United States Pharmaceutical Warehousing Market Size, Share, and COVID-19 Impact Analysis, By Type (Cold Chain Warehouse and Non-Cold Chain Warehouse, and Others), By Application (Pharmaceutical Factory, Pharmacy, Hospital, and Others), and United States Pharmaceutical Warehousing Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Pharmaceutical Warehousing Market Insights Forecasts to 2035

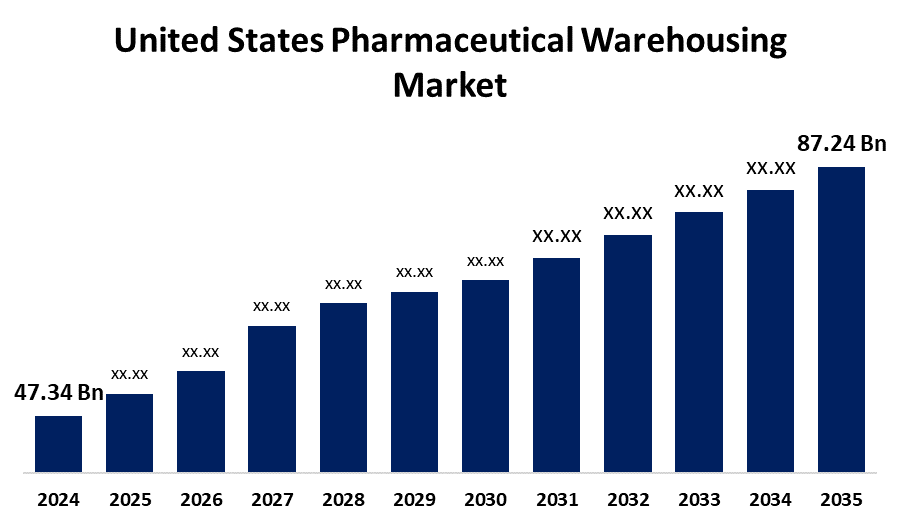

- The U.S. Pharmaceutical Warehousing Market Size was estimated at USD 47.34 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.71% from 2025 to 2035

- The USA Pharmaceutical Warehousing Market Size is Expected to Reach USD 87.24 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The US Pharmaceutical Warehousing Market is anticipated to reach USD 87.24 Billion by 2035, growing at a CAGR of 5.71% from 2025 to 2035. The U.S. pharmaceutical warehousing market is growing due to increasing demand for efficient, compliant storage solutions, driven by factors like rising drug production, regulatory requirements, and the need for temperature-controlled logistics.

Market Overview

The United States market for pharmaceutical warehousing involves specialized storage, handling, and distribution of pharmaceutical items such as drugs, vaccines, biologics, and medical supplies within warehouses designed to ensure product integrity, meet rigorous regulatory requirements, and serve the healthcare supply chain. Moreover, the US pharmaceutical warehousing market is on the rise owing to increasing demand for personalized medicine, growth of clinical trial logistics, enhanced production of biologics, and growth in specialty drug distribution. Sophisticated robotics integration and decentralized warehousing strategies further improve delivery times and enable growing rural and telehealth-driven pharmaceutical distribution networks. Furthermore, key players like AmerisourceBergen, McKesson, Cardinal Health, and UPS Healthcare drive market growth through innovations such as automated storage systems, blockchain for supply chain transparency, AI-driven inventory management, and advanced cold chain logistics to ensure drug safety and compliance.

Report Coverage

This research report categorizes the market for the U.S. pharmaceutical warehousing market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States pharmaceutical warehousing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA pharmaceutical warehousing market.

United States Pharmaceutical Warehousing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 47.34 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.71% |

| 2035 Value Projection: | USD 87.24 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 263 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Type and By Application |

| Companies covered:: | FedEx Corp., DB Schenker, Kuehne Nagel Management AG, CEVA Logistics, United Parcel Service Inc., Hellmann Worldwide Logistics SE and Co KG, Rhenus SE and Co. KG, GEODIS SA, XPO Logistics Inc., KRC Logistics, Alloga, Bio Pharma Logistics, ADAllen Pharma, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The USA pharma warehousing industry is spurred by heightened incidence of chronic diseases, mounting pharmaceutical R&D expenditure, and growing demand from internet-based pharmacies. Accelerated import/export drug activities and domestic manufacturing incentives provided by governments are also supporting it. Further, increased readiness to deal with public health crises and the elderly's population care requirements are spurring demand for safe, expandable warehousing services that can serve high-value, high-volume, and sensitive drug inventories at geographically disparate healthcare networks.

Restraining Factors

Restraining factors include high infrastructure and compliance costs, labor shortages in specialized logistics, complex regulatory requirements, and risks of temperature excursions, which can lead to product spoilage and financial losses for pharmaceutical warehousing providers.

Market Segmentation

The United States pharmaceutical warehousing market share is classified into type and application.

- The non-cold chain warehouse segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States pharmaceutical warehousing market is segmented by type into cold chain warehouse and non-cold chain warehouse, and others. Among these, the non-cold chain warehouse segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the large volume of conventional drugs that do not require temperature-sensitive storage. These warehouses support widespread distribution, are cost-effective, and serve the bulk of pharmaceutical inventory, making them dominant despite growing cold chain demand.

- The pharmaceutical factory segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States pharmaceutical warehousing market is segmented by application into pharmaceutical factory, pharmacy, hospital, and others. Among these, pharmaceutical factory segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. These facilities are central to the production and distribution of pharmaceutical products, necessitating extensive warehousing capabilities for raw materials, intermediate goods, and finished products. The pharmaceutical factory segment's prominence is underscored by its critical role in the supply chain, ensuring the availability and timely delivery of medications to various healthcare providers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US pharmaceutical warehousing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FedEx Corp.

- DB Schenker

- Kuehne Nagel Management AG

- CEVA Logistics

- United Parcel Service Inc.

- Hellmann Worldwide Logistics SE and Co KG

- Rhenus SE and Co. KG

- GEODIS SA

- XPO Logistics Inc.

- KRC Logistics

- Alloga

- Bio Pharma Logistics

- ADAllen Pharma

- Others

Recent Developments:

- In September 2024, MD Logistics LLC (President: John Sell, hereafter "MD"), a subsidiary company of NIPPON EXPRESS HOLDINGS, INC., is transforming the North Area of its current warehouse in Plainfield, Indiana (US) into a specialized pharmaceutical facility that will start operations in October. The warehouse being renovated is the biggest in MD's network at around 37,000m2. The North Area (around 18,500m2) will be transformed into a cutting-edge facility specializing in life science and pharmaceutical products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA pharmaceutical warehousing market based on the below-mentioned segments:

United States Pharmaceutical Warehousing Market, By Type

- Cold Chain Warehouse

- Non-Cold Chain Warehouse

- Others

United States Pharmaceutical Warehousing Market, By Application

- pharmaceutical Factory

- Pharmacy

- Hospital

- Others

Need help to buy this report?