United States Photoresist Market Size, Share, and COVID-19 Impact Analysis, By Product (ARF Immersion, ARF Dry, KRF, and G-Line & I-Line), By Ancillary Type (Removers, Developers, Anti-reflective Coatings, and Others), and United States Photoresist Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsUnited States Photoresist Market Insights Forecasts to 2035

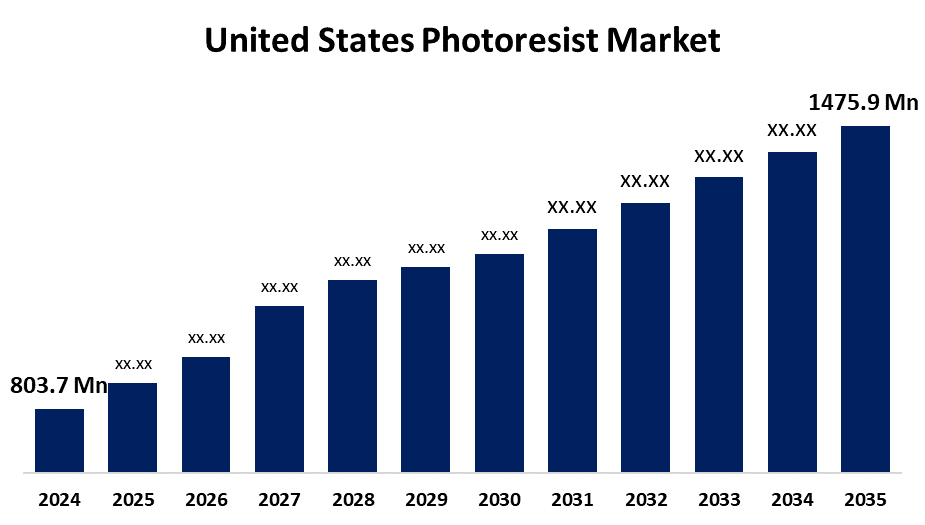

- The US Photoresist Market Size Was Estimated at USD 803.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.68% from 2025 to 2035

- The US Photoresist Market Size is Expected to Reach USD 1475.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Photoresist Market is anticipated to reach USD 1475.9 million by 2035, growing at a CAGR of 5.68% from 2025 to 2035. The expansion of the United States photoresist market is propelled because it is used in flat panel manufacturing, for increasing due to the growing demand for sophisticated displays like OLED and LCD panels.

Market Overview

A photoresist is a light-sensitive organic material employed in photolithography to create patterned coatings on semiconductor wafers. The chemistry of the photoresist alters when exposed to light via a photomask to allow either the exposed or unexposed area to dissolve in a developer solution. This yields a stencil for etching or deposition in the fabrication of integrated circuits. The ongoing photoresist market has many influences, but the development of DUV and EUV materials, combined with a strong demand for high-end semiconductors, driven largely by the expansion of AI, 5G, and automotive applications, provides the strongest forces. As low-power devices form the basis for increasingly smaller and more powerful semiconductors, an optimised photoresist that offers more accurate and rapid lithography has been anticipated. New photoresists for the next generation of chips with improved etch resistance, stability, and resolution requirements would be beneficial. These improvements will assist with the growing complexity of semiconductor devices.

The US market growth for photoresist materials is being driven by the CHIPS and Science Act, which allocates more than $52.7 billion for workforce development, innovative materials, research and development, and domestic semiconductor production.

Report Coverage

This research report categorizes the market for the United States photoresist market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States photoresist market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States photoresist market.

United States Photoresist Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 803.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.68% |

| 2035 Value Projection: | USD 1475.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product, By Ancillary Type and COVID-19 Impact Analysis |

| Companies covered:: | Lam Research Corp, DuPont de Nemours Inc, JSR Corporation, Fujifilm Electronic Materials, Sumitomo Chemical Advanced Technologies, SACHEM, Inc, Futurrex, Inc., C&D Semiconductor Services, Inc., Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States photoresist market is boosted by technical advances and innovation in the development of high-quality photo resists, including KrF, ArF, and EUV, which are key contributors to the development of advanced semiconductors. The materials assist in creating smaller, more efficient chips and more accurate lithography. There are continuing research and development efforts to develop photoresists with higher resolutions, thermal stability, and etch performance for next-generation electronics. Partnerships with academic researchers and supportive policies in different jurisdictions have also helped drive innovation and scale.

Restraining Factors

The United States photoresist market faces obstacles like strict environmental laws. Companies have to increase their research and development investments to meet the added scrutiny and their need for cleaner production methods. The complexity of advanced lithography methods, including extreme ultraviolet (EUV) lithography, has only intensified these challenges.

Market Segmentation

The United States photoresist market share is classified into product and ancillary type.

- The ARF immersion segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States photoresist market is segmented by product into ARF immersion, ARF dry, KRF, and G-line & I-line. Among these, the ARF immersion segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven due to increased complexity in advanced logic devices and memory chips, and its utility for fundamental layers in the 7 nm to 28 nm nodes. With DUV lithography toolkits and a high-volume manufacturing capability, ArF immersion can still be the workhorse technology in volume production, as the best fabs utilize the best accuracy to pattern at a cost-effective point.

- The anti-reflective segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the ancillary type, the United States photoresist market is segmented into removers, developers, anti-reflective coatings, and others. Among these, the anti-reflective segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because developing increasingly sophisticated anti-reflective coatings is paramount for the rapidly adopted multilayer patterns to manufacture sub-7 nm semiconductors. These coatings have become essential in both deep ultraviolet (DUV) and EUV processes, particularly where reflection problems can occur during high-resolution pattern transfer.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States photoresist market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lam Research Corp

- DuPont de Nemours Inc

- JSR Corporation

- Fujifilm Electronic Materials

- Sumitomo Chemical Advanced Technologies

- SACHEM, Inc

- Futurrex, Inc.

- C&D Semiconductor Services, Inc.

- Others

Recent Development

- In February 2024, DuPont launched new EUV-compatible Metal Oxide Resists (MOR) tailored for advanced logic nodes, boosting resolution and sensitivity and scaling supply capacity.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States photoresist market based on the following segments:

United States Photoresist Market, By Product

- ARF Immersion

- ARF Dry

- KRF

- G-Line & I-Line

United States Photoresist Market, By Ancillary Type

- Removers

- Developers

- Anti-Reflective Coatings

- Others

Need help to buy this report?