United States Polyisoprene Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural and Synthetic), By Application (Tires & Related Products, Belt & Hose, Latex Products, Footwear, and Others), and United States Polyisoprene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Polyisoprene Market Insights Forecasts to 2035

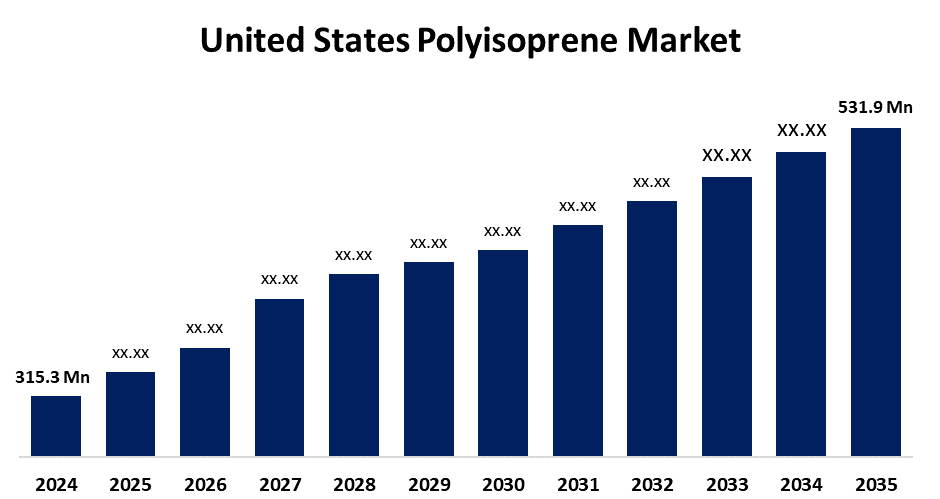

- The US Polyisoprene Market Size Was Estimated at USD 315.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.56% from 2025 to 2035

- The US Polyisoprene Market Size is Expected to Reach USD 531.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Polyisoprene Market is anticipated to reach USD 531.9 million by 2035, growing at a CAGR of 3.56% from 2025 to 2035. The expansion of the United States polyisoprene market is propelled by ongoing developments in end-use industries such as consumer goods, healthcare, and automobiles.

Market Overview

The polyisoprene, which is a polymer composed of repeated isoprene units, can be found in both natural and synthetic forms. A variety of advantageous attributes of polyisoprene have illustrated its use in a number of significant industries. One such attribute is biocompatibility, which has contributed to the proliferation of polyisoprene into applications within the medical domain, including blood bags, catheters, surgical gloves, and medical apparatus. Polyisoprene is also preferable for medical applications because polyisoprene is allergen-free and does not cause the same latex allergies as natural rubber. Polyisoprene can also be compounded with various reinforcing fillers, some specialty chemicals, plasticisers, and curing methods, to improve the well-known attributes of polyisoprene, such as stress relaxation, tear strength, compression set, rebound resilience, and elastic modulus. In future years, the growth of the marketplace for polyisoprene is most likely to be driven by further developments in the medical device arena to enhance outcomes for patients and confront the immensity of hospital admissions. The incorporation of elastomer-compatible 3D printing has enabled new opportunities for polyisoprene-based materials.

The U.S. government has recently supported reshoring programs linked to more general policy demands to boost domestic synthetic rubber production, particularly polyisoprene. At the same time, in August 2024, U.S. Medical Glove Company purchased a domestic polyisoprene facility, making it the sole vertically integrated producer of both nitrile and polyisoprene gloves in the United States.

Report Coverage

This research report categorizes the market for the United States polyisoprene market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States polyisoprene market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States polyisoprene market.

United States Polyisoprene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 315.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.56% |

| 2035 Value Projection: | USD 531.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Goodyear Tire & Rubber Co, ExxonMobil Chemical Company, Kraton Polymers LLC, JSR Corporation, Zeon Corporation, Kuraray Co., Ltd., DowDuPont, Lanxess AG, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States polyisoprene market is boosted as consumers begin to prefer synthetic polyisoprene for essential medical supplies, the polyisoprene market will continue to expand, particularly in the medical market. When latex allergy reactions must be avoided, synthetic polyisoprene is a great building material for these types of facilities because it is free of any latex allergens, and more importantly, it is hypoallergenic. In 2024, some companies increased their ability to manufacture medical-grade synthetic polyisoprene gloves domestically to assist government supply chain resilience operating in the U.S. Some companies were able to do this because the U.S. government started implementing programs that encourage, or at least facilitate, essential domestically made medical supplies and materials to enhance federal and state preparedness while decreasing reliance on external sources.

Restraining Factors

The United States polyisoprene market faces obstacles like the raw material price volatility, particularly for synthetic versions, which are sourced from petroleum-based raw materials like isoprene monomer. Crude oil price, refinery utilization, and supply chain factors all play a significant role in influencing fluctuating prices.

Market Segmentation

The United States polyisoprene market share is classified into type and application.

- The synthetic segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States polyisoprene market is segmented by type into natural and synthetic. Among these, the synthetic segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because, compared to natural rubber, synthetic polyisoprene is more uniformly homogeneous, consistent, and pure. They have high tensile strength and a long life, high resilience to cold, weather, and abrasion. Growth in the polyisoprene market has been driven by its primary applications in protective gloves, sports equipment, sealants, moulded products, and so on.

- The tires & related products segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States polyisoprene market is segmented into tires & related products, belt & hose, latex products, footwear, and others. Among these, the tires & related products segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because the transportation sector is expected to positively influence the growth of the polyisoprene market. In addition, polyisoprene is used for the manufacture of surgical gloves, tubing for drug delivery, fluid pathways, and other medical devices and parts. Therefore, the growing use of polyisoprene in the medical and healthcare of industry will drive the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States polyisoprene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Goodyear Tire & Rubber Co

- ExxonMobil Chemical Company

- Kraton Polymers LLC

- JSR Corporation

- Zeon Corporation

- Kuraray Co., Ltd.

- DowDuPont

- Lanxess AG

- Others

Recent Development

- In October 2023, Goodyear Tire & Rubber Company announced its collaboration with Visolis, a sustainable technology company. The partnership aims to produce isoprene by upcycling bio-based materials. This collaboration leveraged Visolis's technology, which converts waste materials into monomers, to manufacture premium-quality isoprene using lignocellulosic feedstocks, which are non-edible biomass and agricultural materials.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States polyisoprene market based on the following segments:

United States Polyisoprene Market, By Type

- Natural

- Synthetic

United States Polyisoprene Market, By Application

- Tires & Related Products

- Belt & Hose

- Latex Products

- Footwear

- Others

Need help to buy this report?