United States Print Label Market Size, Share, and COVID-19 Impact Analysis, By Print Process (Gravure, Letterpress, Inkjet, and Flexography), By End-User (Healthcare, Cosmetics, Beverage, and Food), and US Print Label Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUSA Print Label Market Insights Forecasts to 2035

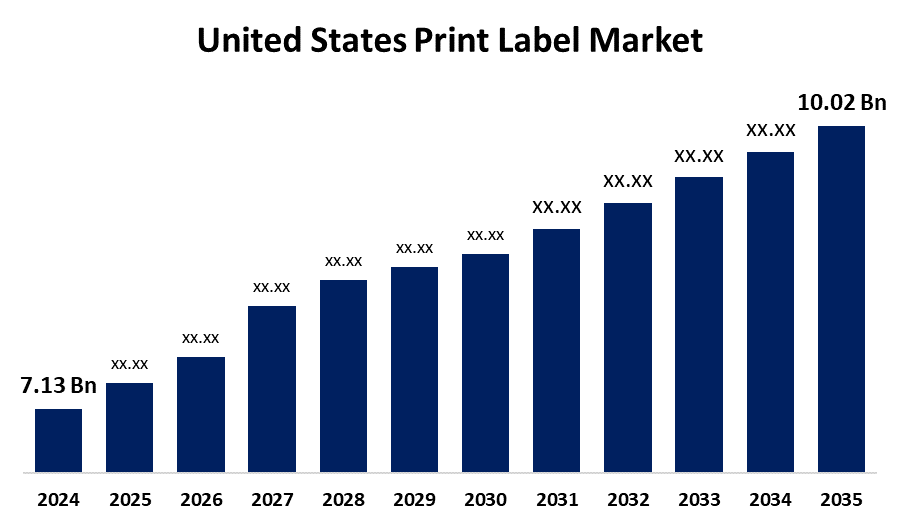

- The US Print Label Market Size was Estimated at USD 7.13 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.14% from 2025 to 2035

- The USA Print Label Market Size is Expected to reach USD 10.02 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Print Label Market Size is Anticipated to Reach USD 10.02 Billion by 2035, Growing at a CAGR of 3.14% from 2025 to 2035. The market growth is attributed to the growing use of packaged foods, the upsurge in e-commerce, and innovations in printing.

Market Overview

The print label market in the United States is in the process of creating and supplying printed labels in a variety of formats for use in food, beverage, pharmaceutical, cosmetic, and retail industries as well as for product identification, branding, and regulatory compliance. Print labels are long-lasting materials that are used to provide product or container information. They provide readable, clear information and are long-lasting and weather-resistant. By using design and branding components, they improve brand appeal and recognition. As a result of personalized products, increased consumer awareness, and the expanding use of barcodes and QR codes for marketing and inventory management, print labels are utilized in many different industries across the globe. More effective labeling systems are required for product identification, logistics, and delivery as e-commerce and online shopping grow in popularity. Products with eco-friendly labels, such as recyclable, compostable, or renewable materials, are becoming more and more popular. Leading businesses are also coming up with new ideas to appeal to this group of eco-aware customers. Stricter environmental regulations are being implemented by governments in the US, and companies are being urged to implement production methods that limit the use of non-renewable resources, minimize waste, and use less energy.

Report Coverage

This research report categorizes the market for US print label market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US print label market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US print label market.

United States Print Label Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.13 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.14% |

| 2035 Value Projection: | USD 10.02 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Print Process, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | Taylor Corporation, Fort Dearborn Company, Avery Dennison, Clayton, Dubilier and Rice, One Rock Capital Partners, LLC, Cenveo Corporation, Mondi Group, Multi Color Corporation,and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The food and beverage industry's increasing need for print labels due to urbanization, shifting lifestyles, and dependence on packaged goods is propelling market expansion. Since print labels inform patients about product composition, side effects, storage instructions, and precautions, the pharmaceutical industry is also seeing a rise in adoption. Label printing technology is expanding the market by increasing quality, versatility, and operational efficiency. Businesses can react swiftly to changes in the market and customer demands thanks to digital printing's customizable labels, reduced setup costs, and quicker turnaround times. All things considered; a major driver of the market is the rising demand for print labels.

Restraining Factors

The US print label market faces challenges such as high production costs, environmental concerns, regulatory compliance, competition from alternative labeling solutions, fluctuations in raw material prices, and may impede the market growth.

Market Segmentation

The USA print label market share is classified into print process and end-user.

- The flexography segment accounted for a significant share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The US print label market is segmented by print process into gravure, letterpress, inkjet, and flexography. Among these, the flexography segment accounted for a significant share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment growth is attributed to automation and customer demand for quick turnaround times. This roll-feed high-speed printing technique is suitable for packaging and label applications, offering quick, affordable, and high-quality labels.

- The beverage segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US print label market is segmented by end-user into healthcare, cosmetics, beverage, and food. Among these, the beverage segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. Large carbonated beverage and energy drink companies use creative packaging techniques to draw in customers, making the beverage industry the main user of the US print label market. Health concerns are also fueling the growth of printing, with different brands using different ingredients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US print label market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Taylor Corporation

- Fort Dearborn Company

- Avery Dennison

- Clayton, Dubilier and Rice

- One Rock Capital Partners, LLC

- Cenveo Corporation

- Mondi Group

- Multi Color Corporation

- Others

Recent Developments:

- In March 2024, Epson introduced its Label Boost software in the United States, transforming traditional black-and-white shipping labels into marketing assets. The software allows businesses to integrate full-color coupons, ads, and QR codes, streamlines warehouse operations, and emphasizes shipping details, making it a powerful marketing tool.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US print label market based on the below-mentioned segments:

US Print Label Market, By Print Process

- Gravure

- Letterpress

- Inkjet

- Flexography

US Print Label Market, By End-User

- Healthcare

- Cosmetics

- Beverage

- Food

Need help to buy this report?