United States Polyolefin Market Size, Share, and COVID-19 Impact Analysis, By Product (PE, PP, EVA, TPO, POM, PC, PMMA, and Others), By Application (Film & Sheet, Injection Molding, Blow Molding, Profile Extrusion, and Others), and United States Polyolefin Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Polyolefin Market Insights Forecasts to 2035

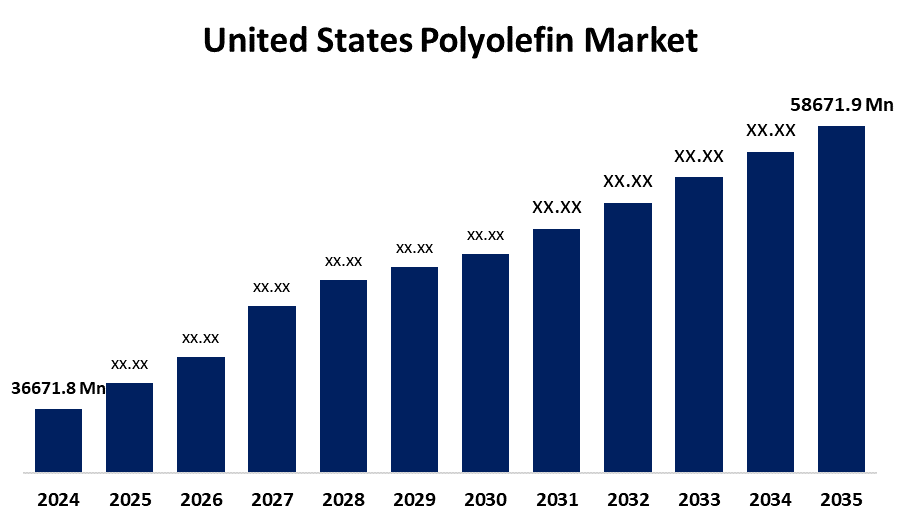

- The US Polyolefin Market Size Was Estimated at USD 36671.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.36% from 2025 to 2035

- The US Polyolefin Market Size is Expected to Reach USD 58671.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Polyolefin Market Size is anticipated to reach USD 58671.9 Million by 2035, growing at a CAGR of 4.36% from 2025 to 2035. The expansion of the United States polyolefin market is propelled by an increasing adoption across the end-use industries.

Market Overview

The polyolefins are a kind of thermoplastic polymer derived from olefins, also known as alkenes, which are hydrocarbons containing two carbon atoms connected by a double bond. Because polyolefins are lighter in weight and density than traditional materials like metal and rubber, their use in automotive applications alone can reduce fuel burn. It is predicted that demand through the forecast period for the market will be driven by growing health risk awareness and consumer safety across multiple industries, including electronics, healthcare, wire & cable, construction, and automotive. The market is growing rapidly due to increased demand from the automotive industry to manufacture lighter-weight and fuel-efficient vehicles. Polyethylene is used for gasoline tanks, piping, and polypropylene, which is frequently used for bumpers, instrument panels, and door trims. Thermoplastic olefins, which are blends of polyolefins and elastomers, can be used in roofing membranes, weather-stripping, and applications where durability and flexibility are important.

The U.S. government has taken a number of steps to improve the recycling and sustainability of polyolefins, a class of plastics that includes polyethylene and polypropylene. The Plastics Innovation Challenge was started by the DOE to promote advancements in energy-efficient plastics recycling systems. This project aims to establish the US as a leader in cutting-edge plastic recycling technology and the production of novel, intentionally recyclable plastics.

Report Coverage

This research report categorizes the market for the United States polyolefin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States polyolefin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States polyolefin market.

United States Polyolefin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 36671.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.36% |

| 2035 Value Projection: | USD 58671.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product and By Application |

| Companies covered:: | Chevron Corp, Exxon Mobil Corp, Dow Inc, LyondellBasell Industries N.V., Westlake Corporation, Formosa Plastics Corporation, U.S.A., LG Chem America, BASF Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States polyolefin market is boosted as it is used as a polymer in many different industries, such as consumer goods, packaging, and textiles. The market is organic due to the growing demand for polyolefin in the solar power and packaging markets. It is easy to convert polyolefin into fibrous products such as yarn, knit fabrics, and non-woven fabrics. Therefore, it is a popular choice in the textile industry. Growth in the textile industry is driving demand for polyolefin. In addition, with more research and development being conducted by market players, there is potential use of polyolefin with nanotechnologies that can be applied across multiple industries.

Restraining Factors

The United States polyolefin market faces obstacles as end users in this sector are becoming more wary about the impending regulations on the use of polyolefin and their potential environmental impacts. As one of the most common groups of polymers, polyolefins can have negative environmental impacts during their lifecycle, including manufacture and disposal.

Market Segmentation

The United States polyolefin market share is classified into product and application.

- The PE segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States polyolefin market is segmented by product into PE, PP, EVA, TPO, POM, PC, PMMA, and others. Among these, the PE segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because of its sheer ability to be used in many situations and its versatility. PE has excellent chemical resistance, flexibility, and moisture barriers, which make it suitable for a wide range of applications, including packaging films, containers, medical supplies, and consumer products. In addition, there have been a number of advancements in polyethylene manufacturing methods that have enhanced material performance and affordability, which drives producers to embrace polyethylene to achieve both desirable performance and financial results.

- The film & sheet segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States polyolefin market is segmented into film & sheet, injection molding, blow molding, profile extrusion, and others. Among these, the film & sheet segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because polyolefins offer high-quality shrink films with enhanced clarity and aesthetics for the consumer goods space. Polyolefins have higher puncture strength, are accepted by the FDA, do not contain any chlorine, and are stronger; however, polyolefins are somewhat more expensive.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States polyolefin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chevron Corp

- Exxon Mobil Corp

- Dow Inc

- LyondellBasell Industries N.V.

- Westlake Corporation

- Formosa Plastics Corporation, U.S.A.

- LG Chem America

- BASF Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States polyolefin market based on the following segments:

United States Polyolefin Market, By Product

- PE

- PP

- EVA

- TPO

- POM

- PC

- PMMA

- Others

United States Polyolefin Market, By Application

- Film & Sheet

- Injection Molding

- Blow Molding

- Profile Extrusion

- Others

Need help to buy this report?