United States Pouches Market Size, Share, and COVID-19 Impact Analysis, By Product (Flat and Stand-up), By Material (Plastic, Metal, Paper, and Bioplastics), and United States Pouches Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Pouches Market Insights Forecasts to 2035

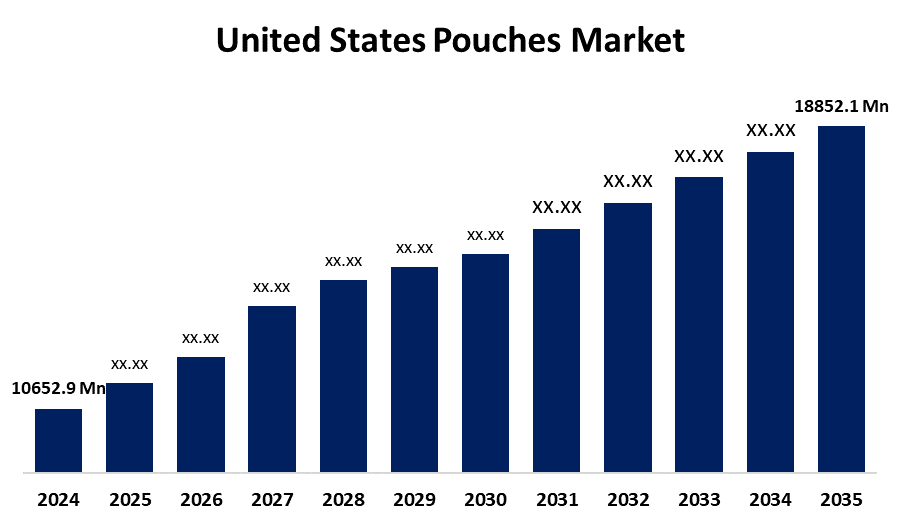

- The US Pouches Market Size Was Estimated at USD 10652.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.33% from 2025 to 2035

- The US Pouches Market Size is Expected to Reach USD 18852.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Pouches Market Size is anticipated to reach USD 18852.1 Million by 2035, growing at a CAGR of 5.33% from 2025 to 2035. The expansion of the United States pouches market is propelled by growing consumer demand for packaged meals and drinks, combined with pouches' affordability and ease of use over rigid packaging.

Market Overview

A pouch is a tiny, pliable container that resembles a bag and is used to carry or store goods. The pouches market in the United States is growing, and there are several driving forces in this market. Many consumers prefer pouches because they are easy to consume, convenient to carry, and offer a variety of uses. Pouches can accommodate various types of products, including snacks, beverages, and personal care products. The ability for pouches to cover many types of product categories helps to drive growth in this segment because manufacturers are looking for ways to move away from old packaging types that are less consumer-friendly. With growth in sustainability and eco-friendliness, the pouches market is undergoing innovation efforts. With increased environmental awareness and more consumers preferring products with recyclable packaging that also have a lower carbon footprint, there is increased demand for pouches. This evolution in consumer preferences coincides with regional initiatives to cut back on plastic waste and make reusable changes in packaging. Along with these aspects, the collaboration and engagement of manufacturers and retailers regarding the aspects of packaging, shelf appeal, and storage efficiency will continue to drive this market forward. Also, it is expected that technological enhancements associated with pouch designs and pouch manufacturing processes, with the evolution of sustainable packaging, will be other drivers of growth in the United States.

Report Coverage

This research report categorizes the market for the United States pouches market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States pouches market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States pouches market.

United States Pouches Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10652.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.33% |

| 2035 Value Projection: | USD 18852.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 219 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Product and By Material |

| Companies covered:: | ProAmpac, Sealed Air Corp, Amcor Plc, Mondi Group, Sealed Air Corporation, Smurfit WestRock, Sonoco Products Company, ProAmpac LLC, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States pouches market is boosted by the greater product shelf life. This is evident in the manufacturing of ready meals, baby food products, snacks, and beverages. The pouches made from plastic components, such as polyethylene, polypropylene, and polyethylene terephthalate, provide superior barrier qualities, so products are protected from moisture, oxygen, and the outside climate. Bioplastic materials, such as polyhydroxyalkanoates and polylactic acid, are emerging as sustainable packaging alternatives. In pouches, there are aseptic and standard treatment types, along with the flat product segment, plus numerous closure options, such as zipper closures and spout closures.

Restraining Factors

The United States pouch market faces obstacles like the complexity of recycling multi-layer pouches, which can be problematic due to typical components such as foils and plastics in conventional recycling systems.

Market Segmentation

The United States pouches market share is classified into product and material.

- The flat segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

Based on the product, the United States pouches market is segmented into flat and stand-up. Among these, the flat segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it is the most popular packaging option for products like dry fruits, fabric care, medical equipment, detergents, confectionery, and snacks, mainly because they are inexpensive to produce, and they are easy to store.

- The plastic segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States pouches market is segmented by material into plastic, metal, paper, and bioplastics. Among these, the plastic segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because of their high durability, impact resistance, and cost outlook compared to other materials, which gives them an advantage over other types of pouches. Most notably, the high resistance of plastic materials to moisture, dust, oxygen, as well as strong and ultraviolet light, means pouches can keep packed products fresh for an extended time, creating a strong selling characteristic for pouch production.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States pouches market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ProAmpac

- Sealed Air Corp

- Amcor Plc

- Mondi Group

- Sealed Air Corporation

- Smurfit WestRock

- Sonoco Products Company

- ProAmpac LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States pouches market based on the following segments:

United States Pouches Market, By Product

- Flat

- Stand-up

United States Pouches Market, By Material

- Plastic

- Metal

- Paper

- Bioplastics

Need help to buy this report?