United States Power Ancillary Service Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Frequency Controlled Ancillary Services, Network Controlled Ancillary Services, Others), By Application (Frequency Regulation, Voltage Compensation, Renewable Integration, Operational Management, Others), and United States Power Ancillary Service Market Insights Forecasts to 2033

Industry: Energy & PowerUnited States Power Ancillary Service Market Insights Forecasts to 2033

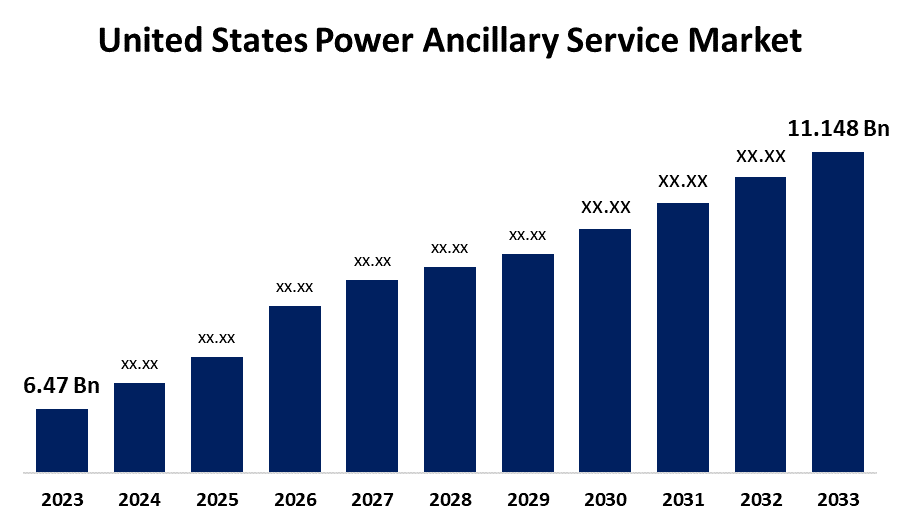

- The United States Power Ancillary Service Market Size was valued at USD 6.47 Billion in 2023

- The Market Size is Growing at a CAGR of 5.9% from 2023 to 2033

- The United States Power Ancillary Service Market Size is Expected to Reach USD 11.48 Billion by 2033

Get more details on this report -

The United States Power Ancillary Service Market Size is expected to reach USD 11.48 Billion by 2033, at a CAGR of 5.9% during the forecast period 2023 to 2033.

Market Overview

The power ancillary services are services that are used in electric power systems to ensure that the bulk power system operates reliably. While these services account for a small portion of total electric power costs, they are critical in some areas, and the types and needs of these services are changing. This report can be used as a resource on the subject, summarizing the various services and products used to ensure reliable electricity operations in the United States. The report describes the types of services required, how the quantity is determined and met, voltage support, and the criteria for becoming a supplier of the service. Services are then classified according to how they are compensated, whether through competitive auctions or cost-based recovery. The final section examines ancillary service prices over time, analyzing various products and trends in service market outcomes within the United States' Independent System Operators (ISOs) and Regional Transmission Organizations (RTOs).

Report Coverage

This research report categorizes the market for United States power ancillary service market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States power ancillary service market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States power ancillary service market.

United States Power Ancillary Service Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.47 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.9% |

| 2033 Value Projection: | USD 11.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service Type, By Application |

| Companies covered:: | AES Corporation, Duke Energy Corporation, Exelon Corporation, California Independent System Operator (CAISO), PJM Interconnection, ERCOT (Electric Reliability Council of Texas), General Electric (GE), Siemens Energy, NextEra Energy, Invenergy and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary drivers of ancillary services in the US power sector is the ongoing integration of renewable energy sources into the grid. The shift to cleaner and more sustainable energy sources, such as wind and solar power, has added variability and intermittency to the system. Ancillary services play an important role in addressing the challenges that come with these fluctuations. As renewable energy's share of the overall energy mix grows, so does the demand for fast-response ancillary services. Balancing services, such as frequency regulation and load following, are critical to ensuring grid stability. Furthermore, the incorporation of energy storage systems, a critical component of ancillary services, helps to mitigate the intermittent nature of renewable sources by storing excess energy during periods of high generation and releasing it when demand is high or renewable generation is low. This driver reflects the overall national goal of transitioning to a cleaner energy future. Policymakers and grid operators recognize the value of ancillary services in facilitating the reliable and secure integration of renewable energy, resulting in a sustainable and resilient power system in the United States.

Restraining Factors

The rapid pace of technological advancement creates the challenge of obsolescence. Ancillary service providers must constantly update their systems to include the most recent innovations, ensuring that they remain effective and compliant with changing grid requirements. To address the technological integration challenge, industry stakeholders, policymakers, and research institutions must work together to develop common standards and promote a technologically adaptive power sector.

Market Segment

- In 2023, the frequency controlled ancillary services segment accounted for the largest revenue share over the forecast period.

Based on the service type, the United States power ancillary service market is segmented into frequency controlled ancillary services, network controlled ancillary services and others. Among these, the frequency controlled ancillary services segment has the largest revenue share over the forecast period. FCAS is an important segment of ancillary services, with the primary goal of keeping the power system's frequency within acceptable limits. With the growing integration of renewable energy sources such as wind and solar, which can introduce variability into the grid, frequency control has become increasingly important. FCAS helps to stabilize the grid by maintaining a balance of electricity supply and demand.

- In 2023, the frequency regulation segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States power ancillary service market is segmented into frequency regulation, voltage compensation, renewable integration, operational management and others. Among these, the frequency regulation segment has the largest revenue share over the forecast period. Electric motors play an important role in frequency regulation in the power system. They can be used as part of demand response programs or grid stabilization plans. Motors can be programmed to consume more power or act as generators based on the grid's frequency requirements, thereby promoting grid stability. Frequency regulation is critical for the stability of the electric grid. To avoid disruptions, the grid must balance electricity supply and demand. Electric motors, particularly those used in industrial processes, can be programmed to provide or absorb power in response to frequency fluctuations, thereby helping to stabilize the grid.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States power ancillary service market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AES Corporation

- Duke Energy Corporation

- Exelon Corporation

- California Independent System Operator (CAISO)

- PJM Interconnection

- ERCOT (Electric Reliability Council of Texas)

- General Electric (GE)

- Siemens Energy

- NextEra Energy

- Invenergy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, The Federal Energy Regulatory Commission (FERC) has issued a final rule requiring grid operators to pay for frequency response services from all types of resources, including batteries and other distributed energy sources. This rule is expected to drive up demand for ancillary services in the United States.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States power ancillary service market based on the below-mentioned segments:

United States Power Ancillary Service Market, By Service Type

- Frequency Controlled Ancillary Services

- Network Controlled Ancillary Services

- Others

United States Power Ancillary Service Market, By Application

- Frequency Regulation

- Voltage Compensation

- Renewable Integration

- Operational Management

- Others

Need help to buy this report?