United States Platelet Rich Plasma Market Size, Share, and COVID-19 Impact Analysis, By Type (Leukocyte Rich PRP and Pure PRP), By Application (Orthopedics, Cosmetic Surgery, Sports Medicine, and Dermatology), By End-User (Clinics, Hospitals, and Others), and US Platelet Rich Plasma Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUSA Platelet Rich Plasma Market Insights Forecasts to 2035

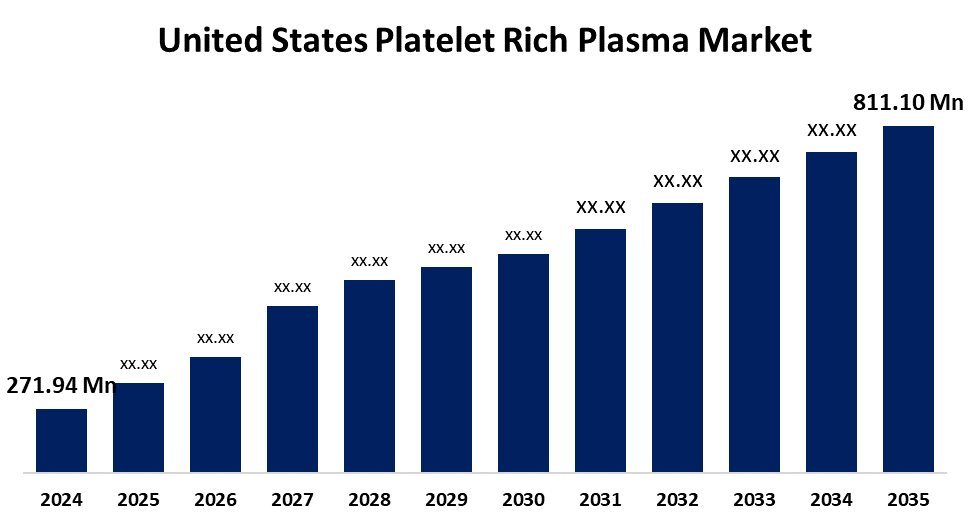

- The US Platelet Rich Plasma Market Size was estimated at USD 271.94 Million in 2024

- The Market Size is expected to grow at a CAGR of around 10.44% from 2025 to 2035

- The USA Platelet Rich Plasma Market Size is expected to reach USD 811.10 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Platelet Rich Plasma Market Size is anticipated to reach USD 811.10 Million by 2035, Growing at a CAGR of 10.44% from 2025 to 2035. Benefits such as wound closure, tissue stabilization, decreased swelling, and accelerated healing make platelet-rich plasma (PRP) therapy more popular in the treatment of chronic illnesses and boost market growth.

Market Overview

The production, application, and marketing of PRP therapy, a method used for tissue regeneration in orthopedics, sports medicine, cosmetic surgery, dermatology, and regenerative medicine, are the main objectives of the US PRP market. Injections of platelet-rich plasma (PRP), a treatment made from blood, contain growth factors and platelets that can promote healing. Blood samples are processed and platelets are concentrated in plasma by healthcare professionals to create PRP. Under ultrasound guidance, the solution is injected into specific locations, such as knees or tendons. To speed up healing, the concentration of particular growth factors in the area is intended to be increased. Although the exact mechanism underlying PRP injections is unknown, research indicates that the higher concentration of growth factors in PRP may promote or accelerate healing, shorten the time it takes for injuries to heal, lessen pain, and even promote hair growth and leading to market growth.

Report Coverage

This research report categorizes the market for the US Platelet Rich Plasma market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US Platelet Rich Plasma market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US Platelet Rich Plasma market.

United States Platelet Rich Plasma Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 271.94 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.44% |

| 2035 Value Projection: | USD 811.10 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Type, By Application, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Terumo Corporation, Celling Biosciences, Johnson & Johnson Services, Inc, Juventix Regenerative Medical, Arthrex, Inc., Zimmer Biomet, Apex Biologix, Stryker, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The rising incidence of chronic tendon injuries in critical organs, along with the use of successful therapies for fractures, arthritis, muscle and ligament tearing, and orthopedic impairments, is driving up demand for PRP-based therapies in the United States. Product demand is also being fueled by increased knowledge of PRP treatment's advantages in reducing inflammation, promoting novel cartilage formulation, and stimulating the production of natural lubricating fluid. The use of PRP-based treatments for common sports injuries is also being accelerated by the construction of state-of-the-art medical facilities for teams and sports clubs. The use of PRP-based techniques to enhance facial volume and shape is also being driven by the growing cosmetic surgery industry.

Restraining Factors

The US platelet-rich plasma (PRP) market faces several challenges, including high treatment costs, limited clinical evidence, regulatory challenges from the FDA, competition from alternative therapies like stem cell therapy and exosome-based regenerative medicine, and standardization issues.

Market Segmentation

The USA platelet-rich plasma market share is classified into type, application, and end-user.

- The pure PRP segment held the largest market share of 48.89% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US platelet-rich plasma market is segmented by type into leukocyte-rich PRP and pure PRP. Among these, the pure PRP segment held the largest market share of 48.89% in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by minimizing pain, more effective, rapid healing, tissue generation, and minimizing adverse effects.

- The orthopedics segment accounted for the largest market share of 25.33% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US platelet-rich plasma market is segmented by application into orthopedics, cosmetic surgery, sports medicine, and dermatology. Among these, the orthopedics segment accounted for the largest market share of 25.33% in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is ascribed to the bone reconstruction, tissue regeneration, repairing tissue, and stimulating the healing.

- The hospital segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US platelet-rich plasma market is segmented by end-user into hospitals, blood banks, diagnostic centers, research labs, pharmacies, and others. Among these, the hospital segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is attributed to the increasing prevalence of chronic diseases in the US, rising cases of osteoarthritis, and availability of sophisticated labs and blood stocks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US platelet-rich plasma market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Terumo Corporation

- Celling Biosciences

- Johnson & Johnson Services, Inc

- Juventix Regenerative Medical

- Arthrex, Inc.

- Zimmer Biomet

- Apex Biologix

- Stryker

- Others

Recent Developments:

- In February 2023, Royal Biologics launched BIOINCYTE PRFM, a next-generation Platelet Rich Plasma (PRP) system that converts traditional PRP to Platelet Rich Fibrin Matrix (PRFM) formulations, aiming to eliminate contamination of red and white blood cells during PRP formulation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US platelet-rich plasma market based on the below-mentioned segments:

US Platelet Rich Plasma Market, By Type

- Leukocyte Rich PRP

- Pure PRP

US Platelet Rich Plasma Market, By Application

- Orthopedics

- Cosmetic Surgery

- Sports Medicine

- Dermatology

US Platelet Rich Plasma Market, By End-User

- Clinics

- Hospitals

- Others

Need help to buy this report?