United States Pharmaceutical Market Size, Share, and COVID-19 Impact Analysis, By Product (Branded and Generic), By Molecule (Biologics & Biosimilars and Conventional Drugs), and United States Pharmaceutical Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Pharmaceutical Market Insights Forecasts to 2035

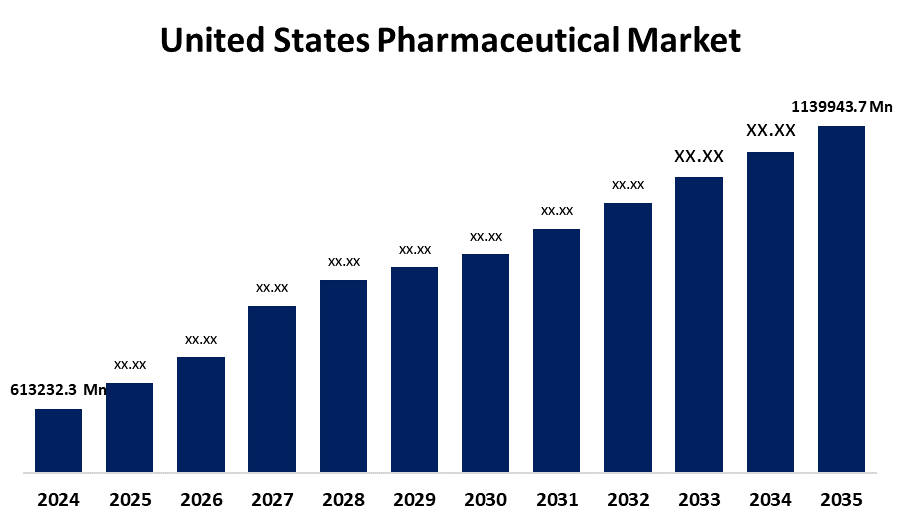

- The US Pharmaceutical Market Size Was Estimated at USD 613232.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.8% from 2025 to 2035

- The US Pharmaceutical Market Size is Expected to Reach USD 1139943.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Pharmaceutical Market is anticipated to reach USD 1139943.7 million by 2035, growing at a CAGR of 5.8% from 2025 to 2035. The expansion of the United States' pharmaceutical market is propelled by the growing number of elderly individuals, the prevalence of chronic diseases, the government's increased spending on healthcare, and the numerous initiatives to make medications more accessible and affordable.

Market Overview

A pharmaceutical is a material or product used in medicine to change physiological processes for therapeutic purposes or to identify, prevent, treat, or cure disease. The U.S. pharmaceutical industry has greatly improved due to strong pipelines and therapeutic advances. With the arrival of targeted medicines, biologics, and personalised medicine, the treatment of complex diseases such as cancer, autoimmune diseases, and genetic defects has become more effective. The approval of gene therapies and RNA-based treatments by the FDA, including several inherited retinal diseases and certain cancer types, has propelled the industry. The valuable, growing market of precision medicine is now more impactful than ever with cutting-edge therapies, including CAR-T cell therapies, that focus on custom-typed tumours and provide potential hope for previously untreatable diseases. Innovation has also become essential with the continued development of immuno-oncology therapies, which are transforming cancer care.

The U.S. government has employed a multifaceted approach to strike a balance between market access, affordability, and innovation in the pharmaceutical industry. A dual framework was established by the Hatch-Waxman Act (1984) that encourages innovation through patent term extensions and facilitates the introduction of generics through the shortened ANDA procedure. This effectively increases competition and lowers drug prices.

Report Coverage

This research report categorizes the market for the United States pharmaceutical market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States pharmaceutical market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States pharmaceutical market.

United States Pharmaceutical Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 613232.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.8% |

| 2035 Value Projection: | USD 1139943.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Product, By Molecule and COVID-19 Impact Analysis |

| Companies covered:: | Bristol Myers Squibb Co, Merck & Co Inc, Pfizer Inc, AbbVie Inc, Johnson & Johnson, GSK plc., Takeda Pharmaceutical Company Limited, Novartis, Roche Holding, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States pharmaceutical market is boosted by Strong research and development (R&D) expenditures, also the U.S. biopharmaceutical industry is the leader in R&D intensity in the country. The U.S. expenditures on prescription drugs amounted to nearly $406 billion in 2022, largely from retail. In comparison to all other industrial sectors, the biopharmaceutical industry invests an average of six times more in research and development (R&D) as a percentage of expenditures, which is a clear indication of their commitment to R&D. This business sector also fully contributes to innovation and growth across the U.S. pharmaceutical market, with this industry spending three times NIH's annual budget just on research and development.

Restraining Factors

The United States pharmaceutical market faces obstacles like the poor local capacity to produce critical medicine ingredients. Over the past three decades, the United States' ability to manufacture key materials has significantly decreased, resulting in an excessive dependence on foreign suppliers—and frequently, a single foreign provider for a large number of essential components.

Market Segmentation

The United States pharmaceutical market share is classified into product and molecule.

- The branded segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States pharmaceutical market is segmented by product into branded and generic. Among these, the branded segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the growing need for the development of new treatments for many conditions, increased R&D and development of new drugs, and the increased incidence of chronic diseases. Key players are always focused on developing new drugs, making the segment grow faster.

- The conventional drugs segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the molecule, the United States pharmaceutical market is segmented into biologics & biosimilars and conventional drugs. Among these, the conventional drugs segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by oral bioavailability, steady pharmacokinetics, and a well-equipped factory. Since more than 2/3 of small molecule-based products are in accelerated mechanisms and will likely reach commerce in the next few years, small molecules will grow as a technology and will lead the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States pharmaceutical market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bristol Myers Squibb Co

- Merck & Co Inc

- Pfizer Inc

- AbbVie Inc

- Johnson & Johnson

- GSK plc.

- Takeda Pharmaceutical Company Limited

- Novartis

- Roche Holding

- Others

Recent Development

- In May 2024, AbbVie and Gilgamesh Pharmaceuticals announced a collaboration and option-to-license agreement to develop next-generation therapies for psychiatric disorders. This strategic partnership combines AbbVie’s extensive neuroscience expertise and development capabilities with Gilgamesh’s innovative approach to addressing psychiatric conditions. The agreement focuses on developing new treatments targeting unmet needs in this field, aiming to advance the understanding and management of psychiatric disorders.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States pharmaceutical market based on the following segments:

United States Pharmaceutical Market, By Product

- Branded

- Generic

United States Pharmaceutical Market, By Molecule

- Biologics & Biosimilars

- Conventional Drugs

Need help to buy this report?