United States Plant Factory Market Size, Share, and COVID-19 Impact Analysis, By Crop Type (Fruits, Vegetables, Flowers & Ornamentals, and Other Crop Types), By Light (Artificial Light and Sunlight), and United States Plant Factory Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited States Plant Factory Market Insights Forecasts to 2035

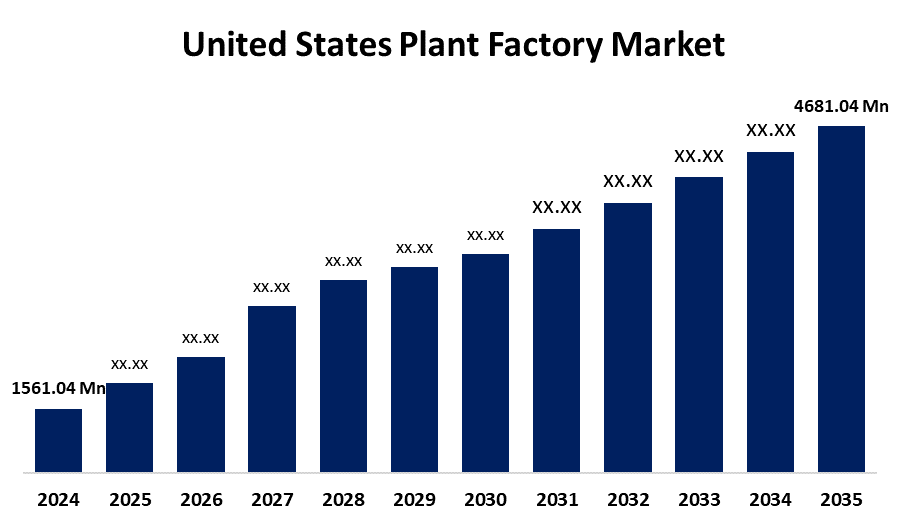

- The United States Plant Factory Market Size Was Estimated at USD 1561.04 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.5% from 2025 to 2035

- The United States Plant Factory Market Size is Expected to Reach USD 4681.04 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Plant Factory Market Size is anticipated to reach USD 4681.04 Million by 2035, growing at a CAGR of 10.5% from 2025 to 2035. The market for plant factories has been growing progressively over the years due to the desire to increase food production in an environmentally friendly manner, and the expanding population.

Market Overview

A plant factory refers to the highly regulated indoor agricultural system that uses exact control over environmental factors, including light, temperature, humidity, carbon dioxide levels, and fertilizer delivery, to grow plants all year round. Modern technologies, which improve plant growth and productivity, such as automation, hydroponics, or aeroponics, and LED lighting, are normally used in these facilities. Because they can also reduce the amount of land and water required for farming, plant factories are an appealing option. Plant factories can produce the fresh, pesticide-free veggies that consumers are demanding more and more. Because of the increased need for reasonable, sustainable products, the market for plant factories is anticipated to continue growing in many years to come. The rapid growth of smarter, fully integrated systems that improve resource use is among the most obvious modifications. These days, modern plant producers use state-of-the-art climate control technologies that combine automation, data analytics, and advanced ventilation techniques with air conditioning, heating, and thermostat management.

The main goal of government programs in the United States for plant factories is to boost the manufacturing industry. Specific programs target workforce development, energy efficiency, and technology adoption, all of which can be beneficial to plant factories. Also, to encourage the safe business of plants, regional organizations help to standardize phytosanitary methods.

Report Coverage

This research report categorizes the market for the United States plant factory market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States plant factory market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States plant factory market.

United States Plant Factory Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1561.04 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.5% |

| 2035 Value Projection: | USD 4681.04 Million |

| No. of Pages: | 158 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Crop Type and By Light |

| Companies covered:: | Gotham Greens Farms LLC, Bowery Farming Inc., Freight Farms, Plenty Unlimited Inc., AeroFarms, LLC, BrightFarms Inc., Iron Ox, Inc., AppHarvest, Inc., Vertical Harvest Farms, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States plant factory market is boosted by growing food demand, limited farmland, and rich soils, caused the development of alternative agricultural methods like vertical farming to boost food output. Also have long struggled with domestic production and supply issues because of a lack of natural resources and good climatic conditions. Utilizing these technologies to become food independent. Due to a lack of arable land, poor soil, and rising food demand, innovative methods like vertical farming have emerged and are slowly gaining popularity. Vertical farming produces food in layers to make the most of available space.

Restraining Factors

The United States plant factory market faces obstacles like small and medium-sized enterprises finding it difficult to compete with bigger companies due to the substantial costs of constructing and maintaining these facilities. Also, it may take a long time to see a return on investment from the substantial initial spending needed to start up a plant production.

Market Segmentation

The United States plant factory market share is classified into crop type and light.

- The vegetables segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States Plant Factory market is segmented by crop type into vegetables, fruits, flowers & ornamentals, and other crop types. Among these, the vegetables segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The strong demand for locally produced fresh products and the relatively short growing seasons of many vegetable crops are responsible for the rise. Due to their great demand and rapid growth, vegetables are among the most commonly cultivated crops in plant factories. Widely grown Vegetables are peppers, cucumbers, tomatoes, and lettuce.

- The artificial light segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the light, the United States lignin market is segmented into artificial light and sunlight. Among these, the artificial light segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. These advanced indoor farms largely depend on modern LED lighting systems that carefully control and enhance growing conditions, allowing dependable and high-yield production all year a long time, independent of weather conditions. Artificial lighting has an obvious advantage over sunlight due to its unique ability to precisely adjust light wavelengths for certain plant growth phases, thus strengthening its position as the primary choice in this competitive sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States plant factory market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gotham Greens Farms LLC

- Bowery Farming Inc.

- Freight Farms

- Plenty Unlimited Inc.

- AeroFarms, LLC

- BrightFarms Inc.

- Iron Ox, Inc.

- AppHarvest, Inc.

- Vertical Harvest Farms

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States plant factory Market based on the following segments:

United States Plant Factory Market, By Crop Type

- Vegetables

- Fruits

- Flowers & ornamentals

- Other crop types

United States Plant Factory Market, By Light

- Artificial Light

- Sunlight

Need help to buy this report?