United States Planting and Fertilizing Machinery Market Size, Share, and COVID-19 Impact Analysis, By Application (Seed Planting, Fertilizer Application, Soil Preparation, and Crop Care), By Type of Machine (Planters, Seeders, Fertilizers, and Cultivators), By End Use (Commercial Farming, Subsistence Farming, and Agro-Forestry), and United States Planting and Fertilizing Machinery Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Planting and Fertilizing Machinery Market Insights Forecasts to 2035

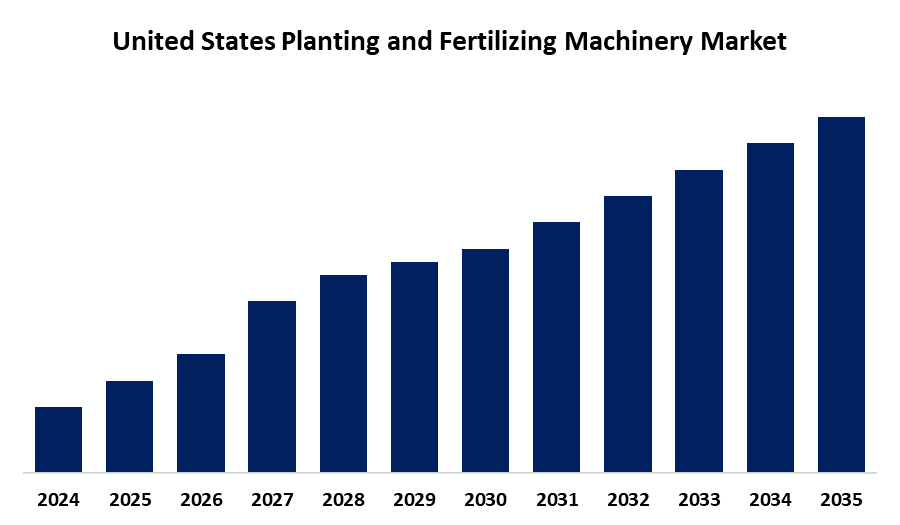

- The United States Planting and Fertilizing Machinery Market Size is Expected to Grow at a CAGR of around 5.2% from 2025 to 2035.

- The U.S. Planting and Fertilizing Machinery Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States planting and fertilizing machinery market is expected to hold a significant share by 2035, growing at a CAGR of 5.2% from 2025 to 2035. The USA planting and fertilizing machinery market growth is fueled by a rise in food demand, labor shortages, and the use of precision agriculture technologies. Improvements in GPS, automation, and data analytics improve productivity and efficiency.

Market Overview

The U.S. farm machinery market for fertilizing and planting involves equipment to maximize seed placement and fertilizer application, leading to greater agricultural productivity. The industry is fueled by growing food demand with population increase, agricultural labor shortages, and extensive use of precision farming technologies. Technological innovation, such as GPS-guided systems, integration of AI, and IoT-driven machines, leading to efficiency and waste reduction, is the major driver. One of the main advantages of the market is the level of mechanization in U.S. farming, where most farms have adopted sophisticated equipment to remain competitive. Moreover, the strong agricultural infrastructure and high R&D spending in the country enable ongoing innovation in farm equipment. Opportunities emerging are the increasing trend towards organic and sustainable farming, which generates a need for equipment that enables environmentally focused agriculture. Government programs like the USDA's Environmental Quality Incentives Program (EQIP) provide monetary incentives to farmers adopting up-to-date, sustainable methods.

Report Coverage

This research report categorizes the market for the United States planting and fertilizing machinery market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' planting and fertilizing machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States planting and fertilizing machinery market.

United States Planting and Fertilizing Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Application, By Type of Machine, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | CNH Industrial, AGCO Corporation, John Deere, Mahindra & Mahindra Limited, Vermeer Corporation, Dawn Equipment Company, Art’s Way Manufacturing, Valmont Industries, Kinze Manufacturing, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Growing advancements are turning farmers to automated and high-capacity machinery to reduce reliance on manual labor and improve efficiency. Technological advancements, such as the application of GPS, AI, IoT, and precision farming technology, have changed the nature of agriculture to be more efficient and environmentally friendly. Greater demand for food also implies greater agricultural production, and this consequently leads to the need for advanced machinery. Governmental policies, such as subsidies and grants provided by the USDA, prompt farmers to employ newer-generation equipment, thereby making the process more efficient. These contributing factors all play their part in the construction of the market, acknowledging the role of innovation and support in constructing the future of United States agriculture.

Restraining Factors

High initial investment costs for advanced equipment are a significant barrier, particularly for small-scale farmers with limited financial resources. The complexity of operating and maintaining modern machinery and the lack of technical knowledge and training in rural areas further hinders adoption. Environmental concerns, stringent regulations, and economic factors, such as declining crop prices and high interest rates, are leading to decreased demand for new machinery.

Market Segmentation

The United States' planting and fertilizing machinery market share is classified into application, type of machine, and end use.

- The seed planting segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States planting and fertilizing machinery market is segmented by application into seed planting, fertilizer application, soil preparation, and crop care. Among these, the seed planting segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the seed planting is a foundational step in crop production, directly impacting yields and overall agricultural success. The success of crop production heavily relies on the precise and efficient distribution of seeds, making advanced sowing equipment a critical component of modern agriculture.

- The planters segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States planting and fertilizing machinery market is segmented by type of machine into planters, seeders, fertilizers, and cultivators. Among these, the planters segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because planter machine types, particularly automatic planters, hold a significant share in the planting and fertilizing machinery market due to their efficiency, precision, and ability to handle large-scale operations.

- The commercial farming segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States planting and fertilizing machinery market is segmented by end use into commercial farming, subsistence farming, and agro-forestry. Among these, the commercial farming segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to several factors, including increased demand for food and agricultural products, the use of advanced technologies in farming, and government support for mechanized farming. Commercial farming is fueled by the need to produce large quantities of crops and livestock to meet growing global food demands.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States planting and fertilizing machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CNH Industrial

- AGCO Corporation

- John Deere

- Mahindra & Mahindra Limited

- Vermeer Corporation

- Dawn Equipment Company

- Art's Way Manufacturing

- Valmont Industries

- Kinze Manufacturing

- Others

Recent Developments:

- In April 2025, VIB announced the launch of its latest spin-off, Rainbow Crops, a next-generation Agtech company focused on engineering complex, high-value agronomic traits that have long been difficult to address. Through an AI-powered technology platform that combines multiplex genome editing and precision breeding.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA planting and fertilizing machinery market based on the below-mentioned segments:

U.S. Planting and Fertilizing Machinery Market, By Application

- Seed Planting

- Fertilizer Application

- Soil Preparation

- Crop Care

U.S. Planting and Fertilizing Machinery Market, By Type of Machine

- Planters

- Seeders

- Fertilizers

- Cultivators

U.S. Planting and Fertilizing Machinery Market, By End Use

- Commercial Farming

- Subsistence Farming

- Agro-Forestry

Need help to buy this report?