United States Polyurethane Market Size, Share, and COVID-19 Impact Analysis, By Product (Rigid Foam, Flexible Foam, Coatings, Adhesives & Sealants, Elastomers, and Others), By Raw Material (Toluene Di-isocyanate, Methylene Diphenyl Di-isocyanate, Polyols, and Others), and United States Polyurethane Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Polyurethane Market Insights Forecasts to 2035

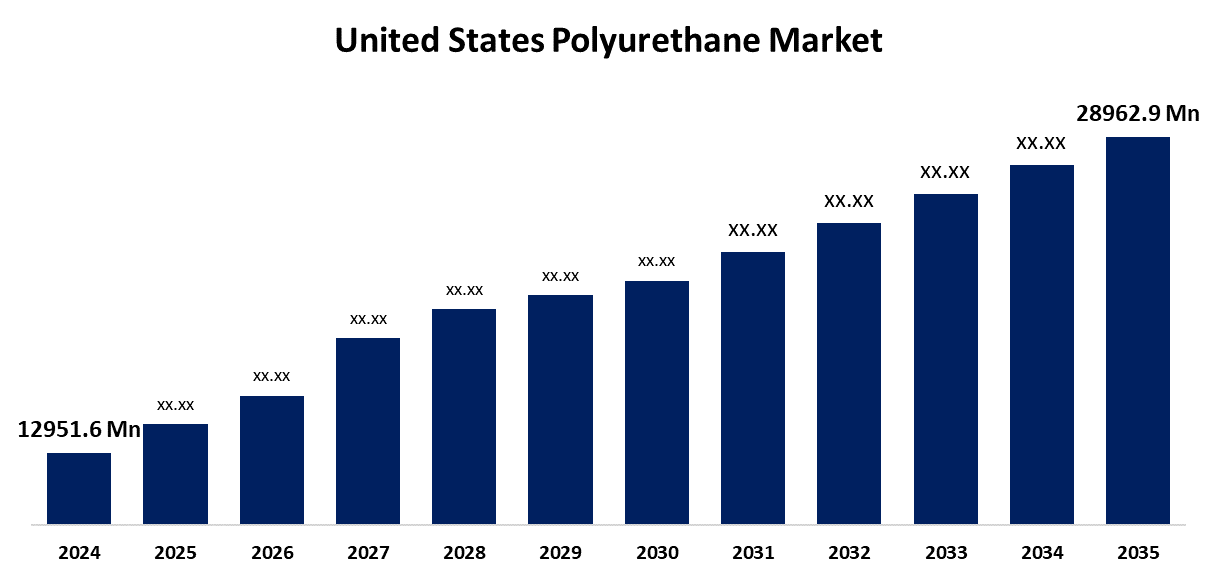

- The US Polyurethane Market Size Was Estimated at USD 12951.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.59% from 2025 to 2035

- The US Polyurethane Market Size is Expected to Reach USD 28962.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Polyurethane Market Size is Anticipated to reach USD 28962.9 Million by 2035, Growing at a CAGR of 7.59% from 2025 to 2035. The expansion of the United States polyurethane market is propelled by the rising demand in response to growing building insulation requirements brought on by sustainability concerns.

Market Overview

Polyurethane, a class of organic polymers with repeating urethane linkages in their backbone, is created chemically by a reaction between a polyol and a diisocyanate. Due to positive government policies and the increasing worries of consumers in relation to the environment, electric mobility has grown by leaps and bounds in the past five years. The increased use of the substance in electric vehicles is probably linked to the growth of the polyurethane market in the U.S. PU has been used as molded parts for wheel arch liners, bumpers, external trim, etc. In the furniture industry, PU is mainly used for foam in bedding and upholstery. It is suitable for use in the industry because of its comfort, durability, and flexibility. The demand for furniture is increasing because of population growth and changes in individuals' lifestyles. The furniture and home furnishings market in the U.S. has posted. Also, during the forecast period, the U.S. construction industry is projected to grow slightly, which will spur additional demand for PU in the construction and furnishing industries.

The U.S. government actively promotes the polyurethane industry through financial incentives, energy efficiency mandates, and regulatory standards to advance sustainable formulations and recycling technologies. The EPA enforces stringent NESHAP regulations that target pollutants like methylene chloride and toluene diisocyanate from flexible polyurethane foam plants in an effort to encourage companies to adopt cleaner, lower-emission practices.

Report Coverage

This research report categorizes the market for the United States polyurethane market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States polyurethane market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States polyurethane market.

United States Polyurethane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12951.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.59% |

| 2035 Value Projection: | USD 28962.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product, By Raw Material and COVID-19 Impact Analysis. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States polyurethane market is boosted because it has a wide variety of applications in the building and construction industry for residential, commercial, and industrial applications due to its strength-to-weight ratio, insulating capabilities, and other characteristics. It is used to produce more efficient products that are enduring, adaptable, and high-performing. Additionally, polyurethane's mechanical and thermal characteristics, its environmental credentials, and energy efficiency are also thought to contribute to the underground popularity in the building and construction industry. The variability of polyurethane is exemplified by the many advantages and benefits it provides.

Restraining Factors

The United States polyurethane market faces obstacles as it is expensive, which discourages consumers who are cost-conscious and restricts their ability to enter lower-income markets. Mattresses typically last 7 to 10 years, which lowers the frequency of replacements and slows repeat business.

Market Segmentation

The United States polyurethane market share is classified into product and raw material.

- The rigid foam segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States polyurethane market is segmented by product into rigid foam, flexible foam, coatings, adhesives & sealants, elastomers, and others. Among these, the rigid foam segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by its variations of structural stability. Rigid foam polyurethane is a high-performing closed-cell polymer used in end-use sectors including packing, transport, industrial insulation, and appliances. This gives producers the ability to create end-use items that thermally insulate.

- The polyols segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the raw material, the United States polyurethane market is segmented into toluene di-isocyanate, methylene diphenyl di-isocyanate, polyols, and others. Among these, the polyols segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as polyester polyols are the raw material most often used to develop polyurethanes. They are particularly advantageous in the production of a range of polyurethanes, which are used in furniture, automotive, and construction industries, among others.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States polyurethane market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- RTP Company

- Huntsman Corp

- Eastman Chemical Co

- Dow Inc

- Foamcraft, Inc.

- Capital Resin Corporation

- BASF SE

- Woodbridge

- Others

Recent Development

In March 2024, Dow launched new bio-circular propylene glycol solutions across North America, aimed at reducing the carbon footprint in polyurethane PU production and supporting sustainable manufacturing.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States polyurethane market based on the following segments:

United States Polyurethane Market, By Product

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

United States Polyurethane Market, By Raw Material

- Toluene Di-isocyanate

- Methylene Diphenyl Di-isocyanate

- Polyols

- Others

Need help to buy this report?