United States Pre-Cooked Flour Market Size, Share, and COVID-19 Impact Analysis, By Source (Wheat, Corn, Rice, Barley, and Legumes) By End Use (Food & Beverages, Nutraceuticals, Foodservice, and Household/Retail), and United States Pre-Cooked Flour Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Pre-Cooked Flour Market Insights Forecasts to 2035

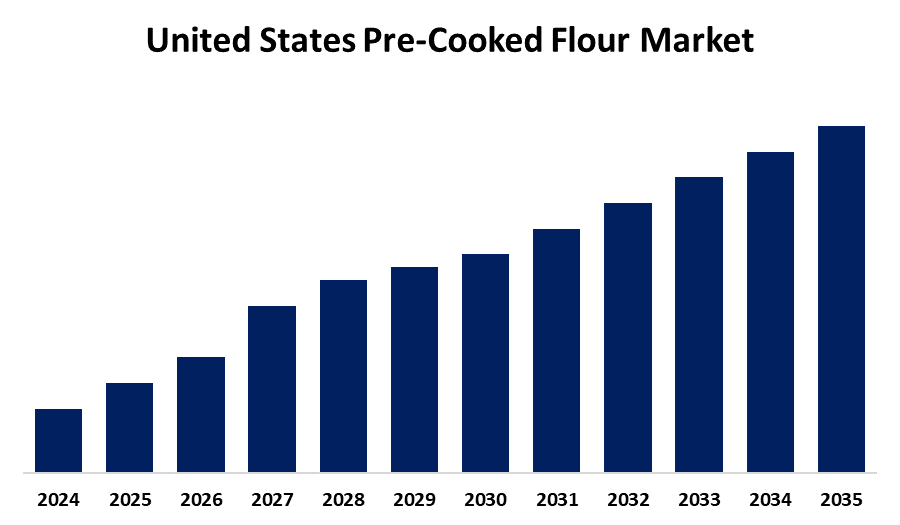

- The USA Pre-Cooked Flour Market Size is Expected to Grow at a CAGR of around 5.8% from 2025 to 2035.

- The U.S. Pre-Cooked Flour Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States pre-cooked flour market is expected to hold a significant share by 2035, growing at a CAGR of 5.8% from 2025 to 2035. The U.S. pre-cooked flour market is growing due to rising demand for convenient, time-saving food options driven by busy lifestyles and urbanization. Increased disposable income, the popularity of food delivery, and a shift toward quick meal preparation among working professionals and small families are boosting adoption across households and foodservice providers, fueling market expansion.

Market Overview

The United States pre-cooked flour market refers to the flour products that undergo processes like steaming, roasting, or extrusion to enhance solubility and reduce cooking times. This treatment reduces cooking time and enhances solubility, making pre-cooked flour convenient for quick meal preparation in both households and foodservice industries. The growing surge for convenience foods, driven by busy lifestyles and the need for quick meal preparation, is a significant driver. Pre-cooked flour offers opportunities for manufacturers to innovate and meet the evolving needs of consumers by expanding into health-conscious and gluten-free product lines. The market’s strengths include its convenience, reducing cooking time significantly for consumers and foodservice providers. High versatility, strong distribution networks, growing consumer preference, and advanced processing technologies ensure consistent quality and longer shelf life. Government initiatives like the FDA’s Food Safety Modernization Act ensure strict safety standards in processing. Agencies like FSIS oversee contamination control, while research collaborations such as the Institute for Food Safety and Health promote innovation.

Report Coverage

This research report categorizes the market for the United States pre-cooked flour market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' pre-cooked flour market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States pre-cooked flour market.

United States Pre-Cooked Flour Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.8% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Source, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Archer Daniels Midland Company (ADM), Cargill, Incorporated, General Mills, Inc., Bob’s Red Mill Natural Foods, Inc., King Arthur Baking Company, The J.M. Smucker Company, Great River Organic Milling, Chelsea Milling Company, Hain Celestial Group, Inc., Ingredion Incorporated, Conagra Brands, Inc., Hodgson Mill, Inc., Ardent Mills, LLC, B&G Foods, Inc., Pillsbury and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for convenient and time-saving food preparation solutions, as busy lifestyles encourage consumers to seek quick-cooking ingredients. Additionally, the rising popularity of processed and ready-to-eat foods in both retail and foodservice sectors boosts the need for pre-cooked flour. Technological advancements in processing techniques have improved the quality and shelf life of pre-cooked flour, making it more appealing to manufacturers and consumers. Moreover, increasing disposable income and urbanization contribute to higher consumption of convenience foods. The expanding restaurant and foodservice industry further drive the market by using pre-cooked flour to streamline operations and reduce cooking times. These factors collectively create a robust growth environment for the U.S. pre-cooked flour market.

Restraining Factors

The higher production costs compared to raw flour can lead to increased product prices. Additionally, limited consumer awareness about pre-cooked flour benefits and preferences for traditional flour pose challenges. Supply chain disruptions and fluctuating raw material prices also affect market stability, potentially hindering widespread adoption and growth.

Market Segmentation

The United States pre-cooked flour market share is classified into source and end use.

- The wheat segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States pre-cooked flour market is segmented by source into wheat, corn, rice, barley, and legumes. Among these, the wheat segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to being highly versatile, widely used in baking bread, pastries, and other staple foods. Its gluten content provides elasticity and structure, essential for many recipes, versatility, and strong consumer preference. Wheat’s high gluten content also makes it ideal for many products, driving its market share.

- The food & beverages segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States pre-cooked flour market is segmented by end use into food & beverages, nutraceuticals, foodservice, and household/retail. Among these, the food & beverages segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its extensive use in bakery products, snacks, and processed foods. High consumer demand for convenience and ready-to-eat items drives manufacturers to incorporate pre-cooked flour for better texture, shelf life, and faster production, making this segment the largest contributor to market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States pre-cooked flour market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated, General Mills, Inc.

- Bob’s Red Mill Natural Foods, Inc.

- King Arthur Baking Company

- The J.M. Smucker Company

- Great River Organic Milling

- Chelsea Milling Company

- Hain Celestial Group, Inc.

- Ingredion Incorporated

- Conagra Brands, Inc.

- Hodgson Mill, Inc.

- Ardent Mills, LLC

- B&G Foods, Inc.

- Pillsbury

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. pre-cooked flour market based on the below-mentioned segments:

United States Pre-Cooked Flour Market, By Source

- Wheat

- Corn

- Rice

- Barley

- Legumes

United States Pre-Cooked Flour Market, By End Use

- Food & Beverages

- Nutraceuticals

- Foodservice

- Household/Retail

Need help to buy this report?