United States Potash Market Size, Share, and COVID-19 Impact Analysis, By Product (Potassium Chloride, Potassium Sulphate, Potassium Nitrate, and Others), By End Use (Agriculture and Other End Uses), and United States Potash Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsUnited States Potash Market Insights Forecasts to 2035

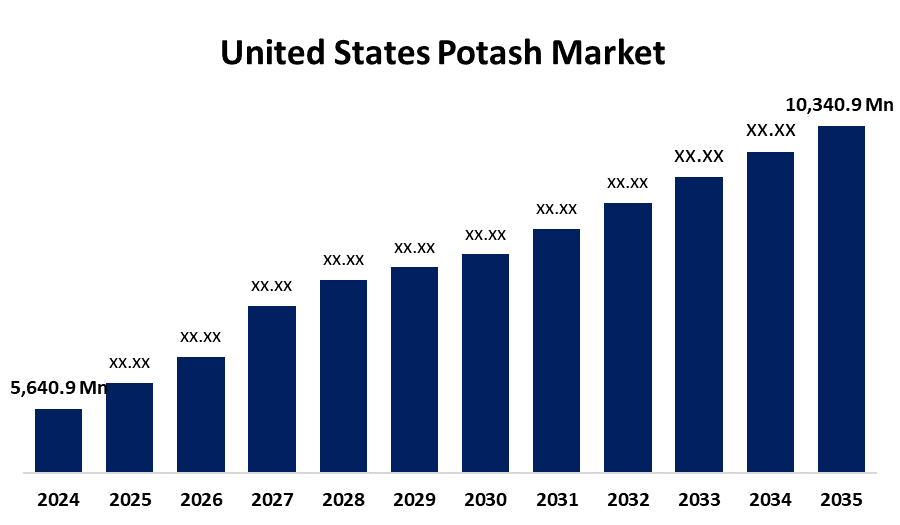

- The US Potash Market Size Was Estimated at USD 5,640.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.66% from 2025 to 2035

- The US Potash Market Size is Expected to Reach USD 10,340.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Potash Market is anticipated to reach USD 10,340.9 million by 2035, growing at a CAGR of 5.66% from 2025 to 2035. The expansion of the United States potash market is propelled by the demand for food and agricultural products, and is also impacted by the growing population.

Market Overview

A wide range of produced and extracted salts that contain potassium (K) in a form that dissolves in water are referred to as potash. The need for food rises in parallel with population growth. To accommodate this demand, farmers boost crop yields and agricultural productivity. It improves nutrient absorption, root formation, and general plant growth. With a wide variety of crops grown on its enormous farmlands, the United States boasts a strong agricultural industry. One essential ingredient needed for the best crop growth and yield is potash. Due to the requirement to continue meeting the production needs of the agricultural sector and the increasing need for food and agricultural products, demand for the U.S. is constantly high. The agricultural sector requirements, crops that are needed/produced, soil productivity, using precision agriculture, specialty crops, technological advances and government assistance have all contributed to the strong and steady demand in the U.S. Collectively, these factors represent continuing demand for the products, ensuring a stable and healthy market in the U.S. Potash was reinstated as a critical mineral in the U.S. by an executive order which allowed expedited permitting and cited laws such as the defense production act.

Report Coverage

This research report categorizes the market for the United States potash market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States potash market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States potash market.

United States Potash Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5,640.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.66% |

| 2035 Value Projection: | USD 10,340.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Product, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Intrepid Potash Inc, Compass Minerals International, The Mosaic Co, Michigan Potash and Salt Company, Potash America, Universal Potash Corp, Emerging U.S. Project, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States potash market is boosted by Increased demand for food due to population growth, necessitating greater agricultural output. Potash is an important source of potassium that enhances crop productivity, water retention, and disease and pest resistance. For intensive farming methods, especially in soils that are depleted of nutrients, this makes it indispensable. The US's massive agricultural economy is a key engine of growth because of the country's growing farming needs. The growing demand for high-value products such as fruits, vegetables, and nuts is creating opportunities to produce specialty potash types that have lower chloride levels, such as potassium sulphate (SOP) and potassium nitrate, which are better for sensitive crops. In addition, the shift to precision and sustainable agriculture is driving the use of customized nutrition solutions, thus creating new possibilities for customized value-added potash.

Restraining Factors

The United States potash market faces obstacles like higher production costs for a company importing raw materials or machinery can lead to higher potash prices if the native currency depreciates. Investors may adjust their holdings in expectation of currency swings, which could indirectly affect potash prices and market dynamics.

Market Segmentation

The United States potash market share is classified into product and end use.

- The potassium chloride segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States potash market is segmented by product into potassium chloride, potassium sulfate, potassium nitrate, and others. Among these, the potassium chloride segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by increasing agricultural activity. A frequent name for potassium chloride is Muriate of Potash (MOP), and its primary usage is as a source of potassium and as a raw material for industrial processes in the production of nitrogen, phosphorus, and potassium (NPK) fertiliser. The expanding population increases demand for food, which in turn boosts food production. As a result, potash products are becoming more and more important in the agricultural industry to increase crop yields.

- The agriculture segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end use, the United States potash market is segmented into agriculture and other end uses. Among these, the agriculture segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the agricultural sector's capacity to enhance crop growth, optimise yields, and guarantee food security. This essential nutrient promotes root formation, plant growth, and crop health in general. Since potash is now a crucial part of fertiliser mixes used to increase agricultural production in response to growing demand, it has become a necessary component of contemporary farming practices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States potash market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Intrepid Potash Inc

- Compass Minerals International

- The Mosaic Co

- Michigan Potash and Salt Company

- Potash America

- Universal Potash Corp

- Emerging U.S. Project

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States potash market based on the following segments:

United States Potash Market, By Product

- Potassium Chloride

- Potassium Sulphate

- Potassium Nitrate

- Others

United States Potash Market, By End Use

- Agriculture

- Other End Uses

Need help to buy this report?