United States Photopolymers Market Size, Share, and COVID-19 Impact Analysis, By Performance (Low, Mid, and High), By Technology (SLA, DLP, and CDLP), and United States Photopolymers Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Photopolymers Market Insights Forecasts to 2035

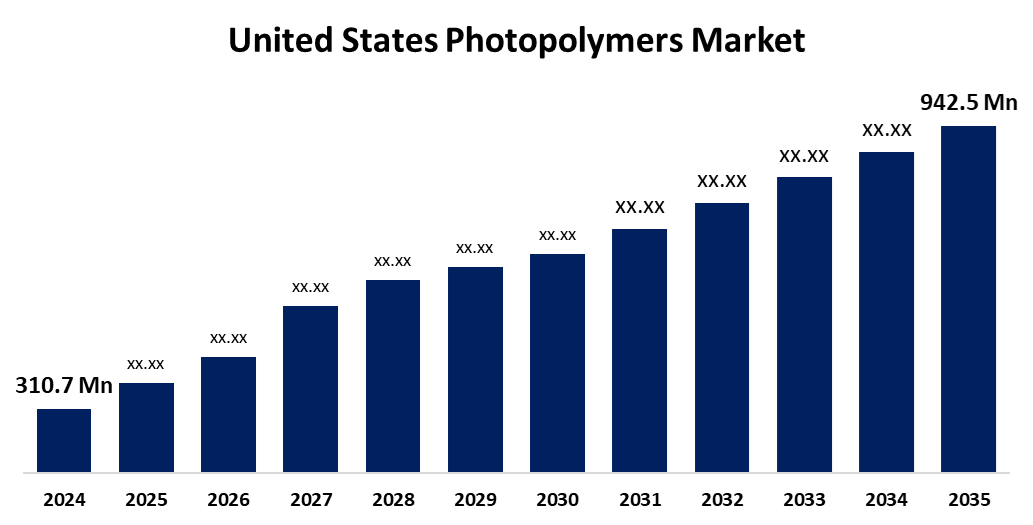

- The US Photopolymers Market Size Was Estimated at USD 310.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.61% from 2025 to 2035

- The US Photopolymers Market Size is Expected to Reach USD 942.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Photopolymers Market Size is anticipated to Reach USD 942.5 Million by 2035, Growing at a CAGR of 10.61% from 2025 to 2035. The expansion of the United States photopolymers market is propelled by the growing use of durable, intricate 3D printed items, high-speed printing, and precise design.

Market Overview

A Photopolymer is a polymer that is light sensitive and will change chemically and structurally when exposed to a specific wavelength of light. Increases in demand for prototyping across the automotive industry and designs for comprehending complex surgical procedures have led to increased demand for a photopolymer for 3D printing. Even increasing demand for artificial jewelry and prosthetics across the population is helping drive market growth. The nation's automobile industry is driving up demand for photopolymers. The original equipment manufacturers (OEMs) in the U.S. are focusing on improvements to traditional prototyping and methods of component development. The need for the production of automotive components like high-performance components at volume, an ample supply of spare parts via 3D printing, and generally easier manufacturing of components should drive demand for photopolymers for 3D printing of components across the U.S. during the forecasting period. The photopolymer market is growing as a result of the developing semiconductor and electronics industries. Within these sectors, photopolymers find employment in a wide range of products, such as optical films for displays, encapsulants for electronic components, and photoresists for photolithography. The electronics sector is expanding due to the growing demand for gadgets like laptops, cellphones, and wearable technology, which is pushing up demand for photopolymers.

Report Coverage

This research report categorizes the market for the United States photopolymers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States photopolymers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States photopolymers market.

United States Photopolymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 310.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.61% |

| 2035 Value Projection: | USD 942.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Performance, By Technology |

| Companies covered:: | PolySpectra, Carbon, Keystone Industries, Formlabs, Stratasys Ltd., 3D Systems Corporation, Chemence Inc., Wikoff Color Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of the photopolymers market in the United States is supported by 3D printing technology, as photopolymers are widely used in 3D printing technologies like stereolithography (SLA), and digital light processing (DLP), because of their details, fine precision, and capable to generate complex geometries. As 3D technology continues to modernize and advance, expanding accessibility, it is predicted that photopolymers will see remarkable growth. The photopolymer market is expanding due to the versatility of photopolymers and the rising use of 3D printing for consumer, production, and prototype applications.

Restraining Factors

The United States photopolymers market faces obstacles like as raw materials cost, i.e, photopolymer formulations generally incorporate specialty compounds and additives that can be costly. Additionally, fluctuations in the pricing of raw materials, particularly petrochemical-based, can adversely affect the production cost of photopolymer resins.

Market Segmentation

The United States photopolymers market share is classified into performance and technology.

- The high segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States photopolymers market is segmented by performance into low, mid, and high. Among these, the high segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The technology that drives this market is high-performance 3D printing, which includes the best print quality, speed, accuracy, and material selections. The high-performance 3D printing technologies include selective laser melting (SLM), electron beam melting (EBM), continuous liquid interface production (CLIP), and multi-material 3D printing.

- The SLA segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the technology, the United States photopolymers market is segmented into SLA, DLP, and CDLP. Among these, the SLA segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by 3D printing technology, with the 3D printing being accomplished via laser light sources. Demand for SLA-based 3D printing has risen steeply over the last few years due to SLA being able to print 25-300-micron components with high XY resolution using plastic resins and photopolymers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States photopolymers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PolySpectra

- Carbon

- Keystone Industries

- Formlabs

- Stratasys Ltd.

- 3D Systems Corporation

- Chemence Inc.

- Wikoff Color Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States photopolymers market based on the following segments:

United States Photopolymers Market, By Performance

- Low

- Mid

- High

United States Photopolymers Market, By Technology

- SLA

- DLP

- CDLP

Need help to buy this report?