United States Polyols Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyester and Polyether), By Application (Rigid Foam, Flexible Foam, Coatings, Adhesives & Sealants, Elastomers, and Others), and United States Polyols Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Polyols Market Insights Forecasts to 2035

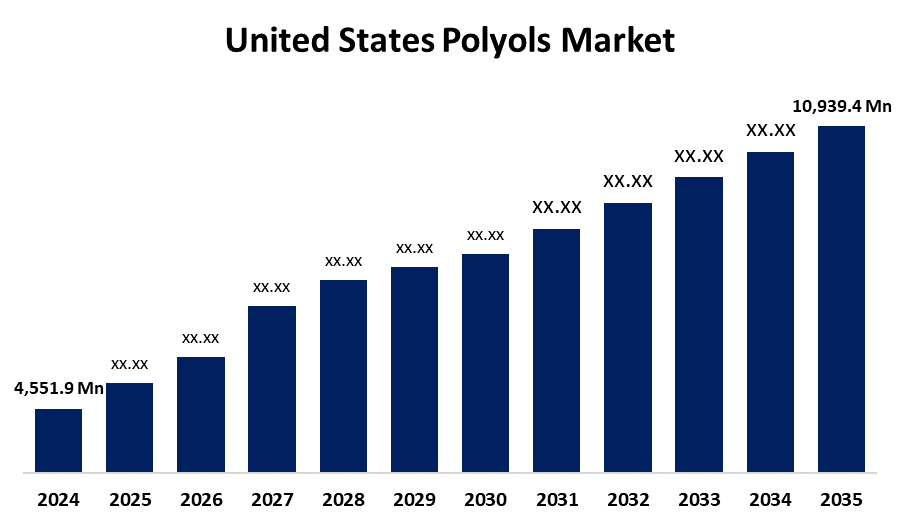

- The US Polyols Market Size Was Estimated at USD 4,551.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.30% from 2025 to 2035

- The US Polyols Market Size is Expected to Reach USD 10,939.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States Polyols Market Size is anticipated to reach USD 10,939.4 Million by 2035, growing at a CAGR of 8.30% from 2025 to 2035. The expansion of the United States polyols market is propelled by the strength, resilience, and energy absorption of polyols that make them perfect for both consumer and commercial items, such as fibres, bedding, furniture, transportation, textiles, carpet cushioning, and packaging.

Market Overview

A class of chemical molecules known as polyols consists of several hydroxyl groups. Polyols are also known as sugar alcohols. Sugar alcohols are low-calorie carbohydrates that function like table sugar in flavor and mouthfeel. Polyols are extensively present in food and drink, where they are utilised in low-calorie items such as gum, candy, ice cream, yoghurt, and fruit spreads. Because in part to product development, the United States is one of the biggest markets for polyols. Polyol-based products are lightweight, resistant to wear, insulating, and can be formulated with a high degree of hardness or durability. These components of polyols make them a key component of many products in various industries, including the furniture industry, electronics, footwear, and plastic etc. Market growth is partly driven by the automotive industry, where polyol-based foams are utilized to manufacture headliners, headrests, armrests, and other seats on ventilated vehicles. Many large companies are using bio-based polyols to reduce their reliance on petrochemical-based polyols in response to public concerns about the environment, as well as fluctuations in raw material prices. Many of these companies also recognize that there may be significant future advantages with bio-based polyols, as regulators are moving toward mandating more environmentally friendly products. Several states in the U.S. offer tax credits and incentives to increase the availability of biofuels and bio-based products. As implied by California's Proposition 65 poster on hazardous chemicals, companies are highly encouraged to use safer alternatives, such as soy-based polyols, versus labeling requirements. The adoption of bio-based polyols may be indirectly aided by other states' rebates and incentives for the purchase and use of alternative fuels.

Report Coverage

This research report categorizes the market for the United States polyols market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States polyols market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States polyols market.

United States Polyols Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,551.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.30% |

| 2035 Value Projection: | USD 10,939.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 282 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Product and By Application |

| Companies covered:: | The DOW Chemical Company, Huntsman, Palmer Holland, Coim USA Inc., The Stephan Co, Honeywell International Inc., ADM, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States polyols market is boosted due to the substantial expansion of the e-commerce sector and the need for proper packaging to guarantee product safety. Several packaging companies frequently employ pre-blended polyols packaging for a variety of containers, such as wooden, plastic, and corrugated boxes. Polyurethane foams based on polyol are used to package items of all kinds that are susceptible to vibration or stress. Because polyurethane foams offer a broad shock or vibration attenuation profile, they are ideal for packaging lightweight objects.

Restraining Factors

The United States polyols market encounters challenges, as many regulatory bodies in the US enforce strict laws governing the production of polyurethane foam. Furthermore, human skin, eyes, noses, throats, and lungs may become irritated by prolonged exposure to dangerous pollutants.

Market Segmentation

The United States Polyols Market share is classified into product and application.

- The polyether segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States polyols market is segmented by product into polyester and polyether. Among these, the polyether segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by their superior resistance, hydrolytic stability, and rebound qualities. Polyether polyols are perfect for creating stiff polyurethane foams. One of the main factors propelling market expansion is their growing use in the production of flexible foams, which are frequently found in furniture, bedding, and car interiors. The need for polyether polyols is further increased by consumers' growing preferences for comfort and luxury.

- The flexible foam segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States polyols market is segmented into rigid foam, flexible foam, coatings, adhesives & sealants, elastomers, and others. Among these, the flexible foam segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by its moulded variety of shapes. It is frequently utilised in furniture, upholstery, carpet padding, packing, and automobile interiors. Pollutant filtration, trash minimisation, and emission-free burning are some of the environmental advantages of this material. It is also environmentally friendly and readily recyclable.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States polyols market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The DOW Chemical Company

- Huntsman

- Palmer Holland

- Coim USA Inc.

- The Stephan Co

- Honeywell International Inc.

- ADM

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States polyols market based on the following segments:

United States Polyols Market, By Product

- Polyester

- Polyether

United States Polyols Market, By Application

- Rigid Foam

- Flexible Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

Need help to buy this report?