Because of the explosion of mobile devices and the increasing consumer familiarity with saving files to cloud storage, both businesses and consumers are seeking printers that are easy to create connections to smartphones and tablets, and to cloud platforms. As a result, it is easier than ever to print anywhere, with no complicated network setup or physical attachment required. This is particularly beneficial for remote work and for printing without monopolising a single printer. Furthermore, consumers will have access to a variety of new cloud printing technologies that provide new levels of security and benefits for document management.

Restraining Factors

The United States printer market faces obstacles like maintenance expenses, including toner, parts, and kiosk assistance, particularly for costly or multipurpose printers. Ongoing maintenance costs generally scare off small businesses and consumers with budget restrictions. Furthermore, poorly manufactured, undesired printer models often increase operating costs and can negatively affect growth in the printer market.

Market Segmentation

The United States printer market share is classified into type and technology.

- The multi-functional printers segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States printer market is segmented by type into multi-functional printers and standalone printers. Among these, the multi-functional printers segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by versatile devices that combine numerous functions in one device, including printing, scanning, copying, and faxing. These printers are designed to serve home and office use, and act as an inexpensive, smaller solution to many document-related functions. The convenience and functionality of MFPs are further enhanced by their advanced features such as cloud printing, wireless networking, and mobile printing compatibility.

- The LED segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the technology, the United States printer market is segmented into dot matrix, 3D, inkjet, LED, thermal, laser, and others. Among these, the LED segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by its fast and reliable printers that are gaining popularity in offices. LED printers transfer images to a drum using an LED array, much like laser printers. The technology used in LEDs allows for faster print speeds and higher resolutions, which makes them suitable for commercial and office applications. LED printers have a simpler design than laser printers, as they have fewer moving parts. LED printers are compact and take up a limited footprint in an office, and they can make a large number of prints, which makes them great for high-volume printing companies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States printer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Xerox Holdings Corp

- HP Inc.

- Canon U.S.A

- Epson America, Inc

- Lexmark International, Inc

- Brother Industries, Ltd

- RR Donnelley

- Deluxe Corporation

- Stratasys Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States printer market based on the following segments:

United States Printer Market, By Type

- Multi-functional Printers

- Standalone Printers

United States Printer Market, By Technology

- Dot Matrix

- 3D

- Inkjet

- LED

- Therma

- Laser

- Others

Need help to buy this report?