United States Popcorn Market Size, Share, and COVID-19 Impact Analysis, By Type (Ready-to-Eat Popcorn and Microwave Popcorn), By Distribution Channel (B2B and B2C), and United States Popcorn Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Popcorn Market Insights Forecasts to 2035

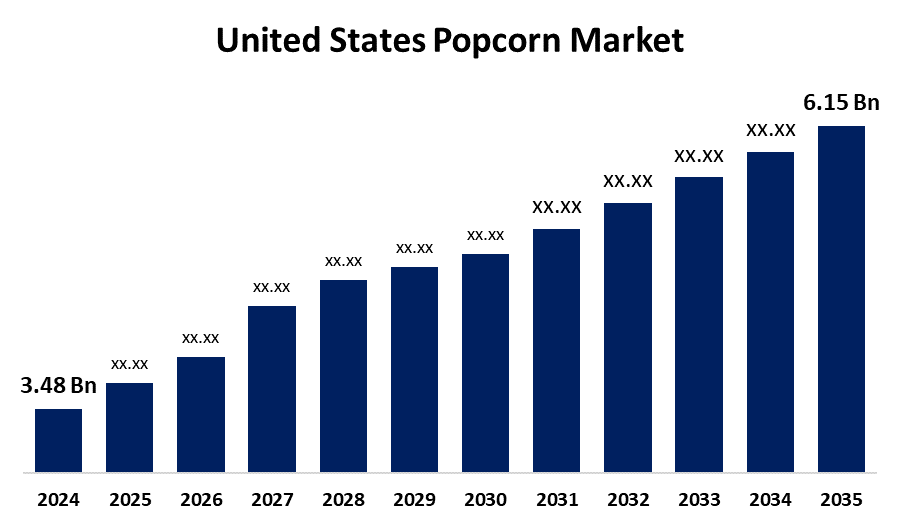

- The US Popcorn Market Size Was Estimated at USD 3.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.31 % from 2025 to 2035

- The US Popcorn Market Size is Expected to Reach USD 6.15 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Popcorn Market is anticipated to reach USD 6.15 Billion by 2035, growing at a CAGR of 5.31% from 2025 to 2035. The expansion of the United States Popcorn market is propelled by depends on the worldwide consumer trend towards wellbeing.

Market Overview

Popcorn is a type of maize whose kernels burst into fluffy, airy puffs when cooked because the hull bursts from internal moisture, turning to steam. Popcorn, a popular food staple, is a vibrant and occupied market in the United States. This popular snack has evolved from a staple primarily eaten in theaters to a fun and flexible snack option. Popcorn offers a perfect blend of nostalgia, and continual innovation has increased its consumption. In addition, the sheer number of potential flavor combinations is impressive, with varieties encompassing all tastes from fun, salty, and buttery flavors to the traditional flavors of caramel and cheese, and even the next evolutionary steps of gourmet popcorn. Moreover, health-related demands are being magnetized into less butter and air-popped varieties, which is encouraging the evolution of the national industry positively. Popcorn is a popular food disguise and guiltless treat, in part as a response to cultural trends to inspire and motivate snacking habits, and lifestyle behavior. The popularity has also been reflected through the growth of ready-to-eat popcorn offerings and the ease of prepackaged microwave and air-popped versions.

The U.S. government support for the popcorn industry is primarily provided through the Popcorn Promotion, Research, and Consumer Information Order, under the Popcorn Promotion, Research, and Consumer Information Act. This work led to the creation of the Popcorn Board, a commodities checkoff program run by USDA's Agricultural Marketing Service (AMS) and funded by assessments that popcorn growers currently pay, equal to about $0.06 per hundredweight.

Report Coverage

This research report categorizes the market for the United States popcorn market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States popcorn market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States popcorn market.

United States Popcorn Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.48 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.31% |

| 2035 Value Projection: | USD 6.15 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Type, Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Jolly Time, Proper Food, Eagle Foods, Quinn Snacks, The Hershey Company, Conagra Brands Inc, Campbell Soup Co, PepsiCo Inc, Grupo Bimbo, S.A.B. de C.V., Popcornopolis, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States popcorn market is boosted by the growing demand for low-calorie snack foods. The ready-to-eat popcorn market in the US has experienced growth in recent years. According to the USDA Economic Research Service, health consciousness is rising amongst US consumers, which has directly impacted the consumption of popcorn in the US. The amount of popcorn eaten per person in the United States increased from approximately 43 quarts in 2019 to nearly 47 quarts by 2023. Since the FDA recognized popcorn as a whole-grain snack food with only 30 to 35 calories per cup, health-conscious consumers have embraced it. According to the National Health and Nutrition Examination Survey (NHANES), popcorn ranked as one of the most popular low-calorie snack foods, and over 28% of US consumers are actively looking for these foods.

Restraining Factors

The United States popcorn market faces obstacles like the raw material price instability, particularly corn and oils, which can decrease profits for manufacturers and lead to fluctuating prices, thereby limiting innovation.

Market Segmentation

The United States popcorn market share is classified into type and distribution channel.

- The ready-to-eat popcorn segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States popcorn market is segmented by type into ready-to-eat popcorn and microwave popcorn. Among these, the ready-to-eat popcorn segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the increase in consumer spending power, along with growing popcorn consumption at home and traditional cinema. Additionally, consumer health awareness could be an influence on demand. There are also elements of novelty, endless new flavours, and continuous product innovations that grab consumer attention.

- The B2C segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States popcorn market is segmented into B2B and B2C. Among these, the B2C segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the internet distribution channel, along with the selection available in supermarkets and hypermarkets, and convenience stores that provide additional benefits such as home delivery, easier payment options, massive savings, and access to a large number of products through one platform. This has changed consumer purchasing behavior.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States popcorn market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jolly Time

- Proper Food

- Eagle Foods

- Quinn Snacks

- The Hershey Company

- Conagra Brands Inc

- Campbell Soup Co

- PepsiCo Inc

- Grupo Bimbo, S.A.B. de C.V.

- Popcornopolis

- Others

Recent Development

- In December 2022, Popcornopolis, a ready-to-eat popcorn brand, partnered with Takis Snacks to launch new popcorn 'Popcornopolis Takis Feugo'. New popcorn is made with American-grown corn and popped coconut oil.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States popcorn market based on the following segments:

United States Popcorn Market, By Type

- Ready-to-Eat Popcorn

- Microwave Popcorn

United States Popcorn Market, By Distribution Channel

- B2B

- B2C

Need help to buy this report?